Embark on an adventurous journey into the world of options trading, where possibilities abound and fortunes can be made. Today, our focus sharpens on the enigmatic call option, a financial instrument that holds the power to unlock substantial profits. Join us as we delve into the realm of call options, deciphering their intricacies and empowering you with the knowledge to navigate this dynamic market.

Image: www.youtube.com

Unveiling the Call Option: A Trading Odyssey

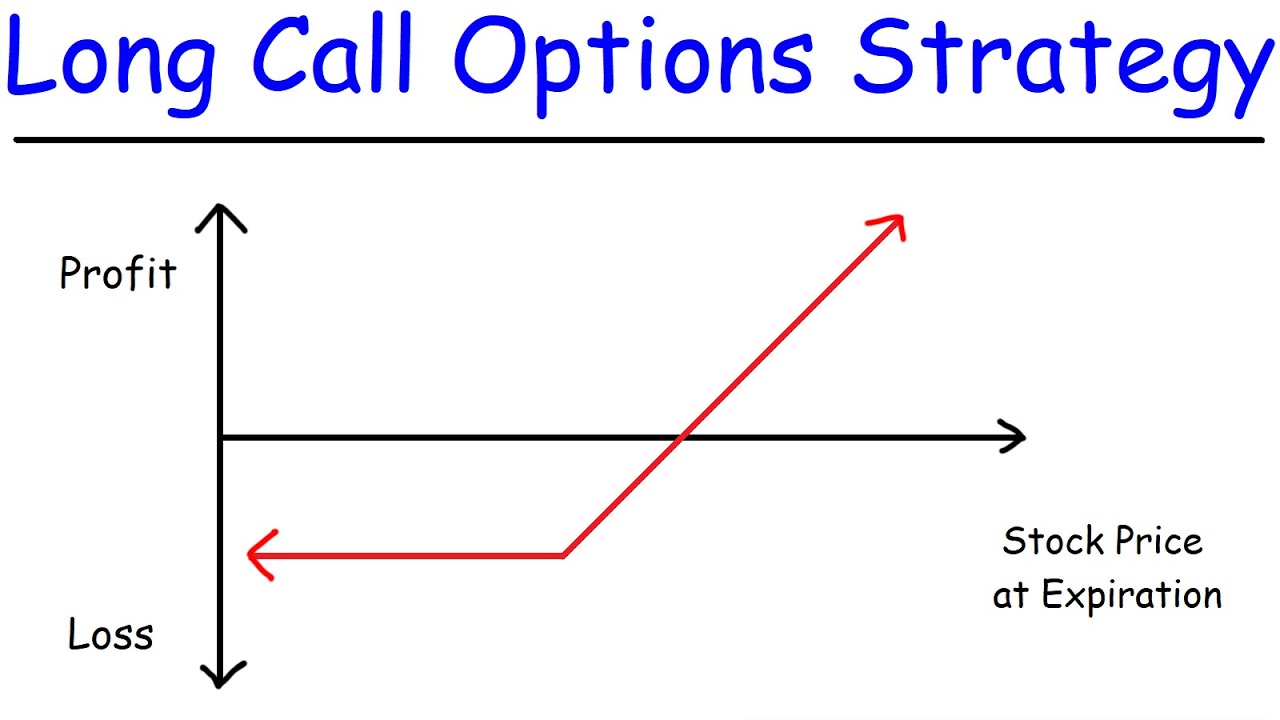

Envision a world where you possess the right, but not the obligation, to purchase an asset at a predetermined price on a specific date. This captivating concept forms the foundation of call options, granting traders the flexibility to capitalize on potential price surges without the burden of immediate ownership. The allure of call options lies in their ability to magnify gains when the underlying asset embarks on an upward trajectory.

Deciphering the Jargon: Key Terms Explained

Before venturing into the call option arena, let’s familiarize ourselves with the essential lexicon:

- Strike Price: The predetermined price at which you can purchase the underlying asset.

- Expiration Date: The date on which your right to buy expires.

- Premium: The price you pay to acquire the call option.

- Underlying Asset: The asset you have the option to buy, such as a stock, commodity, or index.

Mastering the Call Option’s Value Proposition

Understanding the factors that influence the value of call options is paramount. The following variables play a crucial role:

- Underlying Asset Price: As the price of the underlying asset rises, the value of the call option typically increases.

- Time to Expiration: The closer the expiration date, the lower the value of the call option due to the diminishing time value.

- Volatility: High volatility in the underlying asset’s price leads to higher call option premiums.

- Interest Rates: Rising interest rates can make call options less attractive as they increase the cost of carry.

Image: www.youtube.com

Crafting a Winning Call Option Strategy

To emerge victorious in the call option arena, a well-crafted strategy is indispensable. Consider these tactics:

- Trend Following: Align your trades with the prevailing trend of the underlying asset for increased probability of success.

- Earnings Play: Seize opportunities surrounding a company’s earnings announcement, when volatility and trading volume surge.

- Implied Volatility Trading: Capitalize on discrepancies between the market’s implied volatility and the realized volatility of the underlying asset.

Conquering Call Option Trading: Essential Tips

As you embark on your call option trading journey, embrace these invaluable tips:

- Start Small: Begin with modest trades to minimize risk and gain experience.

- Manage Your Risk: Implement risk management strategies such as stop-loss orders and position sizing to protect your capital.

- Research Thoroughly: Delve into the fundamentals and technical analysis of the underlying asset and market conditions.

- Stay Informed: Keep abreast of economic news and events that may impact the value of your call options.

Embracing the Power of Call Options: Success Stories

Witness how call option trading has transformed the lives of countless traders:

- In 2008, investor Warren Buffett purchased call options on ConocoPhillips, reaping a substantial profit as the stock price surged.

- Hedge fund manager David Einhorn famously employed call options to profit from rising gold prices during the 2008 financial crisis.

How To Do Call Option Trading

Conclusion: Mastering the Call Option Enigma

Call option trading presents a unique opportunity to harness market momentum and potentially generate significant returns. By comprehending the fundamentals, implementing prudent strategies, and exercising calculated risk management, you can conquer the call option arena. Remember, knowledge is the key that unlocks the door to trading success.