Navigating the Options Market: A Simplified Approach

Options trading, often shrouded in complexity, holds immense potential for savvy investors. Step into the realm of options and unlock a world of diversified investment strategies. This comprehensive guide demystifies the intricate world of options trading, equipping you with the knowledge to make informed decisions and capitalize on market opportunities.

Image: www.pinterest.com

Understanding Options: The Core Concepts

Think of options as contracts that grant investors the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified expiry date. This flexibility endows investors with various strategic options to enhance their investment portfolios.

Call options provide the right to buy an asset at a specific price (known as the strike price) on a designated date. On the other hand, put options confer the right to sell an asset at a predetermined price. Investors utilize these instruments to mitigate risk, speculate on price movements, and generate income.

Types of Options Strategies: Unleashing Trading Potential

Options trading offers a wide spectrum of strategies, each tailored to distinct investment goals. Covered calls entail owning the underlying asset and simultaneously selling a call option against it. This strategy generates premium income while safeguarding against potential price declines.

Cash-secured puts involve selling a put option while holding sufficient capital to acquire the underlying asset. Should the asset’s price fall below the strike price, the investor becomes obligated to purchase it.

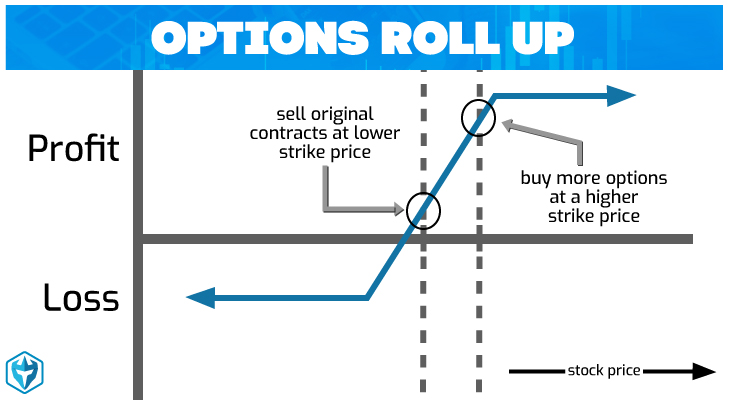

Bull call spreads involve purchasing a call option at a lower strike price and simultaneously selling a call option at a higher strike price. This strategy offers limited profit potential but also involves less risk.

Pricing Options: Decrypting the Valuation Enigma

Options pricing hinges on various factors, including the underlying asset’s current price, strike price, time to expiration, volatility, and risk-free interest rates. The Black-Scholes model, a mathematical formula, serves as a cornerstone for valuing options.

Volatility, measured by the Greek letter sigma, plays a crucial role in determining option premiums. Higher volatility translates to more expensive options as it signals greater potential for price fluctuations.

Image: phaseisland17.gitlab.io

Trading Options: Practical Considerations for Beginners

As you embark on your options trading journey, it’s imperative to adhere to prudent risk management principles. Only allocate funds that you’re comfortable losing, and delve into the intricacies of each strategy before executing any trades.

Moreover, seek counsel from experienced traders or reputable brokers to navigate the complexities of options trading. By proceeding cautiously and seeking guidance, you can harness the potential of options to amplify your investment strategies.

Options Trading In Simple Terms

Image: www.adenshop.rs

Conclusion: Embracing the Power of Options Trading

Options trading empowers investors with an array of sophisticated strategies to enhance their investment portfolios. This guide has illuminated the core concepts, types of strategies, pricing mechanisms, and practical considerations involved in options trading. As you continue to expand your knowledge and refine your skills, the world of options holds boundless opportunities for growth and financial success. Embrace the power of options trading and unlock the full potential of your investment endeavors.