Introduction

In the fast-paced world of financial markets, options trading offers a unique strategy for risk management and potential profit maximization. However, understanding the intricacies of options trading is crucial to navigate its complexities. Among the essential concepts, understanding the break-even point holds paramount importance. It represents the equilibrium where the potential gains and risks associated with an options trade converge, providing valuable insights into the trade’s profitability potential.

Image: www.youtube.com

Defining Options Trading Break Even

An options trading break-even point refers to the price level at which an options contract’s premium cost is offset by the potential profit upon its successful execution. In simpler terms, it is the market price where an options trader neither makes nor loses money on the trade. This point serves as a crucial benchmark for assessing the feasibility and profitability potential of an options position.

Break Even Calculation

Calculating the break-even point for options trading involves precise arithmetic. For a call option, the break-even price is determined by adding the strike price to the premium cost. Conversely, for a put option, the break-even price is calculated by subtracting the premium cost from the strike price.

Harnessing the power of financial calculators or online options pricing tools empowers traders with accurate break-even price evaluations. These tools analyze essential variables such as strike price, premium cost, time to expiration, and volatility to deliver precise calculations, facilitating sound trading decisions.

Trading Strategies and Break Even Analysis

The ramifications of break-even price extend beyond mere theoretical significance; they trickle down to practical applications within various options trading strategies. For instance, in covered call strategies, traders analyze the break-even price against the underlying asset’s current market value to assess the potential profitability.

Similarly, in vertical spreads, the spread’s break-even price dictates the range of potential profitability, guiding traders in making informed decisions about their entry and exit points.

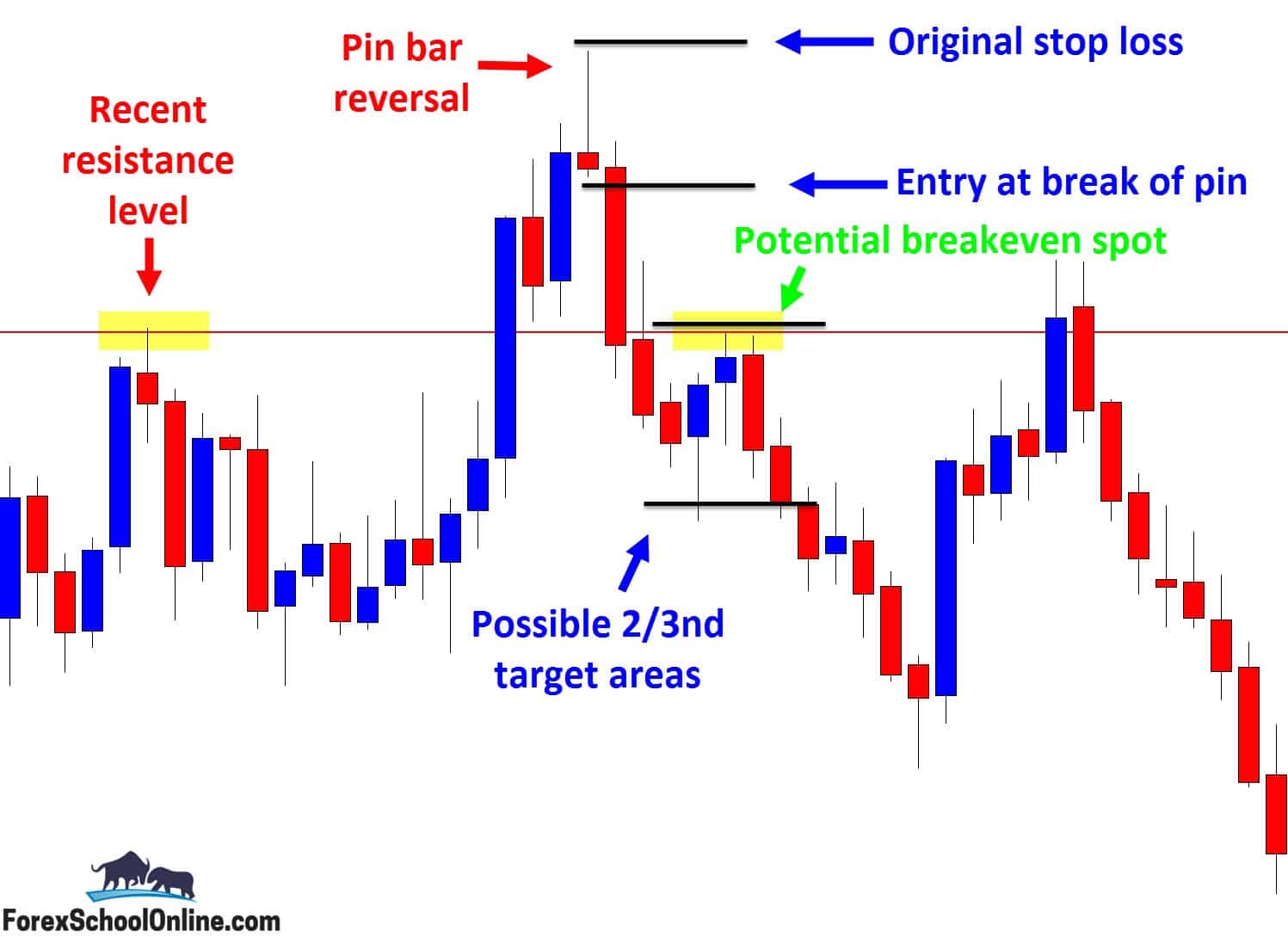

Image: www.forexschoolonline.com

Risk Management and Break Even Analysis

Beyond profitability calculations, break-even analysis serves as a risk management tool. It offers a tangible reference point against which traders can gauge their risk tolerance and adjust their trading strategies accordingly. By establishing predefined break-even targets, traders can set limits on their potential losses, minimizing risk exposure.

Options Trading Break Even Meaning

Image: fintrakk.com

Conclusion

The concept of break-even point in options trading empowers traders with a robust framework for assessing the potential profitability and risks associated with their trades. Through careful calculation and analysis, traders can harness the break-even point to enhance their trading strategies, manage risk, and maximize their financial potential. Understanding and leveraging the break-even point is a crucial step towards becoming a proficient and successful options trader, navigating the complexities of financial markets with informed decisions and strategic insights.