Introduction

Image: www.interactivebrokers.com.au

In the labyrinth of financial markets, options trading and margin trading stand as two powerful tools that can either amplify your profits or lead to devastating losses. Embarking on this journey requires a deep understanding of their intricacies and an unwavering commitment to risk management.

Options trading allows you to wager on the future direction of an asset, granting you the flexibility to both profit from market gains and hedge against potential downturns. Margin trading, on the other hand, magnifies your buying power by borrowing funds from your broker, potentially supercharging your returns. However, both strategies come with inherent risks that must be carefully considered.

Demystifying Options Trading

An option contract represents an agreement between two parties, giving the buyer the right (but not the obligation) to buy or sell an underlying asset at a predetermined price (strike price) before a specific date (expiration date). There are two main types of options: calls and puts.

Calls confer the right to buy an asset. If the underlying asset rises above the strike price, the call option gains value, potentially resulting in significant profits. Conversely, if the asset price falls below the strike price, the call option becomes worthless.

Puts convey the right to sell an asset. When the underlying asset price declines below the strike price, the put option gains value. If the asset price rises, the put option becomes worthless.

Harnessing the Power of Margin Trading

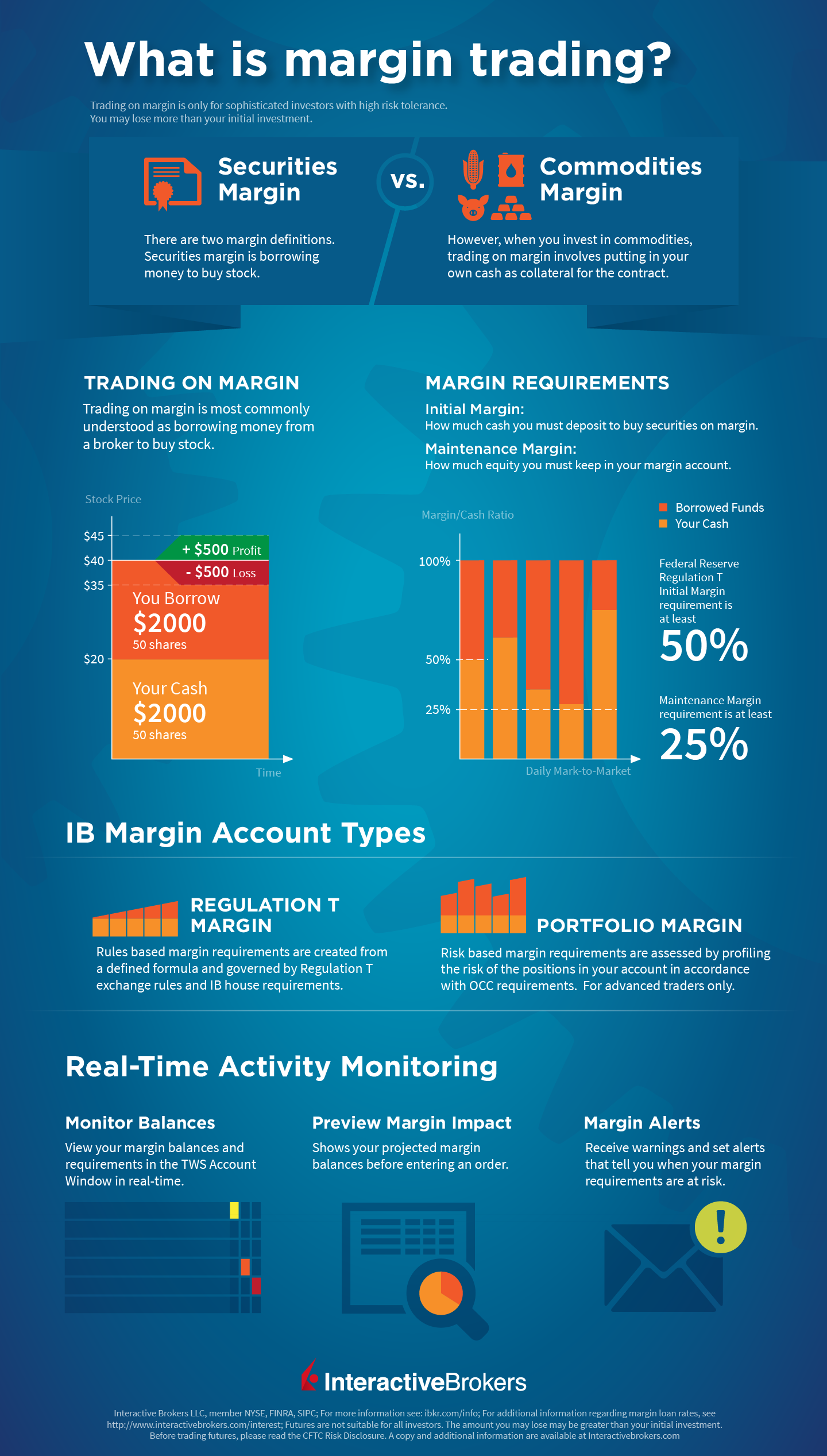

Margin trading enables traders to purchase more assets than their account balance would normally allow. By borrowing funds from their broker, they can effectively extend their buying power and amplify potential returns. However, it is crucial to understand that margin trading carries significant risks.

Margin Calls

If the value of your assets declines significantly, your broker may issue a margin call, demanding that you either repay a portion of the loan or increase your collateral. If you fail to meet the margin call, your broker may liquidate your positions to cover the shortfall.

Risk Management in Options Trading and Margin Trading

The key to successful options and margin trading lies in prudent risk management. Here are some essential strategies to minimize your exposure:

-

Due Diligence: Research the assets you trade thoroughly and understand the underlying factors that influence their prices.

-

Start Small: Begin with modest trades and gradually increase your position size as you gain experience and confidence.

-

Monitor Closely: Keep a close watch on the performance of your trades and adjust your positions as needed.

-

Limit Risks: Set stop-loss orders to automatically liquidate your positions if they fall below a specified threshold.

-

Consider Spreads: Using spread strategies can limit your downside risk while still participating in market movements.

Expert Insights for Success

Seasoned traders emphasize the importance of discipline and emotional control in both options and margin trading.

“Trading is a marathon, not a sprint,” says market strategist Mark Sebastian. “Focus on long-term gains and avoid making impulsive decisions based on greed or fear.”

Trading coach Cameron Hughes advises, “Manage your risk carefully and never trade with more money than you can afford to lose. The financial markets are unforgiving for those who disregard this principle.”

Conclusion

Options and margin trading offer powerful tools for amplifying returns but also carry significant risks. By grasping the fundamentals, seeking knowledge from experts, and implementing robust risk management strategies, you can harness their potential while mitigating potential pitfalls. Remember, the path to financial success is paved with patience, discipline, and unwavering caution. Embrace the journey with a clear-eyed understanding of the rewards and risks, and you will be well-positioned to navigate the turbulent waters of the financial markets with confidence and strategy.

Image: phemex.com

Options Trading And Margin

Image: bitcoinworld.co.in