Unlocking the Potential of Equity Options Trading

The world of financial markets is constantly evolving, presenting new opportunities for investors to grow their wealth. Among these, equity options trading has gained significant traction, offering traders the potential for substantial returns. Whether you’re based in the United Kingdom or South Africa, there are reputable equity options trading platforms available to facilitate your trading journey.

Image: www.cmcmarkets.com

The Basics of Equity Options Trading

Equity options are financial contracts that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock, at a specified price (strike price) on or before a predetermined date (expiration date). By purchasing an option, you acquire the potential to profit from favorable market movements without incurring the full cost of direct ownership.

Navigating the Equity Options Landscape

The influx of new trading platforms has made accessibility easier, but selecting the right one for your unique needs is paramount. Consider factors such as platform stability, user-friendliness, trading fees, and availability of educational resources. In both the UK and South Africa, there are numerous reputable options to choose from, including Saxo Bank, IG, and Plus500.

Expert Insights and Tips for Equity Options Traders

Becoming a successful equity options trader requires a combination of knowledge, strategy, and patience. Here are a few tips to enhance your trading experience:

- Understand the fundamental principles of option pricing models, such as the Black-Scholes model.

- Conduct thorough research and technical analysis to identify underlying assets with potential for favorable price movements.

- Set realistic profit targets and carefully manage your risk exposure.

- Monitor market trends and stay updated with financial news to make informed trading decisions.

- Remember that option trading involves inherent risks and seek professional advice if necessary.

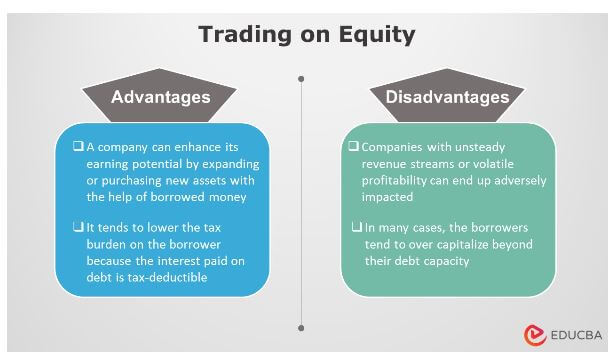

Image: www.educba.com

FAQs on Equity Options Trading

- Q: Are there specific regulations and laws governing equity options trading in the UK and South Africa?

A: In the UK, the Financial Conduct Authority (FCA) regulates equity options trading, while in South Africa, it is the Financial Sector Conduct Authority (FSCA).

- Q: What are the advantages of using an equity options trading platform?

A: Platforms provide access to real-time market data, charting tools, and leverage facilities, enhancing traders’ ability to make informed decisions.

- Q: How is equity options trading different from stock trading?

A: Equity options give the buyer the right, but not the obligation, to buy or sell an underlying asset, while stock trading involves purchasing outright ownership.

Equity Options Trading Platform And Uk And South Africa

Image: www.istockphoto.com

Conclusion

Equity options trading can be a rewarding endeavor with the potential to generate significant returns. By carefully selecting a reputable platform and following the insights provided, you can unlock the opportunities in the equity options market in both the UK and South Africa. If you find this article informative, please share it with others and engage in further discussions on this topic.