Options trading holds immense allure for investors seeking potential returns beyond traditional equity investments. However, the world of options can be daunting, especially for beginners, due to its inherent complexities. One of the most crucial concepts to grasp in this domain is the break-even point, a pivotal threshold that plays a pivotal role in determining the profitability of an options trade.

Image: satsdikk.blogspot.com

What Does Break Even Mean in Options Trading?

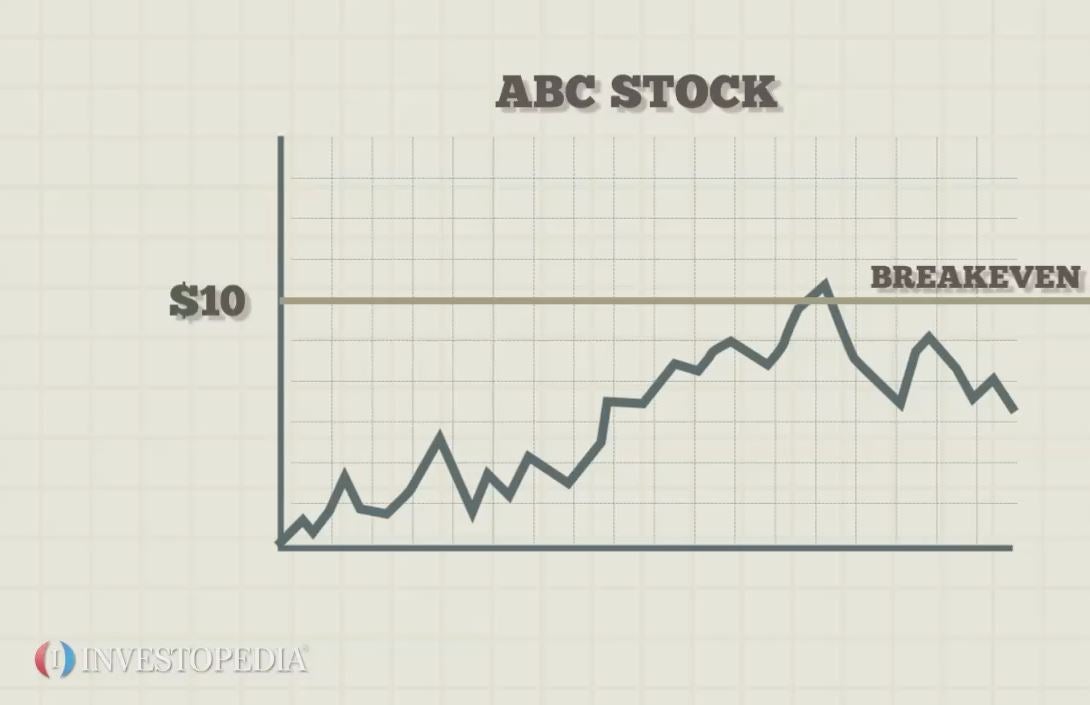

The break-even point in options trading represents the price at which the net profit or loss from the trade becomes zero. In simpler terms, it is the stock price at which you would neither profit nor incur a loss if you were to sell or exercise your option contract at that precise moment. This concept holds true for both call and put options, albeit with slight variations in calculation.

Break-Even Point Calculation for Call Options

For a call option, the break-even point is calculated as the sum of the stock price at the time of the trade and the option’s premium. This is because, to exercise the option, you must pay the premium. Hence, you need to earn at least this amount to make your trade worthwhile.

Break-Even for Call Options = Stock Price + Call Option Premium

Break-Even Point Calculation for Put Options

In contrast, for a put option, the break-even point is calculated by subtracting the put option premium from the stock price at the time of the trade. This difference signifies the profit you must achieve upon exercising or selling your put option to break even.

Break-Even for Put Options = Stock Price – Put Option Premium

Image: tradeasy.tech

Importance of Break-Even Point

Understanding the break-even point is pivotal in options trading for several reasons:

1. Profitability Assessment:

It provides investors with a benchmark against which they can evaluate the potential profitability of their options trades. If the underlying stock’s price rises (for call options) or falls (for put options) beyond the break-even point, investors stand to profit.

2. Risk Management:

The break-even point helps in managing risk by enabling traders to determine the minimum price movements required for profitability. This information aids in making informed trading decisions, especially regarding stop-loss levels.

3. Timing Strategies:

Seasoned options traders often employ the break-even point to devise timing strategies. For instance, they might plan to sell their options contracts once the stock price approaches or surpasses the break-even point to lock in profits.

Expert Insights

“The break-even point serves as a cornerstone in options trading,” opines renowned options expert Michael Cornelius. “It empowers traders to gauge their potential returns and devise appropriate trading strategies. Understanding this concept is essential for successful options trading.”

Actionable Tips

- Calculate the break-even point before executing any options trades. This will help you make well-informed decisions and set realistic expectations about potential profits.

- Monitor the stock’s price and the break-even point closely throughout the trade’s duration. This will help you stay informed and adapt your strategy as needed.

- Consider using options trading simulators to practice calculating break-even points and fine-tune your trading skills.

What Does Break Even Mean In Options Trading

Conclusion

The break-even point is an integral aspect of options trading that all traders must grasp. It provides a roadmap for navigating the complexities of this domain and empowers investors to make informed decisions that prioritize profitability and risk management. By incorporating this concept into your trading arsenal, you can enhance your chances of success in the alluring world of options trading.