The telecommunications giant, AT&T, recently announced a three-way split of its operations into distinct businesses. This corporate restructuring has set the stage for exciting opportunities for options traders. In this article, we will delve into the intricacies of trading AT&T options post-split and provide valuable insights to help you navigate this evolving market landscape.

Image: www.youtube.com

Understanding the AT&T Split

The split, which took effect on July 1, 2022, separated AT&T into three independent companies: AT&T Communications, Warner Bros. Discovery, and Verizon Media.

AT&T Communications

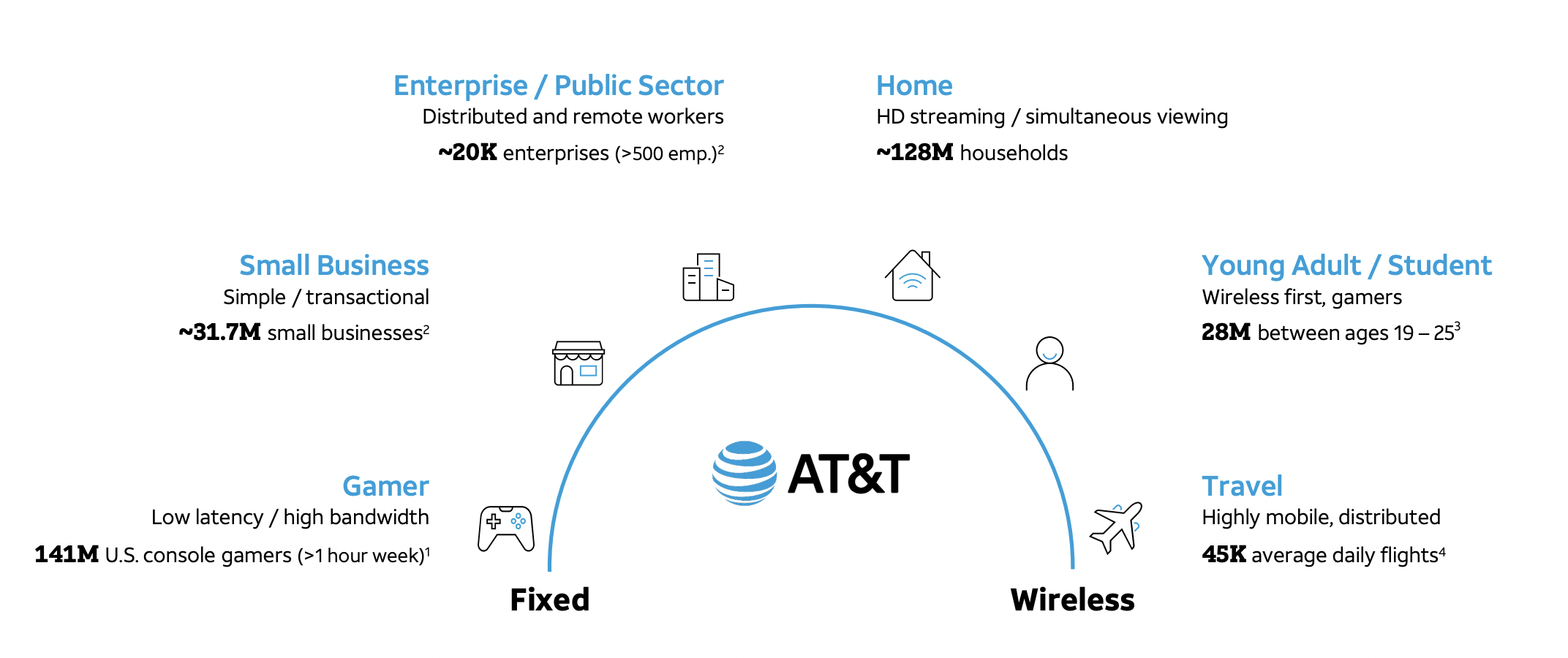

This entity encompasses the legacy telecommunications business of AT&T, including wireless, wireline, and broadband services. It will retain the ticker symbol “T.”

Warner Bros. Discovery

This company comprises AT&T’s entertainment assets, including Warner Bros. Studios, HBO, CNN, and Discovery Channel. It will trade under the ticker symbol “WBD.”

Verizon Media

Verizon Media consists of AT&T’s advertising and technology platforms, including Yahoo! and AOL. It will operate under the ticker symbol “VME.”

Image: seekingalpha.com

Implications for Options Trading

The split has significant implications for options traders:

- Separate Option Chains: Each of the three new companies will have its own option chain. Traders must carefully consider which company’s options to trade based on their investment objectives.

- Increased Volatility: The split may introduce increased volatility to the options market as investors adjust their positions based on the changing business landscape.

- New Trading Opportunities: The creation of three separate entities provides new trading opportunities for investors to capitalize on the unique characteristics of each business.

Tips for Trading AT&T Options Post Split

To maximize your success when trading AT&T options post-split, consider these tips:

- Understand the Underlying Companies: Research each of the three new companies to gain a thorough understanding of their business operations, financial performance, and growth prospects.

- Monitor News and Announcements: Stay informed about the latest news and developments related to the companies and the broader telecommunications industry. This information can guide your trading decisions.

- Manage Risk Effectively: Utilize stop-loss orders and other risk management strategies to mitigate potential losses. Remember, options trading carries inherent risks.

Frequently Asked Questions (FAQs)

- Q: Will the AT&T ticker symbol change? A: No, AT&T Communications will retain the “T” ticker symbol.

- Q: What is the expected volatility post-split? A: Volatility is difficult to predict, but it is likely to increase in the short term.

- Q: Should I buy options in all three companies? A: It depends on your investment strategy. Consider the individual prospects of each company before making a decision.

Trading Att Options Post Split

Image: seekingalpha.com

Conclusion

The AT&T split presents a unique opportunity for options traders. By understanding the implications of the split, conducting thorough research, and implementing sound trading strategies, you can position yourself to capitalize on the market movements. Remember, trading options involves risk, so always manage your positions prudently.

Are you excited about the trading opportunities created by the AT&T split? Share your thoughts and questions in the comments section below.