Introduction

Envision yourself at an auction house, watching with bated breath as bidders vie for a prized painting. Each participant holds a paddle, eager to secure the artwork at a price that suits them. The auctioneer calls out a starting price, and the bidding war begins. As the price rises and falls, a vibrant interplay unfolds between two crucial numbers: the bid and the ask.

In the world of financial markets, a similar dance transpires between buyers and sellers. When it comes to options trading, understanding the bid and ask spread is paramount to making informed decisions and maximizing your market advantage.

Image: www.projectfinance.com

Demystifying the Bid-Ask Spread

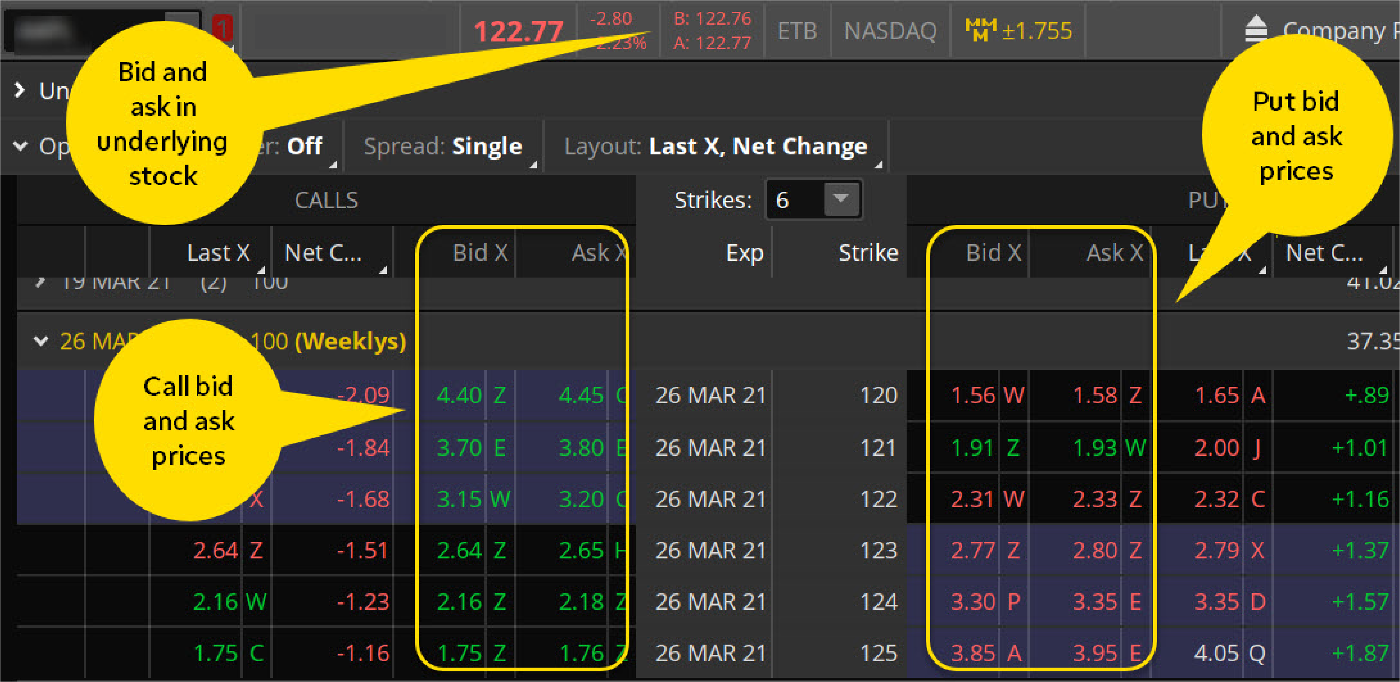

In options trading, the bid price is the highest price a buyer is willing to pay for a particular option contract, while the ask price represents the lowest price a seller is willing to accept. The difference between these two prices is known as the bid-ask spread.

Consider this analogy: Imagine a used car dealership. The dealership advertises a car for $10,000, but they’re willing to negotiate. A potential buyer enters the lot and offers $9,500, while the dealership counters with a price of $10,200. The difference between the two offers – $700 – is the bid-ask spread.

In options trading, the bid-ask spread represents the “middle ground” between buyers and sellers. It provides traders with a snapshot of the market’s sentiment and the liquidity of a particular option contract. A narrow spread indicates strong liquidity, with many buyers and sellers eager to trade, while a wide spread suggests limited liquidity, making it more challenging to execute trades quickly.

Factors Influencing the Bid-Ask Spread

Numerous factors influence the bid-ask spread, including:

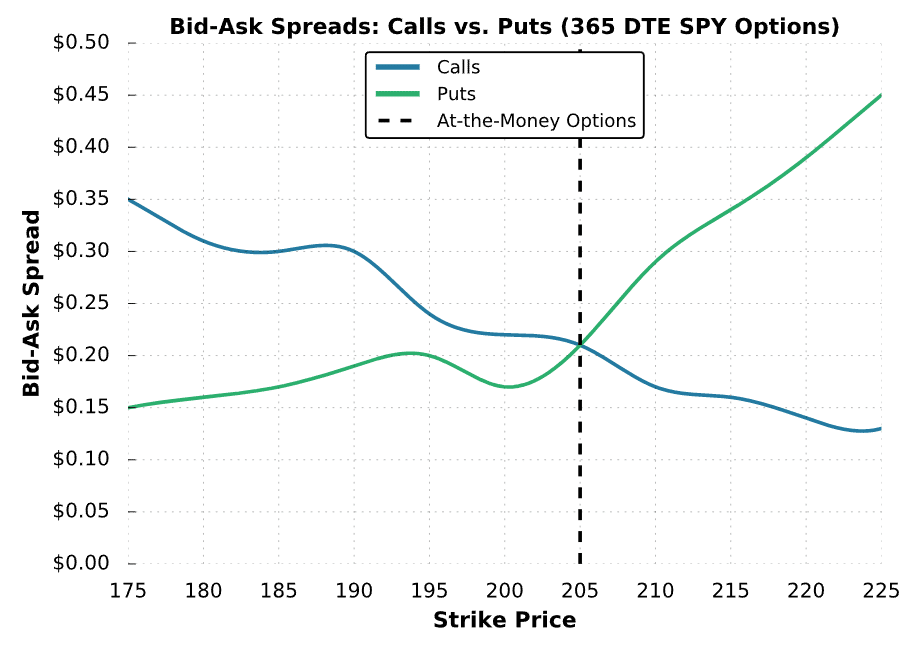

• Option Type: Call options typically have wider spreads than put options, reflecting the inherent asymmetry in their payoff profiles.

• Time to Expiration: Options with shorter time frames tend to exhibit wider spreads due to the elevated level of uncertainty surrounding their future value.

• Underlying Asset Volatility: Options on highly volatile underlying assets often command wider spreads, reflecting the increased risk associated with these instruments.

• Market Conditions: The overall market conditions, such as interest rates, economic outlook, and market sentiment, can significantly impact bid-ask spreads.

Interpreting the Bid-Ask Spread

The bid-ask spread provides valuable information to traders:

• Liquidity Assessment: A narrow spread suggests high liquidity, allowing traders to enter and exit positions quickly and efficiently.

• Market Sentiment: A widening spread can indicate increased uncertainty or volatility, signaling potential price fluctuations in the underlying asset.

• Trading Strategy: The spread can help traders identify trading opportunities, such as profitable bid-ask reversals, where the bid price rises above the ask price, or vice versa.

Image: tickertape.tdameritrade.com

Expert Insights

“The bid-ask spread is a reflection of market dynamics,” says renowned options trader James Cordier. “Traders should consider the spread when determining their trading strategy, as it can impact profitability and trading efficiency.”

“Novice traders often overlook the bid-ask spread, resulting in costly mistakes,” cautions Mark Sebastian, a veteran options educator. “Understanding this crucial concept is essential for success in options trading.”

Actionable Tips

• **Research Spreads:** Familiarize yourself with historical and current spread data for various options contracts and underlying assets.

• **Monitor Liquidity:** Assess the liquidity of an option contract by observing its bid-ask spread. Consider trading more liquid options with tighter spreads.

• **Negotiate Spreads:** In some cases, traders can negotiate lower bid-ask spreads, especially when dealing with large option positions or illiquid markets.

What Is Bid And Ask In Options Trading

Image: www.theforexguy.com

Conclusion

The bid-ask spread plays a vital role in options trading, acting as a barometer of market sentiment and liquidity. By understanding this key concept, traders can gain a competitive edge and navigate the options markets with greater precision and confidence. Whether you’re a seasoned pro or just starting out, embracing the intricacies of the bid-ask spread will empower you to make informed decisions and maximize your trading potential.