In today’s volatile market, savvy investors are looking for innovative strategies to protect and grow their wealth. Long term capital gains options trading has emerged as a popular choice, providing investors with the potential for tax savings, enhanced returns, and a reduced risk portfolio. In this article, we will explore the nuances of long term capital gains options trading, providing you with the knowledge and tools to employ this effective strategy in your personal investing journey.

Image: www.eunduk.com

Maximizing Your Returns with Long Term Capital Gains Options Trading

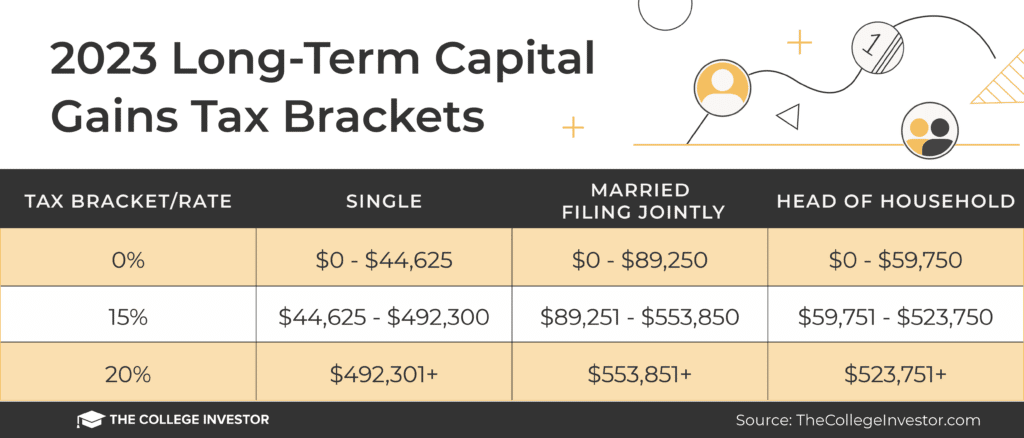

Long term capital gains options trading involves selling or buying options contracts with the intention of holding them for more than one year. This simple shift from the traditional strategy of holding options for a year or less provides investors with significant tax advantages. When options are held for over 12 months, the profits are taxed at a lower long-term capital gains rate, resulting in potential tax savings.

Furthermore, long term capital gains options trading offers enhanced returns compared to short-term trading. By holding options for an extended period, investors can capitalize on long-term market trends and minimize the impact of short-term market fluctuations. This patient approach allows investors to capture greater profits from options contracts that appreciate in value over time.

Navigating the World of Long Term Capital Gains Options

Understanding the fundamentals of long term capital gains options trading is essential for maximizing its potential. Essentially, options contracts grant investors the right, but not the obligation, to buy (call options) or sell (put options) a specified underlying asset (typically a stock, index, or fund) at a predetermined price (strike price) by a certain date (expiration date).

When investing in long term capital gains options, it’s crucial to consider the following factors:

- Option Type: Determine whether to trade call options (right to buy) or put options (right to sell), depending on your market outlook and investment goals.

- Underlying Asset: Identify the underlying asset, such as stocks, ETFs, or indices, that aligns with your investment strategy and risk tolerance.

- Strike Price: Select a strike price that balances potential profits with the risk involved. Consider factors such as market conditions and the current price of the underlying asset.

- Expiration Date: Establish an expiration date that aligns with your investment horizon and market expectations. Longer expirations provide more time for potential market movements, but they also come with a higher premium cost.

Embracing Practical Tips and Expert Insights

To optimize your long term capital gains options trading strategy, consider implementing these valuable tips and expert advice:

- Thorough Research: Conduct in-depth research on potential underlying assets, market trends, and historical price patterns to make informed investment decisions.

- Diversify Your Portfolio: Reduce risk by investing in a variety of options contracts across different underlying assets, industries, and expiration dates.

- Monitor Market Conditions: Stay abreast of market news, economic indicators, and analyst reports to adjust your trading strategy as needed.

Image: www.dfginsus.com

Frequently Asked Questions: Unlocking Clarity

Q: What are the eligibility criteria for long term capital gains options trading?

A: To qualify for long term capital gains rates, options contracts must be held for more than one year.

Q: Are there any potential risks associated with long term capital gains options trading?

A: Yes, like any investment, there are risks involved. Potential risks include market volatility, liquidity issues, and the possibility of losing the entire investment.

Q: What are some common strategies employed in long term capital gains options trading?

A: Popular strategies include buying and holding options, covered calls, cash-secured puts, and option spreads. Each strategy offers unique advantages and risk profiles.

Long Term Capital Gains Options Trading

Image: penobscotfa.com

Conclusion: Embracing Informed Investment Decisions

Long term capital gains options trading can potentially provide investors with significant returns, tax savings, and risk mitigation. By incorporating the strategies and advice outlined in this guide, you can harness the power of this innovative approach and enhance your financial well-being. Remember, investing involves risk, so always conduct thorough research and consult with a financial advisor before making any investment decisions.

Are you ready to delve deeper into the world of long term capital gains options trading?