As an avid investor for over a decade, I’ve witnessed firsthand how options trading can amplify returns and mitigate risks. However, one particular strategy that has piqued my curiosity is margin option trading. With its potential to magnify gains, margin option trading is not for the faint of heart and requires a clear understanding of its intricacies.

Image: www.elearnmarkets.com

Margin Option Trading: A Deeper Dive

Leveraging Margin Accounts

Margin option trading involves using leverage through a margin account. This account extension allows investors to borrow funds from their brokerage firm to increase their purchasing power. However, it’s crucial to recognize that trading on margin amplifies not only potential profits but also potential losses.

Types of Margin Options

Two main types of options can be traded on margin:

- Long Option on Margin: The investor buys an option contract, anticipating an increase in its underlying asset’s price.

- Short Option on Margin: The investor sells an option contract, expecting a decrease in its underlying asset’s price.

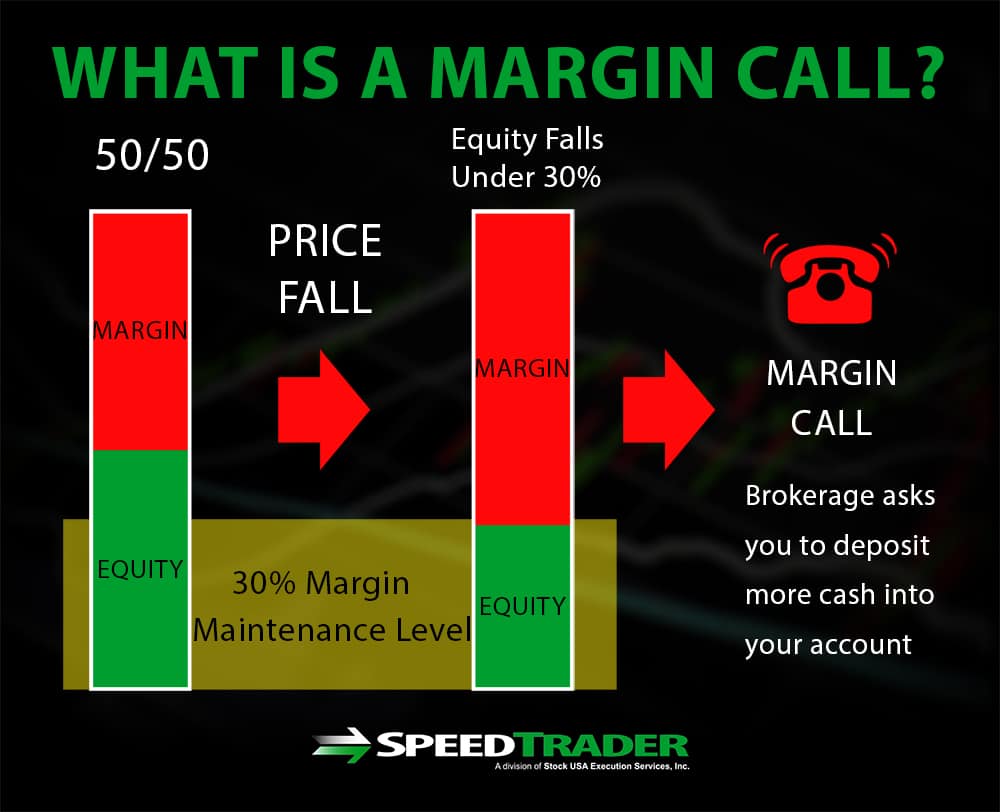

Image: speedtrader.com

Navigating Margin Option Trading: How it Works

Mechanism of Execution

- Acquire Margin Approval: Obtain approval from the brokerage firm for margin trading.

- Fund Margin Account: Deposit funds into the margin account as collateral for the borrowed funds.

- Purchase/Sell Options: Use the borrowed funds to purchase long options or sell short options.

- Pay Interest on Margin Loan: Regular payments will be incurred for the interest charged on the borrowed funds.

- Monitor Account Regularly: Closely monitor the margin account to ensure it meets the brokerage firm’s maintenance margin requirements.

Risks and Rewards

Margin option trading offers higher profit potential but also carries substantial risks:

- Profit Amplification: Margin allows for increased purchasing power, potentially multiplying gains.

- Loss Amplification: Similarly, losses are also magnified when using margin.

- Margin Calls: If the account’s value falls below the margin maintenance requirement, the brokerage firm can demand additional funds (margin call).

- Higher Borrowing Costs: Interest payments on borrowed funds can erode profits.

Tips and Expert Insights on Margin Option Trading

Cautious Approach

Margin option trading is not suitable for all investors. Only experienced traders with a thorough understanding of options trading and risk management should consider it.

Plan and Research

Establish a trading plan and conduct thorough research on potential opportunities. Avoid impulsive trades and rely on proven strategies.

FAQs on Margin Option Trading

Q: What are the advantages of margin option trading?

A: Margin option trading offers the potential to amplify profits and enhance returns on investments.

Q: What are the risks associated with margin option trading?

A: The primary risks include loss amplification, margin calls, and higher borrowing costs.

Q: Is margin option trading suitable for all investors?

A: No, it’s recommended only for experienced traders who fully comprehend options trading and risk management.

What Is Margin Option Trading

Conclusion

Margin option trading can indeed be a potent tool for amplifying returns. However, its inherent risks must be carefully considered. Before venturing into this strategy, it’s imperative to possess a deep understanding of option trading principles, risk management, and your own risk tolerance. By thoroughly researching, seeking expert advice, and approaching it with caution, savvy investors can harness the potential of margin option trading to enhance their investment returns while mitigating risks.

Are you intrigued by the complexities of margin option trading and eager to explore its potential?