In the realm of investing, the pursuit of optimal returns often leads to a careful exploration of strategies that harness both risk and reward. Options trading, a potent financial instrument, offers a dynamic approach to potentially enhance portfolio performance. Amidst the myriad of trading strategies, this comprehensive guide delves into the intricacies of option trading strategies, providing essential knowledge and valuable insights to navigate this complex domain.

Image: www.projectfinance.com

Decoding Options: A Foundation for Understanding

Options, simply put, confer the right, not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specific date. This unique attribute distinguishes options trading from traditional stock or bond investments, enabling investors to speculate on the future price movements of underlying assets without incurring the inherent ownership obligations.

The versatility of options trading stems from their ability to cater to diverse investment objectives, from hedging against potential losses to pursuing amplified returns in volatile markets. Understanding the fundamentals of options pricing, comprising factors such as the underlying asset’s price, time to expiration, volatility, and interest rates, empowers investors to assess the potential value and risks associated with option strategies.

Exploring Core Option Strategies: Unlocking Market Opportunities

Recognizing the broad spectrum of option strategies available, this guide focuses on elucidating the most fundamental and widely employed approaches, each meticulously crafted to exploit specific market conditions and investor objectives.

1. Covered Call Strategy: Generating Income in Favorable Markets

The covered call strategy involves the simultaneous sale of a call option against an existing holding of the underlying asset. This strategy generates income from the premium received for selling the call option while maintaining the potential for capital appreciation should the underlying asset’s price rise. The covered call strategy, however, limits the potential upside gain to the strike price of the sold call option.

2. Put-Write Strategy: Harvesting Premiums in Anticipation of Stability

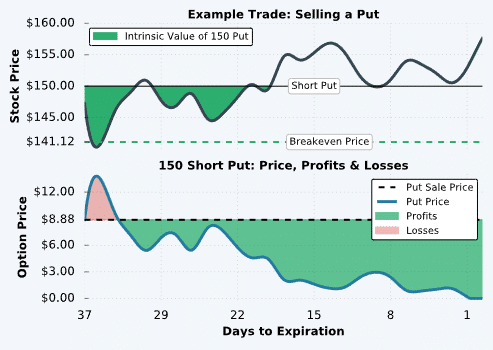

Similar to the covered call strategy, the put-write strategy entails selling a put option while anticipating a stable or modestly declining market. The premium earned from selling the put option offers income generation, but the downside risk extends beyond the strike price of the put option sold. This strategy suits investors who foresee sideways market movement or a gradual depreciation in the underlying asset’s price.

3. Protective Put Strategy: Shielding Portfolios against Downswings

The protective put strategy, commonly employed by risk-averse investors, involves purchasing a put option against a held asset. This strategy offers downside protection by setting a predetermined floor price at which the underlying asset can be sold, thereby limiting potential losses in the event of adverse price movements. The premium paid for the put option represents the cost of this protection.

4. Long Call Strategy: Betting on Upside Potential

The long call strategy entails purchasing a call option, anticipating a price increase in the underlying asset. This approach offers potentially unlimited upside potential but carries the risk of losing the premium paid if the underlying asset’s price fails to rise above the strike price before expiration. The long call strategy appeals to investors seeking exposure to potential market gains.

5. Long Put Strategy: Positioning for Market Downturns

Conversely, the long put strategy involves purchasing a put option, speculating on a decline in the underlying asset’s price. This strategy provides leverage to profit from falling markets but carries the risk of losing the premium paid if the underlying asset’s price remains stable or rises. The long put strategy caters to investors seeking to capitalize on market downturns or hedge against potential losses.

Mastering the Nuances: Beyond the Basics of Option Trading Strategies

Venturing beyond the foundational strategies, experienced options traders meticulously navigate the intricacies of multi-leg strategies, combining multiple options to create sophisticated risk and return profiles. These complex strategies, such as straddles, strangles, and butterflies, empower investors to tailor their positions to specific market expectations and volatility scenarios.

Furthermore, delving into advanced option trading techniques, such as volatility trading and delta-neutral strategies, unlocks the potential for advanced execution and risk management. Understanding the intricacies of option pricing and leveraging sophisticated analytical tools empowers traders to refine their decision-making process and enhance their strategic edge.

Image: www.pinterest.co.uk

Risk Management: Navigating the Perils of Options Trading

Options trading, while potentially rewarding, carries inherent risks that demand careful management. Being perpetually mindful of risk, precisely calculating potential losses, and employing prudent risk management practices is paramount. Options trading strategies should always be implemented within the context of a comprehensive financial plan, ensuring alignment with investment objectives and risk tolerance.

Optiona Trading Strategy

Image: www.pinterest.com

Conclusion: Harnessing the Power of Options Trading

Options trading presents an enticing avenue for investors seeking to amplify returns, manage risk, and strategically navigate market dynamics. By understanding the fundamental option strategies, embracing a risk-conscious approach, and continuously refining their knowledge and skills, investors can unlock the potential of options trading to enhance their financial acumen and achieve their investment aspirations.