In the intricate realm of finance, options trading stands as a potent tool for investors seeking to navigate market dynamics with precision and finesse. This enigmatic world of options empowers traders with the ability to harness the potential of underlying assets without the obligation of immediate ownership. Embarking on our 3-course options trading extravaganza, you’ll unravel the intricacies of this intriguing financial instrument, deciphering its nuances and unlocking its wealth of opportunities.

Image: mts-finance.com

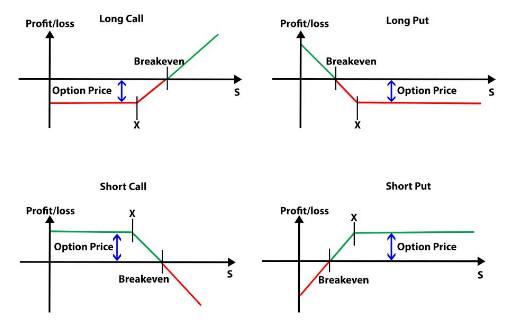

As we embark on this educational sojourn, we’ll delve into the very essence of options, unraveling their nature and significance in the financial landscape. Options, in their simplest form, are but contracts that bestow upon their holders the right, yet not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a stipulated date (expiration date). This flexibility empowers investors with strategic maneuvers, enabling them to respond nimbly to market fluctuations and tailor their investments to their unique risk tolerance.

1. Call Options: A Journey into Upside Potential

Think of call options as a gateway to harnessing the bullish power of the underlying asset. These instruments grant you the authority to exercise your right to purchase the underlying asset at the strike price anytime before expiration. Should the underlying asset embark on an upward trajectory, exceeding the strike price, you, the astute call option holder, stand to reap substantial profits. However, if the underlying asset remains stagnant or embarks on a downward spiral, the call option’s value erodes, resulting in a potential loss.

2. Put Options: Embracing the Power of Downward Momentum

Contrastingly, put options present a strategic approach for investors anticipating a downswing in the underlying asset’s fortunes. With a put option in your arsenal, you gain the right to execute your option to sell the underlying asset at the strike price before expiration. If the underlying asset’s value takes a tumble, the put option holder triumphs, generating profits from the asset’s decline. However, should the asset defy expectations and embark on an upward trajectory, the put option’s value diminishes, potentially resulting in a loss.

3. Trading Strategies: Navigating Market Dynamics with Precision

As we delve deeper into the realm of options trading, we’ll unveil an array of strategies meticulously crafted to exploit market opportunities and manage risk. From the elementary covered call strategy, designed to generate income while preserving capital, to the daring but rewarding straddle strategy, which seeks to profit from high volatility, each technique carries its unique nuances and risk parameters. We’ll equip you with the knowledge to parse these strategies, discerning their strengths and potential pitfalls, empowering you to make informed decisions tailored to your investment objectives.

Image: lottolearning.com

4. The Allure of Vertical Spreads: Leveraging the Dance of Time and Price

In the captivating realm of options trading, vertical spreads take center stage as sophisticated strategies that delve into the intricate interplay of time and price. These multifaceted strategies involve simultaneously purchasing and selling options with different strike prices and expiration dates, creating a customized risk-reward profile. We’ll guide you through these intricate maneuvers, deciphering the nuances of bull call spreads, bear put spreads, and other vertical variations, empowering you to harness their potential to amplify profits or hedge against risk.

Options Trading Basics 3-Course Bundle

Image: wsolib.com

5. Unveiling Greeks: Unraveling the Secrets of Options Pricing

As we delve deeper into the options trading universe, we encounter the elusive Greeks – a mysterious ensemble of metrics that hold the key to unraveling the intricate pricing mechanisms that govern options. Delta, the ever-reliable measure of an option’s price sensitivity to changes in the underlying asset, will be our trusted companion. We’ll enlist the aid of Gamma, Theta, Vega, and Rho, each playing a distinct role in the dynamic pricing dance. By deciphering the language of the Greeks, you’ll gain unparalleled insights into options pricing, enabling you to navigate market fluctuations with greater precision and finesse.

As we approach the conclusion of our comprehensive options trading odyssey, we’ll underscore the paramount significance of risk management in this dynamic arena. Understanding your risk tolerance, meticulously calculating potential losses, and employing effective risk management techniques will serve as the bedrock of your trading endeavors. By embracing these prudent practices, you’ll transform from a novice navigator into a seasoned captain, adeptly riding the waves of market volatility.

Embarking on this 3-course options trading extravaganza marks the beginning of an exhilarating journey, a transformative metamorphosis from passive observer to active market participant. The knowledge you glean from this in-depth exploration will arm you with the tools and insights to navigate the ever-evolving financial landscape with confidence and acumen. Embrace the challenge, immerse yourself in the intricacies of options trading, and unlock a realm of investment opportunities previously veiled from your sight.