The world of options trading may seem like a complex and enigmatic realm, but don’t let its intricacies intimidate you. Understanding the language of options trading, specifically the terms “bid” and “ask,” is the key to unlocking the potential that lies within this financial instrument.

Image: thetradingstrategist.info

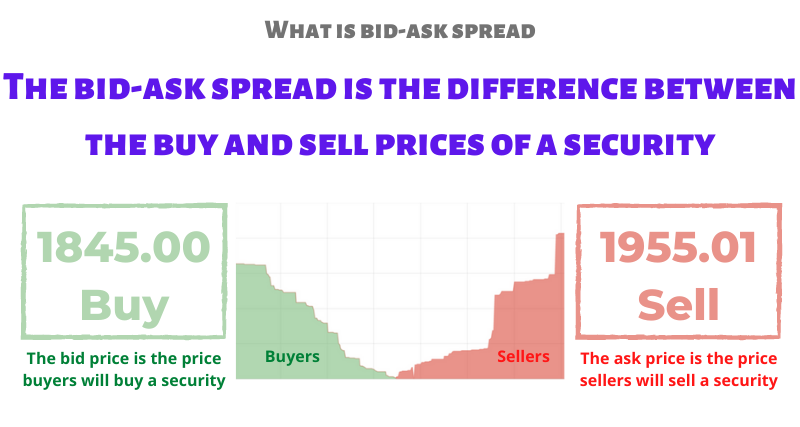

In essence, a bid is an offer to buy an option contract at a specific price, while an ask is an offer to sell an option contract at a different price. These two prices are constantly in flux, akin to a delicate dance, as buyers and sellers negotiate the terms of their transactions.

Unveiling the Bid-Ask Spread

The difference between the bid and ask prices is known as the bid-ask spread. It represents the market’s perception of the option’s value and liquidity. A wider spread indicates that the market is less certain about the option’s value, while a narrower spread suggests a more confident market.

For instance, if the bid price for a particular option is $1.50 and the ask price is $1.75, the bid-ask spread is $0.25. This spread reflects the underlying uncertainty about the future value of the underlying asset.

Bid and Ask: A Tale of Two Sides

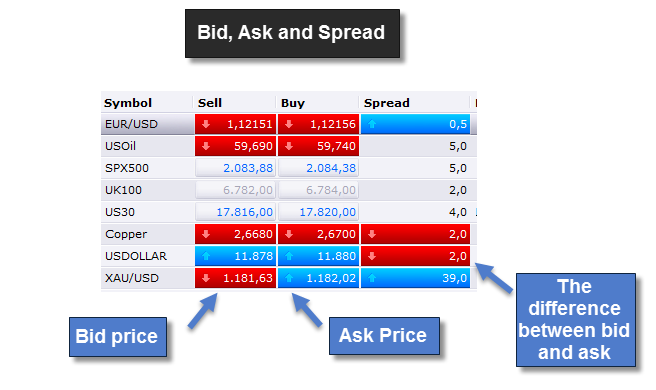

As a buyer, you’re interested in the bid price. After all, you want to pay as little as possible for the option contract. On the other hand, as a seller, you’re more concerned with the ask price, as you want to sell your contract for the highest price possible.

In a perfect world, buyers and sellers would meet at a single equilibrium price, eliminating the bid-ask spread altogether. However, in reality, the market is constantly in motion, causing the bid and ask prices to fluctuate in response to changing supply and demand dynamics.

Navigating the Bid-Ask Landscape

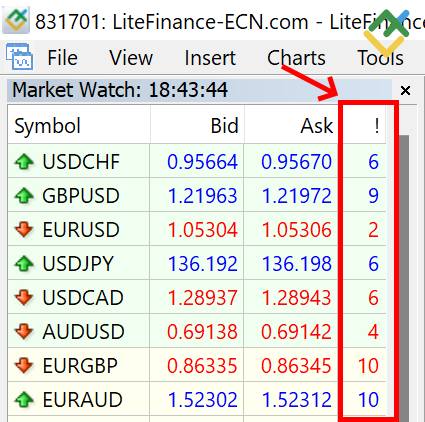

Understanding the bid and ask prices is essential for making informed trading decisions. By monitoring the bid-ask spread, options traders can gauge market sentiment and anticipate potential price movements.

A widening spread often signals increased uncertainty or a lack of liquidity, while a narrowing spread suggests growing confidence or increased trading activity. These subtle shifts provide valuable clues about the market’s perception of the option’s value.

Image: www.litefinance.org

The Importance of Liquidity and Volatility

Liquidity, or the ease with which an option can be bought or sold, plays a significant role in bid-ask spread. Highly liquid options have narrow spreads, making it easier for traders to enter and exit positions quickly.

Volatility, or the extent to which an option’s price fluctuates, also influences the bid-ask spread. Volatile options tend to have wider spreads, reflecting the greater uncertainty associated with their future value.

Bid And Ask In Options Trading

Image: tradeciety.com

Mastering the Bid and Ask: A Path to Trading Success

Becoming proficient in interpreting bid and ask prices is a fundamental skill for options traders. It empowers you to understand market dynamics, make informed trading decisions, and navigate the complexities of the options market with confidence.

Embrace the ebb and flow of bid and ask prices, and you’ll unlock the potential to harness the power of options trading. Remember, each bid and ask carries a story, and it’s up to you to decode its meaning and make the most of every trading opportunity.