Title: Master the Basics of Options Trading: A Comprehensive Guide to yr4nv.options.trading.basics.3course.bundle.part3.rar

Image: www.chegg.com

Introduction:

In the world of finance, where volatility often reigns supreme, options trading offers a beacon of hope for those seeking to mitigate risk and amplify their returns. Welcome to your comprehensive guide to yr4nv.options.trading.basics.3course.bundle.part3.rar, a treasure trove of knowledge that will equip you with the foundational principles of this powerful trading strategy.

Options, financial instruments that derive their value from underlying assets, empower traders to hedge against market uncertainties or speculate on future price movements. yr4nv.options.trading.basics.3course.bundle.part3.rar is a meticulously crafted resource that unveils the secrets of options trading, unlocking its potential for both seasoned investors and those venturing into the realm of derivatives for the first time.

Deep Dive into yr4nv.options.trading.basics.3course.bundle.part3.rar:

1. Unlocking the Lexicon of Options:

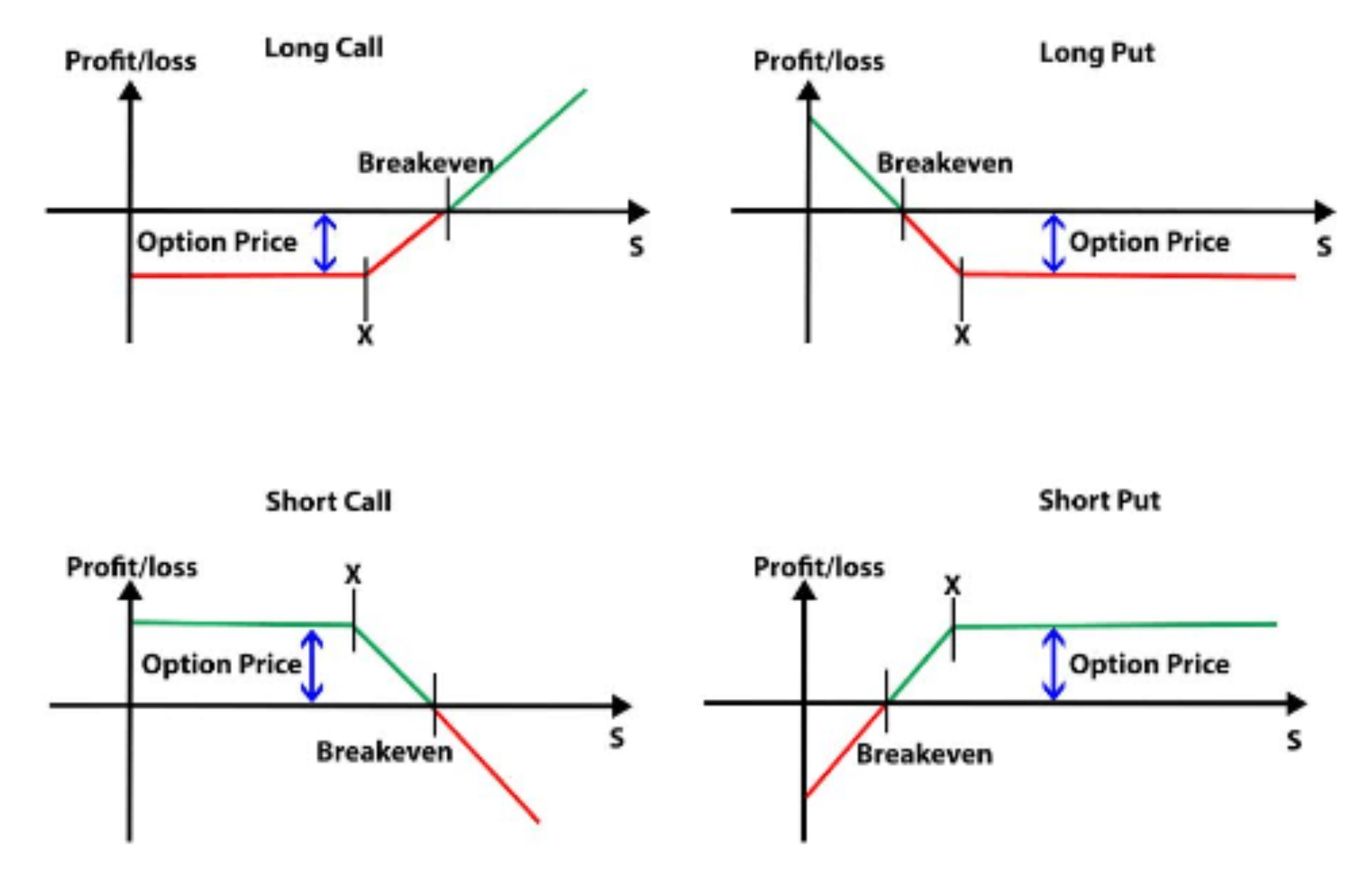

Options trading revolves around a specialized vocabulary. This section introduces you to essential terms such as calls, puts, premium, strike price, and expiration date, providing a solid foundation for understanding the fundamentals of this market.

2. Options vs. Futures: Delving into the Differences:

Both options and futures offer avenues for risk management and speculation. This segment explores their distinctive characteristics, highlighting the unique advantages and limitations of each instrument, ensuring you make informed choices based on your trading objectives.

3. Call Options: Unlocking Upside Potential:

Call options grant the holder the right, but not the obligation, to purchase an underlying asset at a predetermined price. This section delves into the mechanics of call options, explaining how they can be leveraged to capitalize on bullish market sentiments.

4. Put Options: Hedging against Downturns:

Put options bestow upon the holder the right, but not the obligation, to sell an underlying asset at a predetermined price. This segment unravels the intricacies of put options, demonstrating their effectiveness as a defensive tool against market downturns.

5. Option Premiums: The Cost of Options Contracts:

Option premiums represent the price paid by a trader to acquire the rights associated with an options contract. This section elucidates the factors that influence option premiums, empowering you to make judicious decisions when executing trades.

6. Greeks: Uncovering the Hidden Dynamics of Options:

Greeks are mathematical measures that gauge an option’s sensitivity to various market variables. Understanding Greeks, such as delta, gamma, and theta, provides invaluable insights to fine-tune your trading strategies and manage risk effectively.

Expert Insights and Actionable Tips:

1. Master Trader Insights on Options Strategies:

Harness the collective wisdom of acclaimed experts, who provide practical tips and proven strategies for maximizing returns in various market conditions. Learn from their experience and implement these tactics to enhance your trading acumen.

2. Risk Management Strategies for Options Traders:

Options trading carries inherent risks. This section outlines robust risk management strategies, imparting techniques to minimize losses and protect your portfolio from adverse market movements.

Conclusion:

yr4nv.options.trading.basics.3course.bundle.part3.rar unveils the intricacies of options trading, empowering you with knowledge that can transform your financial aspirations. Embrace this comprehensive guide and step confidently into the dynamic world of derivatives, unlocking the potential for prudent risk management and enhanced investment returns.

Image: tme.net

Yr4nv.Options.Trading.Basics.3course.Bundle.Part3.Rar

Image: www.bigcommerce.com