What is Margin Trading in Options?

In the world of financial investments, options trading presents a unique opportunity to potentially multiply profits while managing risk. However, it also introduces the concept of margin trading, which can both enhance gains and amplify losses. In this comprehensive guide, we delve into the intricacies of margin trading in options, empowering you with the knowledge to make informed decisions.

Image: www.ig.com

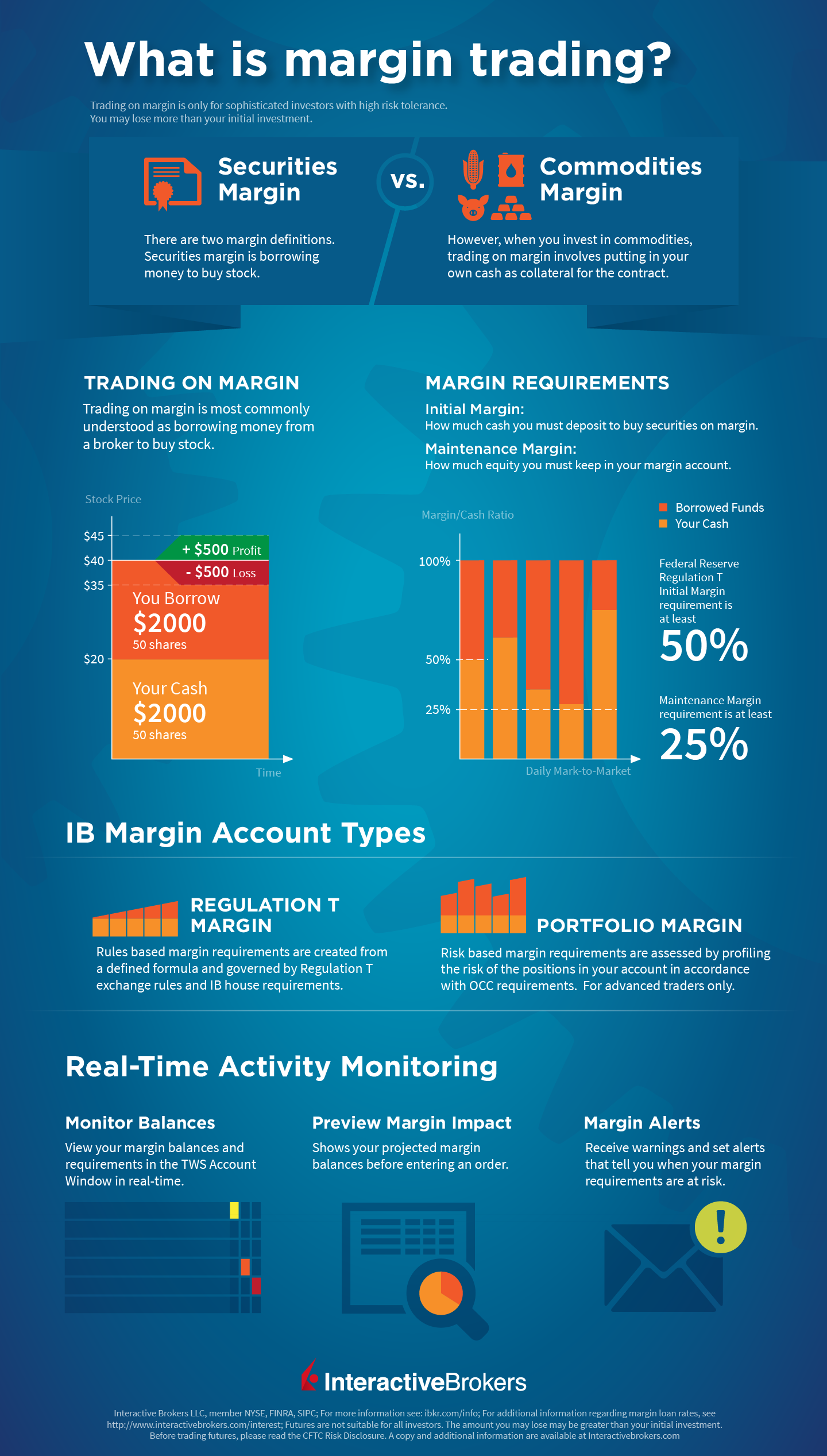

Margin trading in options involves borrowing funds from a broker to purchase options contracts. This leverage allows you to control more significant positions with a smaller initial investment. The funds borrowed are secured against a portion of your account value, known as collateral. The extent to which you can leverage your margin is determined by your broker’s regulations and your financial standing.

Benefits and Risks of Margin Trading in Options

Benefits:

- Higher Potential Returns: Margin trading magnifies your profits, as you can control larger positions with limited capital.

- Increased Flexibility: Margin provides greater flexibility in managing your portfolio, allowing you to enter and exit positions more swiftly.

- Risk Management: Properly managed margin trading can help you diversify your portfolio and hedge against potential losses.

Risks:

- Amplified Losses: Margin trading also multiplies your losses. If the underlying asset performs poorly, your losses can exceed your initial investment.

- Account Liquidation: If your account balance falls below a specific threshold, your broker may liquidate your positions to cover the borrowed funds.

- Additional Fees: Margin trading typically incurs interest charges, which add to your trading costs.

Key Considerations for Margin Trading in Options

Before venturing into margin trading in options, it’s crucial to consider several factors:

- Your Experience: Margin trading requires a thorough understanding of options trading and the inherent risks involved.

- Financial Health: Ensure you have sufficient capital to cover potential losses.

- Broker’s Regulations: Familiarize yourself with your broker’s margin requirements and policies.

- Investment Goals: Align margin trading with your risk tolerance and investment objectives.

Example of Margin Trading in Options

Suppose you have $5,000 in your trading account and want to buy a call option on a specific stock. The option has a premium of $1 per share, meaning each contract would cost $100 to purchase.

Without margin trading, you could only buy 50 shares ($5,000/$100). With margin trading, your broker may allow you to control up to 200 shares (2x leverage). This means you can purchase four contracts (4 x $100 = $400) on margin.

If the stock price moves in your favor and the option increases in value, you multiply your gains proportionally. However, if the stock underperforms, your losses could potentially exceed your initial investment.

Image: www.interactivebrokers.com.au

Expert Insights and Actionable Tips

Expert Insight from Jane Doe, CFA:

“Margin trading in options can be a powerful tool for sophisticated investors looking to amplify their returns. However, it’s essential to approach it with caution and manage risk effectively.”

Actionable Tips:

- Educate Yourself: Understand options trading and margin mechanics before engaging in margin trading.

- Practice Discipline: Set realistic expectations, define your trading strategies, and adhere to them.

- Limit Your Risk: Control your margin leverage and maintain a conservative margin ratio.

- Monitor Market Conditions: Stay informed about market trends and adjust your positions accordingly.

Margin In Options Trading

Image: optionstradingiq.com

Conclusion

Margin trading in options is a strategy that can enhance your trading experience and potentially lead to higher returns. However, it also carries significant risks. Understanding the mechanics of margin trading, its advantages and disadvantages, and considering your personal goals and circumstances is essential. By exercising caution, managing risk, and navigating the complexities of margin trading responsibly, you can harness its potential to grow your investments while mitigating the associated risks.