Uncovering the Dynamics of Option Prices

Options trading offers investors a versatile tool for managing risk and speculating on future market movements. At the heart of options trading lies the concept of spread, a crucial element in determining an option’s price and potential profitability.

Image: www.projectfinance.com

In essence, spread refers to the difference between the bid and ask prices of an option. It represents the market’s estimate of the fair value of the option, considering factors such as time to expiration, underlying asset volatility, and interest rates. The spread provides insights into the market’s sentiment and expectations.

Components of the Spread

Bid Price

The bid price is the highest price a market maker is willing to pay to buy an option. It reflects the market’s demand for the option.

Ask Price

The ask price is the lowest price a market maker is willing to sell an option. It represents the market’s supply of the option.

Image: top10stockbroker.com

Spread

The spread, therefore, is the difference between the bid and ask prices. It indicates the transaction cost associated with buying or selling an option.

Significance of Spread in Options Trading

Understanding spread is paramount in options trading for several reasons:

- Transaction Costs: The spread represents the upfront cost of trading options. Traders need to consider the spread before executing trades to calculate overall profitability.

- Market Liquidity: A narrow spread indicates high market liquidity, with many buyers and sellers actively trading the option. Conversely, a wide spread suggests lower liquidity, making it more challenging to execute trades.

- Pricing Mechanism: The spread is influenced by factors that affect option pricing, including time to expiration, volatility, and interest rates. Traders can monitor spread changes to gauge market sentiment and identify potential trading opportunities.

Latest Trends and Developments

The options market is constantly evolving, with new trends and developments shaping spread dynamics. Recent noteworthy developments include:

- Electronic Trading: The advent of electronic trading platforms has increased market transparency and reduced spreads.

- Volatility Trading: The rise of volatility trading strategies has influenced spread dynamics for options with higher implied volatility.

- Options Clearing Corporations: Enhanced oversight by Options Clearing Corporations (OCC) has contributed to reduced trading risks and improved market stability.

Tips and Expert Advice

Navigating the options market successfully requires a sound understanding of spread dynamics. Experienced traders and market experts recommend the following tips:

- Research and Understand: Thoroughly research options pricing models and factors that influence spread before trading.

- Monitor Market Liquidity: Pay attention to spread changes and market depth to identify potential trading opportunities.

- Utilize Market Orders: When trading in highly liquid markets, market orders can minimize slippage and ensure efficient trade execution.

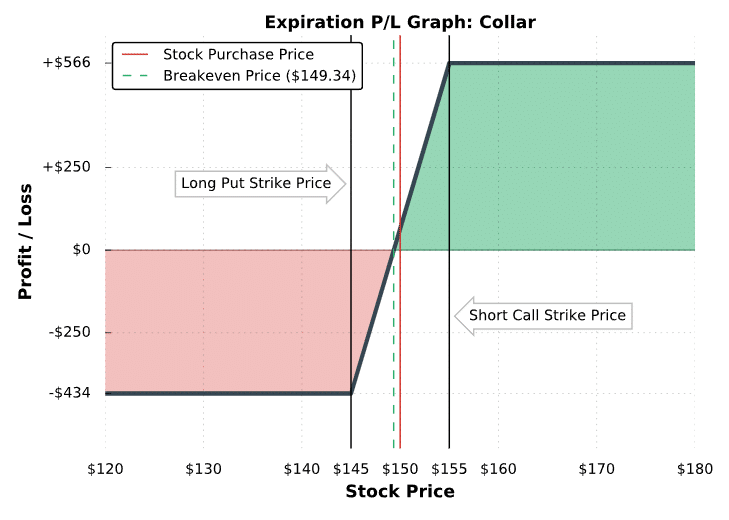

- Calculate Break-Even Points: Determine the break-even point of an option trade by considering the spread and other trading costs.

- Manage Risk: Implement proper risk management strategies to mitigate potential losses and preserve capital.

By adhering to these guidelines, traders can enhance their understanding of spread and its implications in options trading. This knowledge empowers them to make informed decisions, optimize profitability, and manage risks effectively.

FAQs on Spread in Options Trading

- What is the typical spread range for options?

Spread ranges vary depending on option type, underlying asset, and market conditions. Narrow spreads may range from a few cents to a few dollars, while wide spreads can extend to several dollars or more.

- How does volatility affect spread?

Increased volatility generally widens spreads, as options become more expensive to buy and sell. Conversely, decreased volatility tends to narrow spreads, making options more attractive for trading.

- What are the advantages of trading options with narrow spreads?

Narrow spreads reduce transaction costs and enhance liquidity, enabling traders to enter and exit positions more efficiently and at favorable prices.

What Is The Spread In Options Trading

Image: www.religareonline.com

Conclusion

Grasping the concept of spread in options trading is fundamental for successful trading. By understanding the components of spread, its significance, and incorporating expert advice into their strategies, traders can navigate market dynamics effectively, optimize profitability, and minimize risks. Remember, knowledge is power, and a thorough comprehension of spread dynamics empowers traders to unlock new opportunities in the options market.

Are you intrigued by the intricacies of options trading? Delve deeper into the world of spread dynamics, explore innovative trading strategies, and join the ranks of informed investors. Embrace the knowledge and seize the opportunities that await you in the vibrant options market!