Exploring the Nuances of Options Trading at the Critical Moment

Are you ready to unravel the mysteries of options trading at expiration, particularly in the context of Amazon? Join us on an illuminating journey as we delve into the intricacies of this exhilarating market. Options, with their inherent flexibility, offer a tantalizing opportunity to enhance your trading prowess. By understanding the dynamics at play near expiration, you can harness the power of this financial instrument and potentially secure profitable outcomes.

Image: www.madhedgefundtrader.com

Unveiling the Essence of Options: A Tale of Rights and Obligations

At its core, an option is a contract that grants the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. Options empower traders with the ability to speculate on the future direction of an asset without the commitment of directly owning it. This flexibility translates into a myriad of strategic possibilities, making options a versatile tool for both risk management and profit generation.

Navigating the Amazonian Market: An Expiration Date to Remember

In the realm of stock options, expiration takes on paramount importance. Amazon options, like their counterparts, have a finite lifespan, typically expiring on the third Friday of each month. As this fateful day approaches, the options market undergoes a transformation, and it is crucial for traders to recognize the nuances that come into play. Volatility, the ever-present force in options trading, tends to heighten as expiration nears, creating both opportunities and challenges for astute traders.

Decoding the Anatomy of Options: Intrinsic and Extrinsic Value

To grasp the dynamics of options trading at expiration, a clear understanding of intrinsic and extrinsic value is essential. Intrinsic value measures the inherent worth of an option based on the difference between the underlying asset’s price and the strike price. Extrinsic value, on the other hand, incorporates factors such as time to expiration, volatility, and interest rates. As expiration draws near, intrinsic value becomes increasingly dominant, while extrinsic value diminishes.

Unveiling the Art of Trading Options at Expiration: Strategies Unleashed

The countdown to expiration presents a fascinating landscape for options traders, as various strategies emerge as potential avenues for profit.

-

Day Trading at Expiration: This fast-paced approach capitalizes on the heightened volatility near expiration by executing numerous trades within a single trading day.

-

Selling Options Near Expiration: By selling options close to their expiration date, traders can potentially generate income from the decay of extrinsic value.

-

The Wheel Strategy: A combination of selling and buying options, this strategy aims to capture premiums while managing risk.

Trading Psychology: Embracing Emotional Discipline

Options trading, particularly near expiration, can be an emotionally charged endeavor. It is imperative to cultivate emotional discipline to avoid succumbing to fear or greed. Patience, objectivity, and a well-defined trading plan are invaluable assets in navigating the rollercoaster of options markets.

Seeking Wisdom from the Masters: Quotes to Inspire

“The best way to learn is by doing. The best way to learn options is by trading them.” – Mark Douglas

“Volatility is the mother’s milk of options traders.” – Nassim Nicholas Taleb

Conclusion: Embracing the Power of Options at Expiration

Options trading at expiration offers a unique set of opportunities and challenges, demanding a thorough understanding of the underlying concepts and the emotional fortitude to navigate the market’s volatility. By equipping yourself with the knowledge and strategies outlined in this article, you empower yourself to leverage options effectively, potentially enhancing your trading outcomes. Remember, the expiration date is not an end but rather a critical juncture, a time to unleash the transformative power of options trading.

Image: www.investors.com

Trading Options At Expiration Amazon

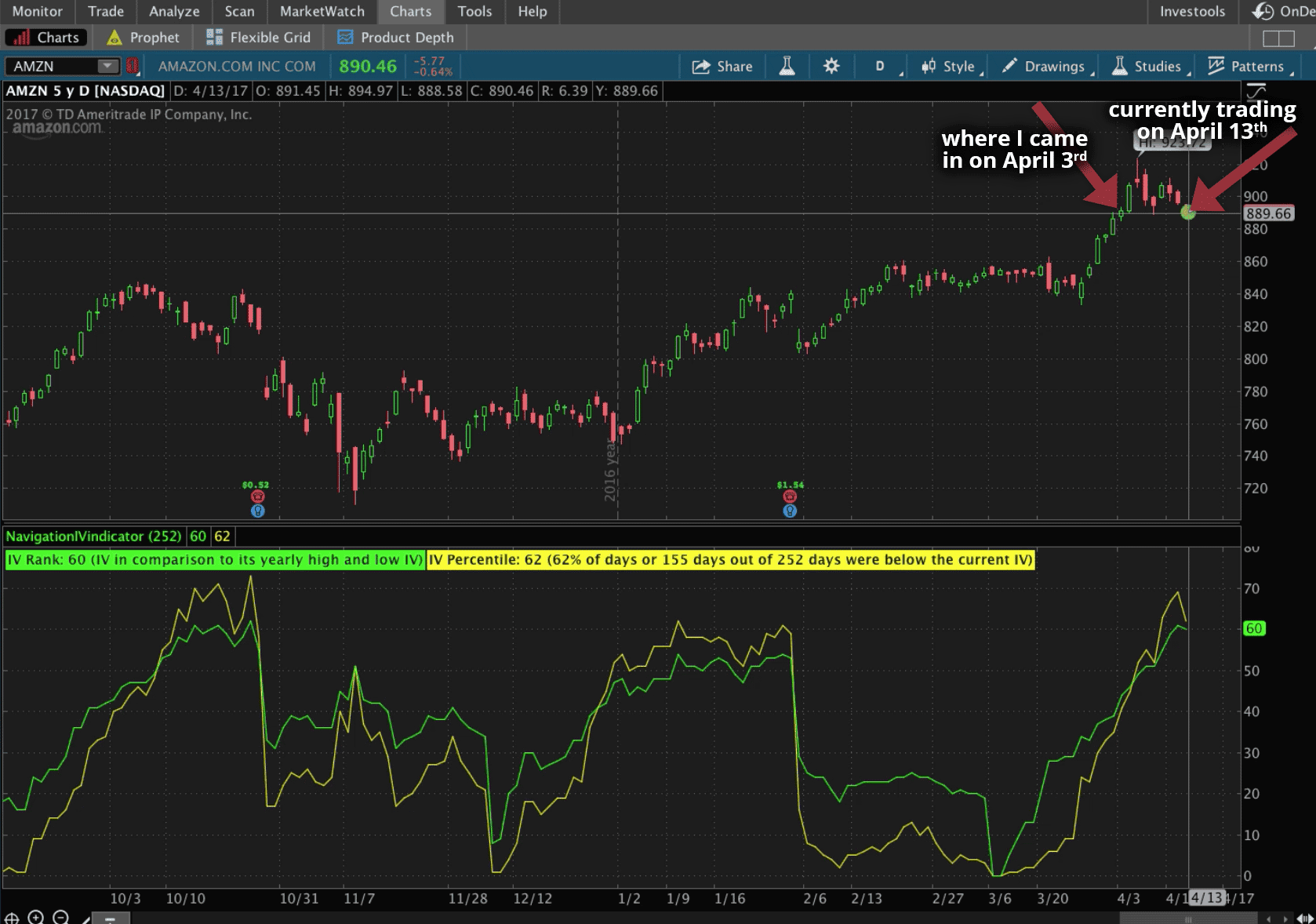

Image: navigationtrading.com