Understanding Option Trading Basics

Option trading involves contracts that give buyers the right to buy or sell an underlying asset at a specific price before a particular date. When you already hold equity in the underlying asset, trading options becomes a powerful tool to potentially enhance returns, reduce risk, or generate additional income.

Image: www.pinterest.com

The Benefits of Option Trading with Equity

- Enhanced returns: Options can provide leveraged exposure to the underlying asset, offering the potential to generate higher returns compared to holding the stock alone.

- Risk management: Hedging strategies involving options can help mitigate downside risk associated with stock ownership, protecting gains or limiting losses.

- Income generation: Selling covered calls against existing shares can generate premium income while allowing potential upside participation.

Types of Option Trading for Equity Holders

There are various options strategies suitable for investors with equity holdings:

- Covered call: Selling a call option against shares already owned, with the obligation to sell a fixed number of shares if the option is exercised.

- Cash-secured put: Selling a put option with sufficient cash available to purchase the underlying asset if the option is exercised.

- Call spread: Simultaneously buying a lower strike call and selling a higher strike call to potentially profit from a narrow rise in the stock price.

- Put spread: Buying a lower strike put and selling a higher strike put to potentially profit from a limited decline or consolidation in stock price.

Expert Advice for Trading Options with Equity

- Understand the risks: Option trading involves significant risk, especially for inexperienced investors.

- Educate yourself: Thoroughly research option trading strategies and their potential outcomes before engaging.

- Manage leverage: Use options cautiously and avoid using excessive leverage that could amplify losses.

- Consider the investment horizon: Options have limited lifespans, so determine your timeframe before executing trades.

- Have a plan: Develop a clear strategy for each trade, including defined entry and exit points, to mitigate emotional decision-making.

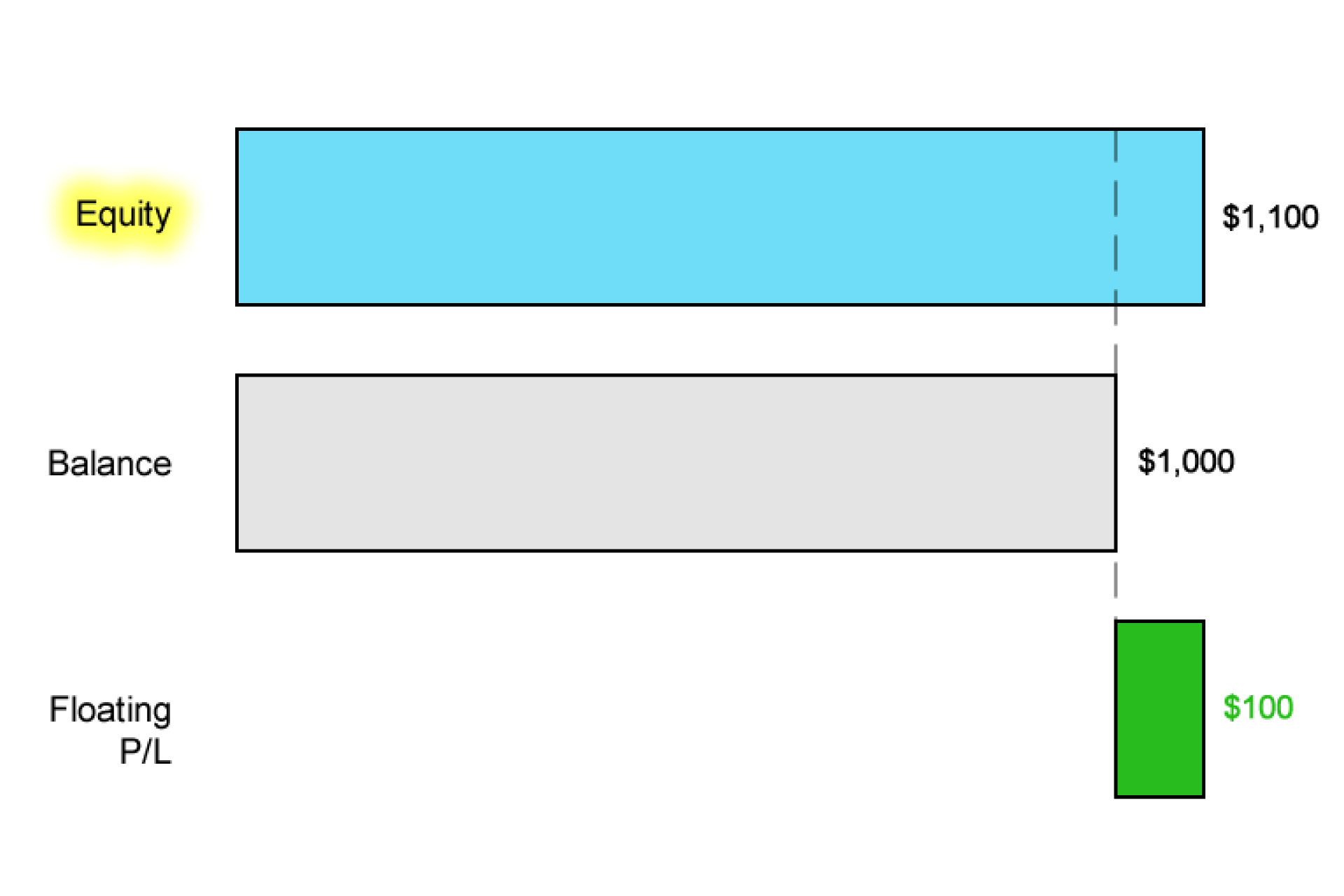

Image: fxaccess.com

Trading Options When You Have Equity

Image: www.cmcmarkets.com

Frequently Asked Questions on Option Trading with Equity

Q: What is the primary goal of trading options with equity?

A: To enhance returns, manage risk, or generate income by utilizing contracts that give the right to buy or sell an underlying asset.

Q: Which type of option trade is commonly used for stock holders?**

A: Covered call, as it allows investors to sell a call option against existing shares while maintaining ownership.

Q: How much leverage can I use when trading options?**

A: Leverage in option trading is determined by the specific strategy employed. Exercise caution and consider individual circumstances.

Q: What are the risks associated with option trading?**

A: Option trading involves the risk of losing the entire investment, as well as undefined risk for option sellers.

Conclusion**

Trading options with equity can offer opportunities for enhanced returns, risk management, and income generation. However, it is crucial to approach options trading with a clear understanding of the risks involved. By conducting thorough research, incorporating expert advice, and following prudent trading practices, investors can potentially augment their investment returns while mitigating downside exposure. If you are interested in exploring the world of option trading with equity, consider seeking professional guidance from a qualified financial advisor.