Introduction

Image: www.reddit.com

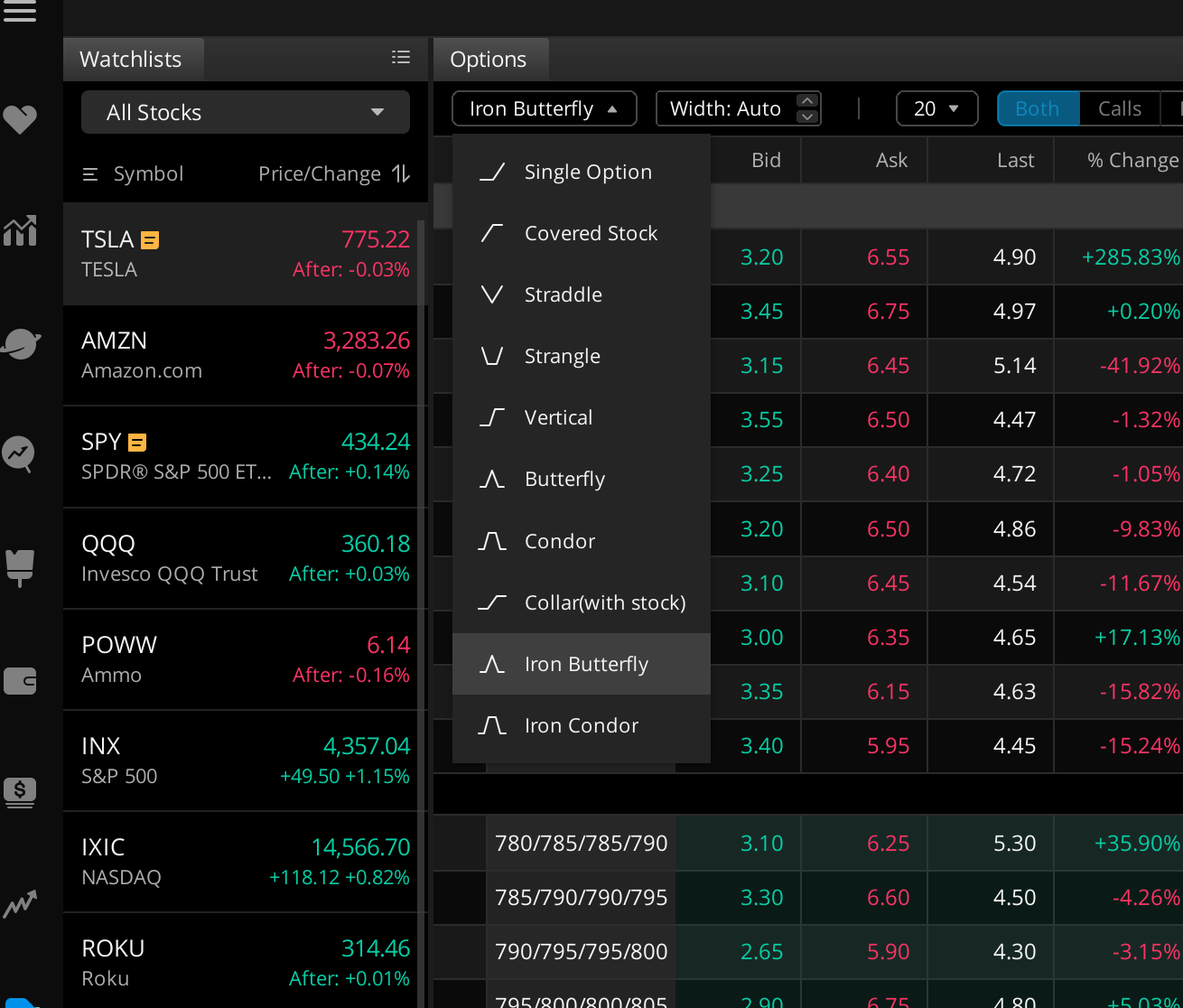

In the labyrinthine world of online trading, options emerge as complex yet potentially lucrative financial instruments. As a novice trader, navigating the complexities of options trading can be daunting. Enter Webull, a renowned online brokerage platform that has gained immense popularity among aspiring investors. One question that lingers on the minds of many is, “Does Webull have free options trading?” This comprehensive article aims to unravel the intricacies surrounding this topic, meticulously exploring the nuances of Webull’s offering and providing insights from expert sources. Through a blend of factual information, practical tips, and compelling narratives, we embark on a journey to empower you as you seek to unravel the depths of options trading on Webull.

Delving into the Enigma of Options Trading

Options trading presents a multifaceted landscape where traders have the ability to speculate on the future price of an underlying asset, such as a stock or index, without the obligation to purchase or sell. This intricate dance between risk and reward has captivated traders for decades, offering the potential for substantial profits. However, it is imperative to note that options trading also carries inherent risks, making it crucial for traders to exercise prudence and a comprehensive understanding of the subject matter.

Navigating Webull’s Options Trading Realm

Webull has emerged as a formidable force in the online brokerage arena, catering to a diverse clientele ranging from casual investors to seasoned professionals. As you contemplate the viability of options trading on Webull, it is essential to delve into the platform’s intricacies and uncover the details of its offering.

Unveiling the Truth: Is Options Trading on Webull Truly Free?

At the heart of our inquiry lies the burning question: does Webull indeed offer free options trading? The answer, dear reader, is somewhat nuanced and demands further elucidation. Unlike some competing platforms that levy commission fees on options trades, Webull staunchly maintains a zero-commission policy for both stock and options trading. This pivotal advantage translates to a significant financial benefit, particularly for active traders who execute a high volume of transactions.

Exploring the Potential Pitfalls: Unforeseen Costs in Options Trading

While Webull’s zero-commission policy may evoke a sense of elation, it is crucial to recognize that options trading on any platform often entails additional expenses beyond commissions. These expenses, although not directly charged by Webull, play a vital role in the overall cost of trading.

-

Options Contract Premiums: The intrinsic value of an options contract represents the price you must pay to acquire it. This premium can vary based on factors such as the underlying asset’s price, volatility, time to expiration, and strike price.

-

Exercise and Assignment Fees: In the event that you choose to exercise your options contract, which involves buying or selling the underlying asset at the strike price, you may incur an exercise fee. Additionally, assignment fees may arise if your options contract is assigned to you before its expiration date.

-

Margin Interest: If you employ margin trading strategies in your options trading endeavors, you may be subject to margin interest charges levied by Webull. Margin trading involves borrowing funds from your brokerage to increase your buying power, thereby amplifying both potential profits and risks.

Expert Insights: Unlocking the Secrets of Options Trading

To further illuminate the complexities of options trading on Webull, we sought the counsel of seasoned experts in the field. Their invaluable insights provide a beacon of guidance, empowering you to navigate this intricate landscape with confidence.

Practical Tips: Enhancing Your Options Trading Journey

Armed with a comprehensive understanding of the costs associated with options trading on Webull, let us now delve into practical tips that can elevate your trading acumen.

-

Embrace Education: Equip yourself with a deep understanding of options trading fundamentals. Immerse yourself in educational resources, attend webinars, and seek mentorship from experienced traders.

-

Start Small: As you embark on your options trading adventure, it is prudent to start with small trades. This measured approach allows you to gain experience and refine your strategies without risking substantial capital.

-

Manage Risk: The rollercoaster ride of options trading is invariably accompanied by inherent risks. Implement sound risk management techniques, such as setting stop-loss orders and position sizing strategies, to safeguard your hard-earned capital.

Conclusion: Unveiling the Truth and Empowering Your Trading

The world of options trading on Webull presents a tantalizing blend of opportunities and challenges. While the allure of free options trading is undeniable, it is essential to remain cognizant of the potential additional costs involved. Through a seamless fusion of factual information, expert insights, and practical tips, this article has endeavored to illuminate the complexities of Webull’s offering, empowering you with the knowledge to make informed decisions. Remember, the path to successful options trading is paved with a relentless pursuit of education, prudent risk management, and unwavering determination. We invite you to continue your exploration of this captivating realm, unearthing its intricacies and unlocking its potential rewards. Embrace the thrill of options trading on Webull, armed with the enlightenment this article has bestowed upon you, and embark on a journey of financial growth and empowerment.

Image: www.youtube.com

Does Webull Have Free Options Trading

Image: stockapps.com