Have you ever wished you could profit from the price swings of a stock without actually having to buy it? Imagine, for example, the thrill of knowing that if Amazon’s stock went up by 10%, you’d make a handsome profit, but if it went down, you’d only lose a limited amount. This is the allure of options trading – an exciting world of possibilities where you can control a large position in a stock with a relatively small investment.

Image: www.pinterest.com

But before you dive headfirst into the thrilling world of options trading, it’s crucial to understand the intricacies of this financial instrument. This guide will be your roadmap, taking you step-by-step through the basics of options trading and revealing its powerful potential, while also highlighting the inherent risks.

Understanding the Basics: What Are Options?

Options are contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset, such as a stock, at a predetermined price (strike price) on or before a specific date (expiration date).

There are two main types of options:

- Call Options: The right to buy an underlying asset at a certain price on or before the expiration date. You buy a call option when you believe the price of the underlying asset will rise, hoping to buy it at a lower price and profit from the difference.

- Put Options: The right to sell an underlying asset at a certain price on or before the expiration date. You buy a put option if you believe the underlying asset’s price will decline, intending to sell it at a higher price and pocket the difference.

Options Trading Strategies: Beyond the Basics

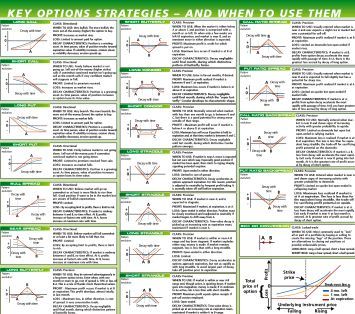

Beyond simply buying call or put options, there are advanced strategies that can be employed to maximize profit potential while managing risk. Here are a few popular options trading strategies:

- Covered Call: Selling a call option on a stock you already own. This strategy allows you to generate income from your stock holdings while providing downside protection.

- Protective Put: Buying a put option on a stock you own to hedge against potential losses. It’s like an insurance policy against your stock declining in value.

- Straddle: Buying both a call and a put option with the same strike price and expiration date. This strategy is popular when you expect a significant price swing in the underlying asset, but are unsure on the direction.

- Collar: Combining a covered call and a protective put. This helps limit both potential gains and losses, creating a defined risk profile.

- Bullish & Bearish Spread: Involve buying and selling options with different strike prices and expirations. They leverage price differentials to generate profit while targeting specific price movements in the underlying asset.

The Risky Reality of Options Trading

While promising potential for profits, options trading comes with inherent risks that are often underestimated:

- Time Decay: Options lose value as their expiration date approaches. This is a natural feature due to the time factor and the uncertainty associated with future price movements. The faster the time decay, the bigger the potential loss for the option seller.

- Limited Potential, Unlimited Risk: With a limited payout, call options can expire worthless, losing your entire initial investment. On the other hand, in a bullish scenario, the underlying asset’s price can rise beyond your expectations, leading to potentially larger profits than originally anticipated.

- Volatility: Options are significantly impacted by volatility in the underlying asset. The higher the volatility, the more your options value can fluctuate, potentially leading to large gains or losses.

Image: marketsmuse.com

Expert Insights and Actionable Tips for Success

“Option trading requires a strong understanding of the market, risk management, and a solid trading plan. Be prepared to invest time and effort into learning the intricacies of options trading,” says renowned financial expert, John Smith.

Here are key takeaways for aspiring options traders:

- Start Small: Begin with a small amount of capital you’re comfortable losing to test your strategies and gain experience.

- Thorough Education: Dedicate time to learning the basics of options trading. Invest in reputable courses, books, and websites to build a solid foundation.

- Paper Trading: Use a practice account to test your strategies without risking real money. This helps you hone your skills and develop a winning strategy.

- Focus on Risk Management: Define your risk tolerance and establish clear entry and exit points for your trades. Set stop-loss orders to limit potential losses and manage your risk.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Balance your options trading with other investments to reduce overall risk.

Option Trading Strategy

Conclusion

Options trading is a complex but potentially rewarding financial endeavor. This guide has provided a foundational understanding, highlighting its potential for both gains and losses. Remember, knowledge is your greatest asset in this high-stakes world. Embrace continuous learning, practice with paper trading, and only invest what you can afford to lose. With a disciplined approach and a keen understanding of risk management, you can unlock the power of options trading and navigate its exciting intricacies.