The Basics of Options Taxation

When it comes to taxes, options trading can be a complex realm. Unlike traditional stock trading, where gains are taxed favorably as capital gains, options profits are subject to a different set of rules. The nature of options contracts, involving the right but not the obligation to buy or sell an underlying asset, leads to specific tax treatment of the profits generated from their exercise or sale.

Image: cachandanagarwal.com

Understanding the Section 1256 Treatment

Options profits are primarily governed by Section 1256 of the Internal Revenue Code. This section categorizes options as either “Section 1256 contracts” or “non-Section 1256 contracts.” Section 1256 contracts include options on stocks, indexes, bonds, or currencies, while non-Section 1256 contracts encompass options on futures or forwards.

The key distinction between the two lies in tax treatment. Profits from Section 1256 contracts are taxed at the more favorable capital gains rate of 60% long-term and 40% short-term, as long as the option is held for over a year and a day. In contrast, non-Section 1256 contract profits are taxed as ordinary income.

Taxation of Exercise Profits

When an option is exercised, the profit is calculated by subtracting the strike price from the underlying asset’s current value. This profit is then classified as either a capital gain or ordinary income, depending on the holding period and the type of option contract involved.

For Section 1256 options held for more than a year and a day before exercising, the profit qualifies for the preferential capital gains rate. Non-Section 1256 options, however, are always taxed as ordinary income regardless of the holding period.

Taxation of Premium Profits

Instead of exercising an option, traders may choose to sell it in the options market. The premium received from this sale represents the profit. For Section 1256 options that are not deep ITM (in the money), the profit is treated as ordinary income. However, for Section 1256 options that are deep ITM, the profit is eligible for capital gains treatment.

Image: www.youtube.com

Strategies for Minimizing Tax Liability

Comprehending the nuances of options taxation is crucial for minimizing tax liability. Here are some strategies:

- Consider holding options for over a year and a day: The favorable 60/40 long-term capital gains rate can significantly reduce taxes.

- Identify appropriate option strategies: Certain options strategies, such as covered calls and cash-secured puts, can protect against large losses and generate premium income taxed as capital gains.

- Consult a tax professional: Seeking professional advice is highly recommended to navigate the complexities of options taxation and optimize your tax strategy.

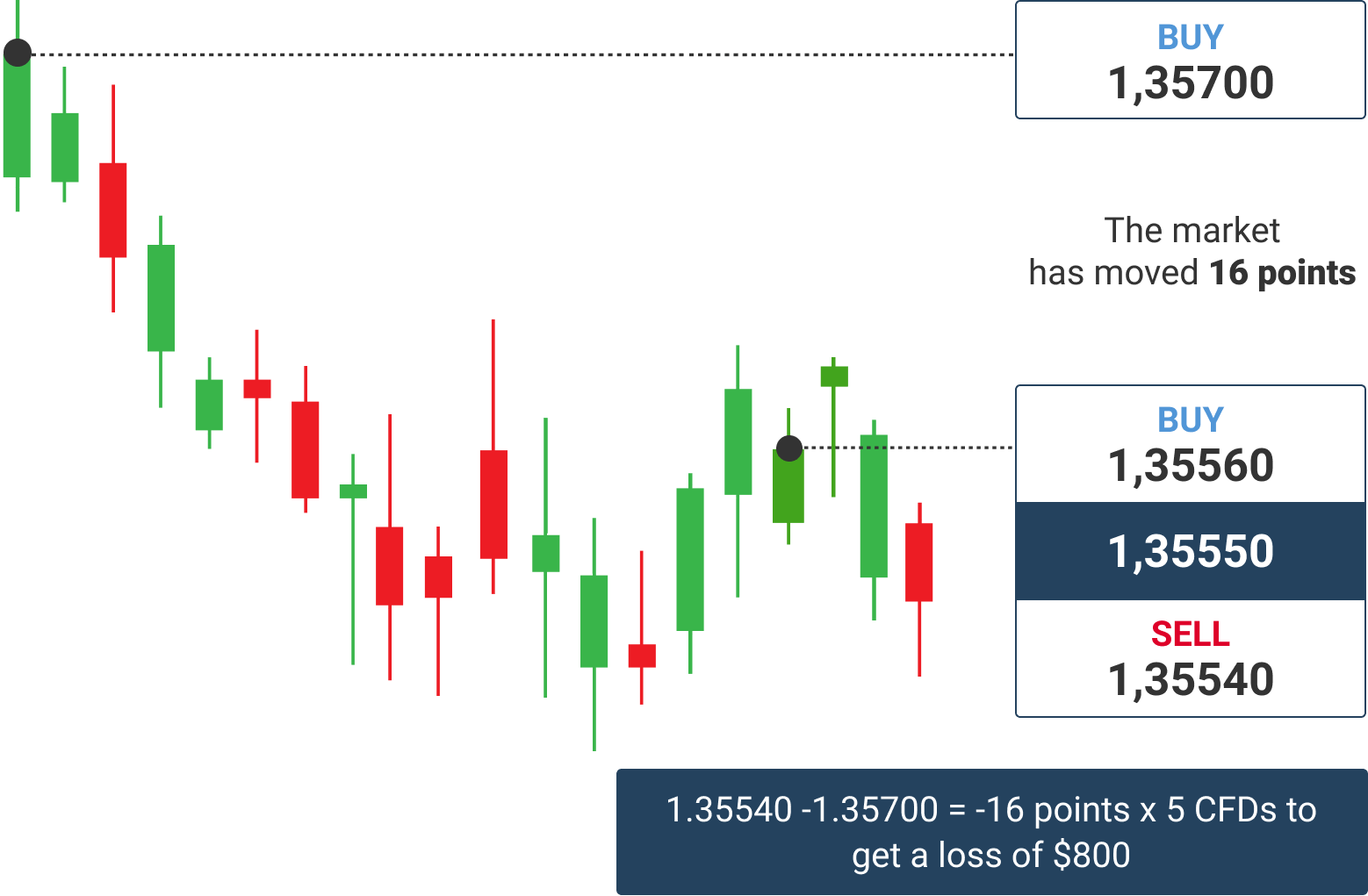

How Are Profits Taxed On Options Trading

Image: www.monfex.com

Frequently Asked Questions (FAQs)

Q: What is the difference between Section 1256 and non-Section 1256 options contracts?

A: Section 1256 options include options on stocks, indexes, bonds, and currencies, while non-Section 1256 options encompass options on futures or forwards. The key distinction lies in tax treatment: Section 1256 contracts qualify for capital gains rates, while non-Section 1256 contracts are taxed as ordinary income.

Q: How are exercise profits on options taxed?

A: Exercise profits from Section 1256 options held for over a year are taxed at capital gains rates. Profits from exercising non-Section 1256 options are always taxed as ordinary income.

Q: What tax implications arise from selling options?

A: If a Section 1256 option is not deep ITM when sold, the premium received is taxed as ordinary income. For deep ITM Section 1256 options, the profit qualifies for capital gains treatment.

Conclusion

Understanding the tax implications of options trading is vital for maximizing profits and minimizing liability. Options traders should familiarize themselves with the Section 1256 tax treatment and explore strategies to optimize their tax position. By embracing these principles, options traders can navigate the complexities of taxation and increase their profitability.

Are you interested in learning more about options trading and its tax implications? Share your thoughts and questions in the comments below!