Introduction: Unlocking the Power of Option Trading

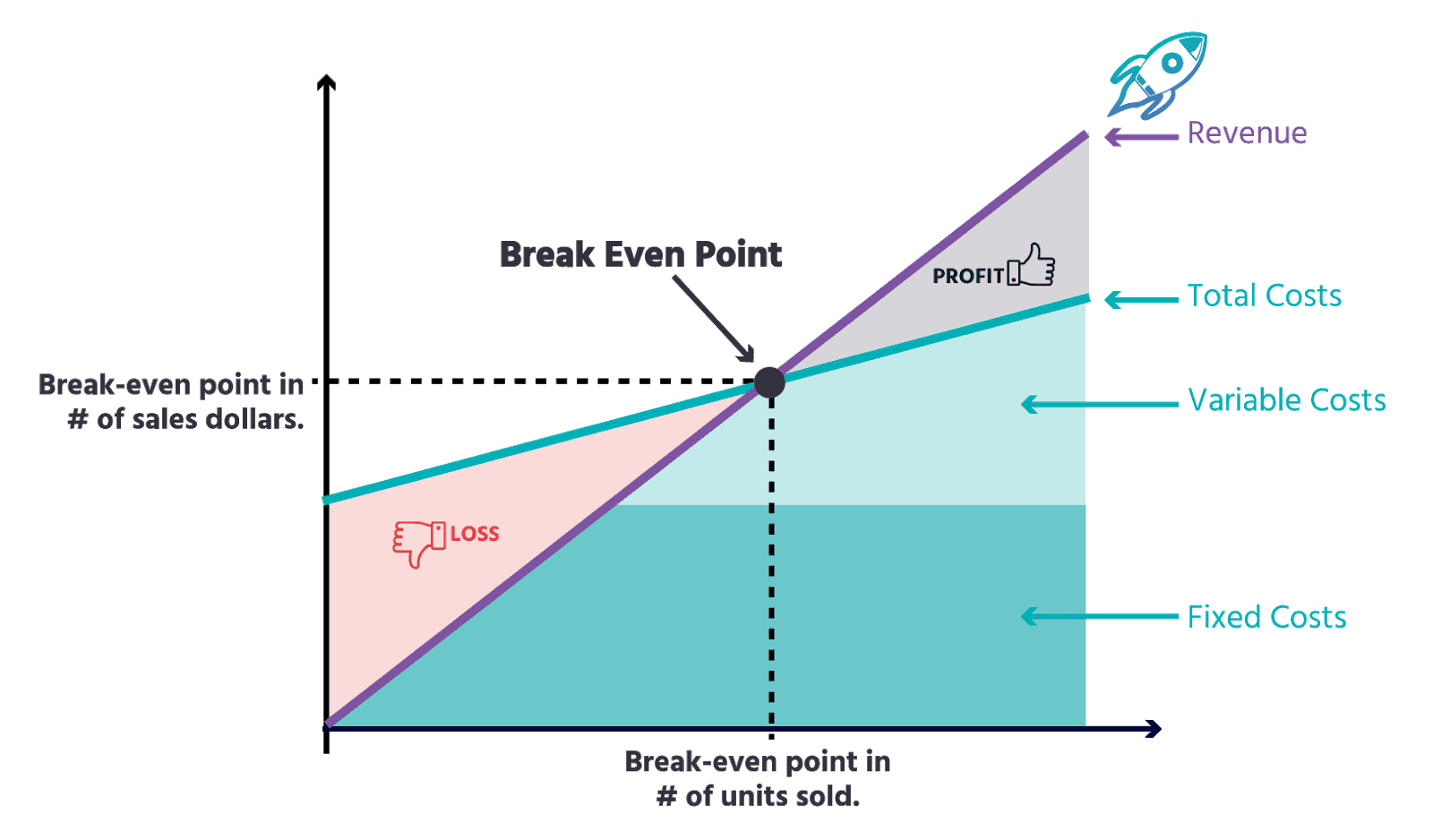

In the realm of investing, options trading presents a unique world of opportunities. As you navigate this dynamic landscape, understanding the break-even point becomes crucial for success. This pivotal concept marks the point where you neither gain nor lose on your option trade. By mastering the art of break-even analysis, you can make informed decisions, manage risk effectively, and maximize your potential profits.

Image: www.ecommerceceo.com

Defining the Break-Even Point: A Crossroads in Option Trading

The break-even point represents the underlying stock price at which the value of your option contract equals the total cost, including the premium you paid to purchase it. In other words, it is the point at which your trade balances out, leaving you neither better nor worse off financially. Understanding this concept is essential for setting realistic profit targets and minimizing potential losses.

Key Factors Influencing the Break-Even Point: Unveiling the Hidden Dynamics

Several factors play a pivotal role in determining the break-even point:

• Type of option: Call options and put options have different break-even points due to their inherent characteristics.

• Option premium: The amount you pay for the option directly affects the break-even point. A higher premium raises the break-even point.

• Underlying stock price: The current price of the underlying stock relative to its strike price significantly impacts the break-even point.

• Time to expiration: The time remaining until the option expires influences the break-even point as it affects the option’s time value.

Expert Insights: Navigating the Break-Even Labyrinth with Wisdom

Seasoned option traders swear by the following insights to excel in this challenging market:

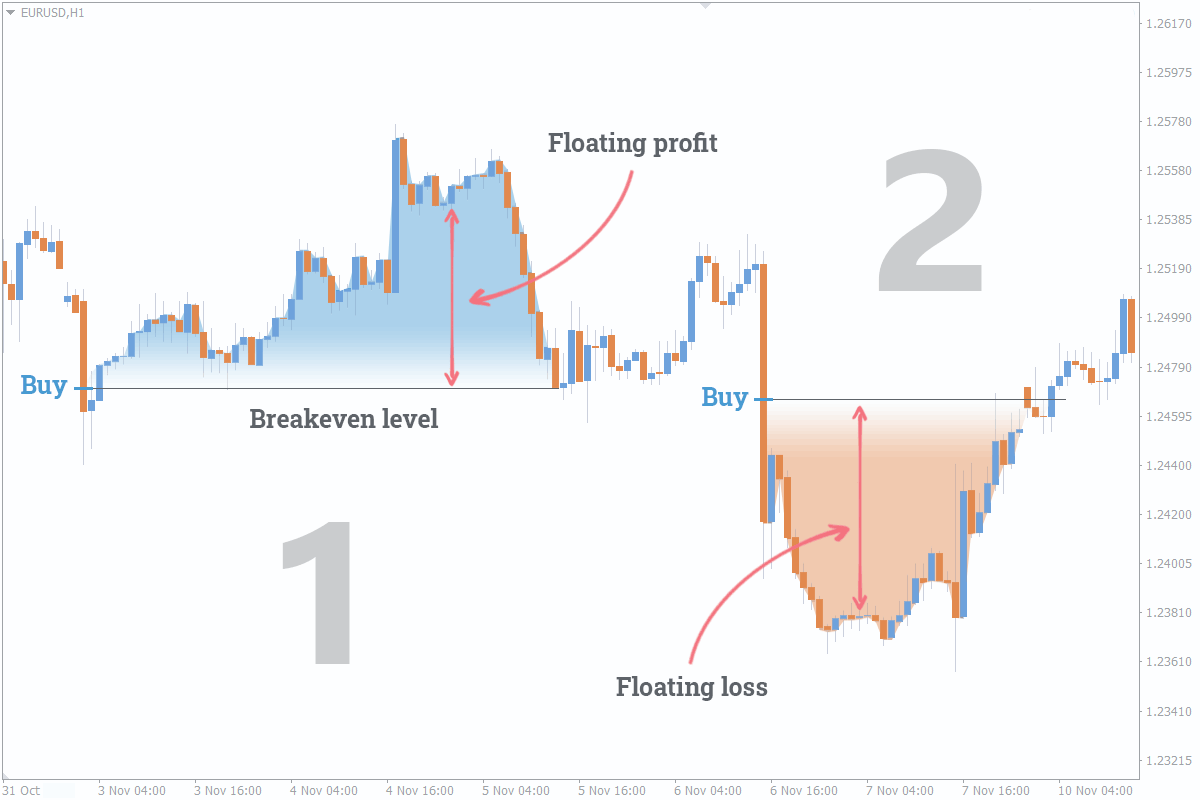

• Plan your entry and exit strategies: Carefully consider your entry point, taking into account the break-even point. Define your exit strategy in advance to avoid emotional decision-making.

• Monitor the underlying stock price: Keep a close eye on the underlying stock price fluctuations to assess the impact on the break-even point.

• Manage risk effectively: Utilize stop-loss orders and adjust your position size to manage risk and protect your capital.

Image: fxssi.com

Actionable Tips for Mastering the Break-Even Conundrum

• Calculate the break-even point before trading: Use the formula (Strike Price + Premium) for call options and (Strike Price – Premium) for put options.

• Consider the option premium thoughtfully: Choose options with premiums that align with your trading strategy and risk tolerance.

• Analyze historical stock price patterns: Study the underlying stock’s historical price movements to anticipate its future trajectory and make informed decisions.

Break Even Point In Option Trading

Conclusion: Empowering Yourself with Break-Even Knowledge

Understanding the break-even point in option trading empowers you with a valuable tool to navigate the often volatile market. By incorporating these insights, you can unlock the potential of this powerful financial instrument, make strategic decisions, and maximize your chances of success. Remember, the break-even point is not a definitive target but rather a guiding light that enhances your trading journey. Embrace this knowledge, practice diligent risk management, and let your trading prowess reach new heights.