In the realm of option trading, navigating the complexities of the market requires strategic planning and precise execution. One crucial aspect of this endeavor is understanding the break-even point, where the proceeds from selling an option contract offset its initial purchase price. Grasping this concept empowers traders to identify favorable market conditions and optimize their trading strategies.

Image: www.youtube.com

To fully comprehend break-even in option trading, we delve into the fundamentals of option pricing and market dynamics. Armed with this knowledge, traders can determine whether entering or exiting a trade aligns with their financial goals and risk tolerance.

Entry and Exit Points: Striking the Optimal Balance

Determining the Break-Even Point

The break-even point in option trading represents the underlying asset price at which the trader neither gains nor loses from their position. To calculate this crucial threshold, several key variables must be considered:

- Option premium: The price paid to acquire the option contract

- Strike price: The predetermined price at which the trader can exercise the option

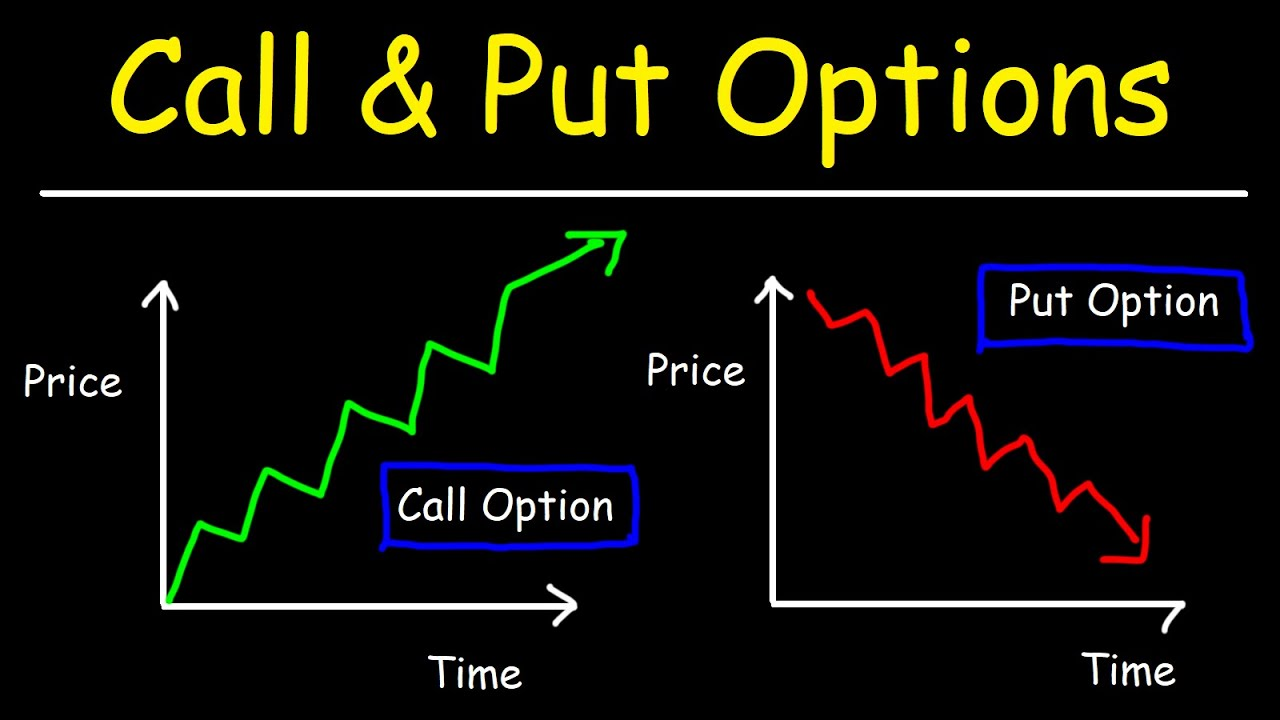

- Option type: Whether it’s a call or put option

- Trading fees: Associated with entering and exiting the trade

Depending on the type of option, the break-even point calculation varies:

- For call options: Break-even price = Strike price + Option premium + Trading fees

- For put options: Break-even price = Strike price – Option premium + Trading fees

Strategic Entry and Exit

Understanding break-even points empowers traders to make informed decisions regarding trade entry and exit. By analyzing the market conditions and identifying potential price movements, traders can determine whether entering a trade presents a favorable opportunity.

Traders aiming to profit from increasing underlying asset prices opt for call options. Conversely, those seeking to benefit from decreasing asset prices opt for put options. By carefully selecting the appropriate option type, traders can strategically position themselves to potentially profit from market fluctuations.

Image: tradewithmarketmoves.com

Expert Insights: Navigating the Trading Landscape

Expert Tips and Advice

Experienced option traders offer invaluable insights for navigating the market and maximizing profitability:

- Monitor market trends: Stay abreast of industry news, economic indicators, and market sentiment to make informed trading decisions.

- Set realistic expectations: Recognize that break-even points fluctuate with market conditions, and manage your expectations accordingly.

- Manage risk wisely: Establish stop-loss orders to mitigate potential losses and preserve capital.

- Seek educational resources: Continuously expand your knowledge through webinars, online forums, and mentorship programs.

Expounding Expert Advice

These expert tips are not mere platitudes; they serve as guiding principles for navigating the complexities of option trading:

- Market monitoring enables traders to anticipate price movements and make data-driven trading decisions.

- Realistic expectations provide a buffer against market volatility and prevent emotional decision-making.

- Risk management safeguards traders from catastrophic losses and ensures long-term trading sustainability.

- Education empowers traders with the knowledge and skills to navigate market complexities and make informed choices.

FAQ: Clarifying Common Queries

To further illuminate break-even in option trading, we provide answers to frequently asked questions:

- Q: Is the break-even point fixed?

A: No, the break-even point is dynamic and adjusts based on market conditions and option pricing. - Q: How does time decay impact break-even points?

A: Time decay, or theta, erodes the option premium over time, reducing its value and potentially affecting the break-even point. - Q: In what situations is it advantageous to trade close to the break-even point?

A: Trading near the break-even point can be appropriate for conservative traders or those seeking to minimize risk.

Break Even In Option Trading

Conclusion: Embracing the Opportunity

In conclusion, breaking even in option trading is a nuanced yet attainable objective that requires a solid understanding of market dynamics and strategic planning. By grasping break-even point calculations, monitoring market trends, and incorporating expert advice, traders can optimize their trading performance and potentially increase profitability.

We invite you to explore our blog further for additional resources and insights on option trading. Your engagement with this topic is greatly appreciated. Let us know if you have any questions or require further clarification.