As a seasoned stock market enthusiast, I’ve witnessed the exhilaration and pitfalls of trading firsthand. After a series of setbacks, I realized the crucial need for a simulated environment where I could hone my skills without risking my hard-earned capital. That’s how I stumbled upon paper trading options in TradingView.

Image: www.bursahaga.com

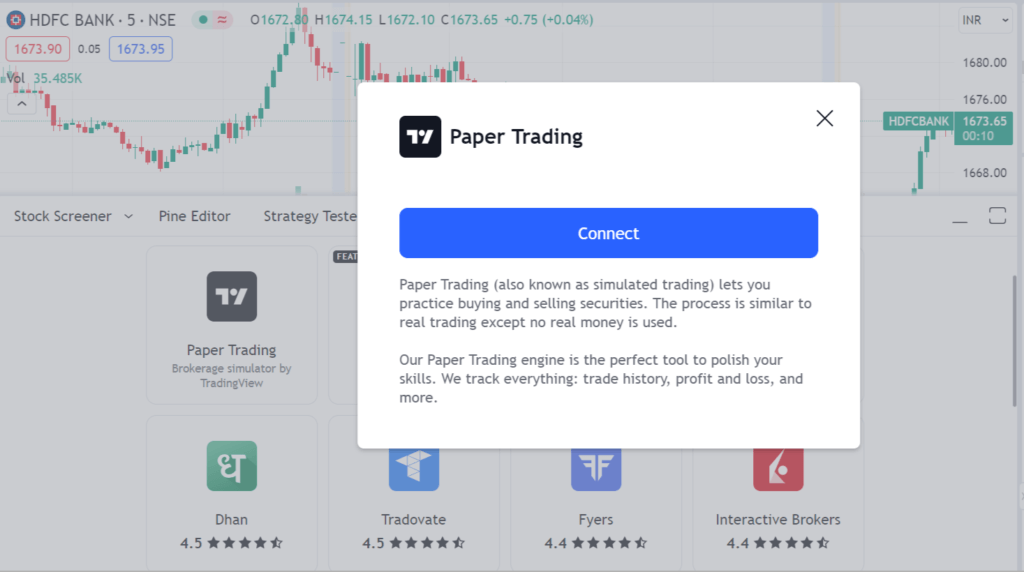

Image: www.bursahaga.comPaper trading simulates real-world trading conditions, allowing you to trade options without putting a single dollar at stake. TradingView, a popular charting and technical analysis platform, offers an exceptional paper trading experience with an intuitive interface and a myriad of analytical tools.

Unlocking the Power of Paper Trading

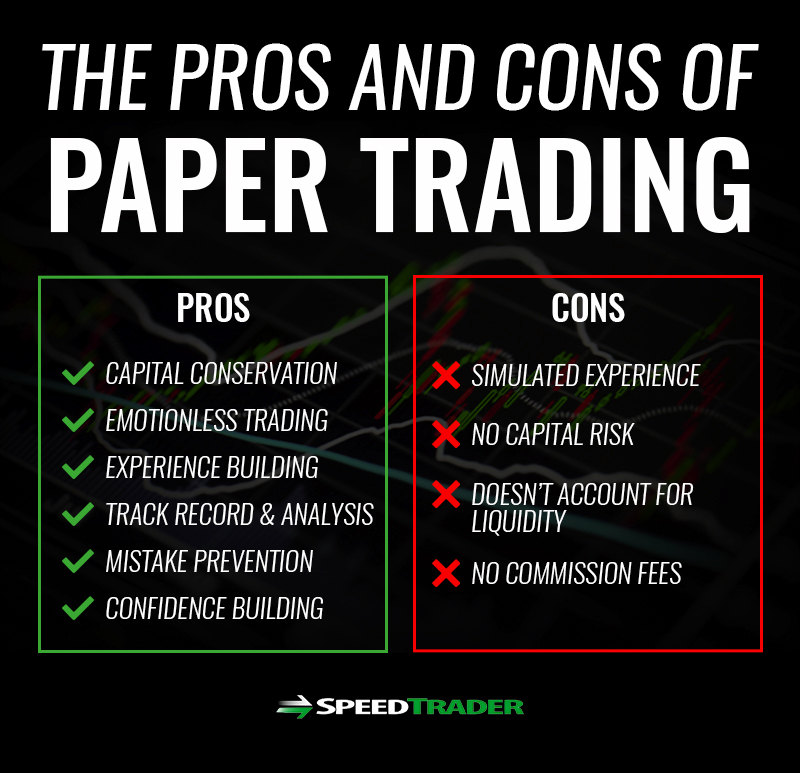

Paper trading options provides a risk-free environment to:

- Practice trading strategies without financial consequences

- Test your understanding of options contracts and market behavior

- Refine your risk management techniques

li>Experiment with different trading styles and time frames

By engaging in paper trading, you can gain invaluable experience that will significantly enhance your chances of success in live trading.

How to Get Started with Paper Trading in TradingView

- Create a TradingView Account: Sign up for a free or paid TradingView account.

- Enable Paper Trading: Navigate to the “Settings” tab in the top right corner and select “Paper Trading.”

- Select a Simulated Broker: Choose a simulated broker from the available options to connect to your paper trading account.

- Add Funds to Your Paper Account: Allocate virtual funds to your simulated trading account to begin paper trading.

- Start Trading: Use the TradingView platform to analyze charts, identify trading opportunities, and place paper trades.

- Advanced Charting Tools: Access a wide range of technical analysis and drawing tools to analyze market data.

- Option Chain: View and trade options contracts across various underlying assets, expiries, and strike prices.

- Trade Panel: Execute paper trades with ease, including market, limit, and stop orders.

- Position Tracker: Monitor your paper trading portfolio, including open positions, profit/loss, and performance metrics.

- Start with a Small Account: Begin with a modest virtual capital to avoid unrealistic expectations and promote prudent trading habits.

- Practice Regularly: Dedicate time to practice trading on a consistent basis to improve your skills and refine your strategies.

- Analyze Trades: After each trade, regardless of the outcome, take time to analyze your decision-making process and identify areas for improvement.

- Seek Feedback: Share your paper trading experiences with fellow traders or mentors to gain valuable feedback and insights from others.

- Be Patient: Paper trading is not a quick fix. Approach it as a learning tool and be patient with your progress.

Navigating the Paper Trading Interface

TradingView’s paper trading interface is highly user-friendly, featuring:

Image: financefundaa.com

Tips and Expert Advice for Effective Paper Trading

Remember, paper trading is not a substitute for live trading. However, it provides an invaluable platform to develop the knowledge, skills, and discipline necessary to succeed in the real world of options trading.

Frequently Asked Questions

A: Yes, TradingView offers real-time market data for paper trading, ensuring that you make decisions based on accurate and up-to-date information.

A: Paper trading in TradingView is generally unlimited, allowing you to practice trading as much as you need. However, certain simulated brokers may impose limits on the number of trades or the duration of paper trading sessions.

A: Paper trading is beneficial for both beginners and experienced traders. Beginners can learn the basics of options trading without financial risk, while experienced traders can refine their strategies and test new ideas.

Paper Trading Options In Tradingview

Conclusion

Paper trading options in TradingView empowers you with the tools and simulated environment to become a more confident and successful trader. Embrace this invaluable learning opportunity, follow the tips and expert advice provided, and start honing your trading skills today.

Are you ready to embark on the journey to paper trading options in TradingView? Share your thoughts and any questions you may have in the comments section below.