Image: www.eunduk.com

The allure of the financial markets tempts many with dreams of substantial returns. Options trading, a sophisticated strategy involving the buying and selling of contracts representing the underlying asset, has gained significant traction. However, confusion often arises regarding the tax implications of options trading. Does it qualify for the coveted capital gains treatment?

Understanding Capital Gains

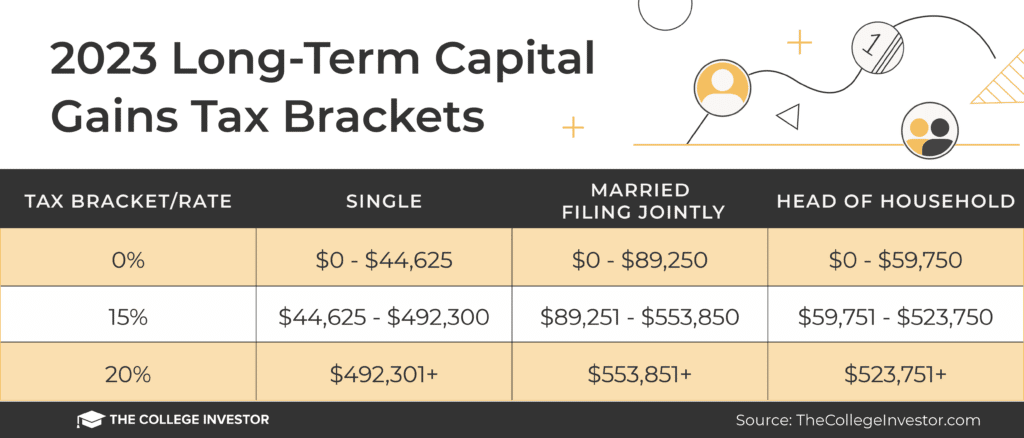

Capital gains refer to the profit earned when an asset, held for more than a year, is sold at a price higher than its purchase cost. The Internal Revenue Service (IRS) categorizes these gains into short-term (held for a year or less) and long-term (held for over a year). Long-term capital gains enjoy favorable tax rates compared to short-term gains, making them highly sought after by investors.

Options Trading and Capital Gains Treatment

The IRS treats options trading differently depending on how the trader exercises the option. If the option is exercised to acquire or sell the underlying asset, the gain or loss is classified as a capital gain or loss if the underlying asset is held for more than a year. This means that options used for investment purposes, rather than speculative trading, can potentially qualify for the advantageous long-term capital gains rates.

However, if the option is sold before exercise, the gain or loss is generally considered short-term, regardless of the holding period of the underlying asset. This is because the option itself is considered a short-term asset. Traders aiming for long-term capital gains should be mindful of exercising their options and acquiring the underlying asset if they wish to benefit from the favorable tax rates.

Factors Influencing Capital Gains Treatment

The determination of capital gains treatment for options trading involves various factors:

-

Holding period: The duration for which the option or underlying asset is held is crucial in differentiating short-term from long-term gains.

-

Exercise of option: The actual exercise of the option to acquire or sell the underlying asset triggers a capital gains or loss consideration.

-

Intent: The trader’s intention, whether investment-oriented or speculative, can influence the tax classification of the gain or loss.

Impact on Tax Liability

Understanding the capital gains implications of options trading is essential for effective tax planning. Long-term capital gains are taxed at a lower rate than ordinary income, potentially reducing your tax liability. However, the short-term capital gains are taxed at the same rate as your regular income. This distinction can significantly impact your overall tax bill.

Expert Advice and Best Practices

To navigate the intricacies of options trading and capital gains treatment, it is highly recommended to consult a tax professional. They can provide personalized guidance based on your individual circumstances. Additionally, consider the following best practices:

-

Keep accurate records: Maintain detailed records of your options trades, including acquisition dates, sale dates, and any other relevant information.

-

Plan ahead: Factor in the potential tax implications when formulating your trading strategies.

-

Consider long-term strategies: Aiming for long-term capital gains treatment by holding options or underlying assets for more than a year can offer substantial tax savings.

Conclusion

Options trading can be a powerful tool for investors seeking substantial returns. Understanding the capital gains implications is crucial to maximizing your financial benefits. By carefully considering holding periods, exercising options strategically, and seeking professional guidance, you can leverage options trading effectively while optimizing your tax liability. Remember, knowledge is power, and investing wisely involves embracing the intricacies of the financial world with a proactive approach.

Image: www.thestreet.com

Do Options Trading Qualify For Capital Gains Treatment

Image: www.financestrategists.com