Embark on a captivating journey through the realm of options trading, a dynamic and potentially lucrative investment strategy that empowers individuals to tap into the vast potential of the financial markets. Our exclusive Options Trading Australia Forum, a vibrant hub of knowledge and insights, welcomes you to explore the intricacies of this multifaceted world.

Image: www.ozstudies.com

In this article, we will delve into the ins and outs of options trading, untangling complex concepts and providing expert guidance to equip you with the knowledge and skills needed to navigate this exciting landscape. Whether you’re a seasoned trader seeking to enhance your strategy or a curious novice eager to discover the possibilities, our comprehensive guide will serve as your trusted companion.

Navigating the Options Trading Landscape

Options trading involves the buying and selling of contracts that give buyers the right, but not the obligation, to buy or sell an underlying asset (stock, index, or commodity) at a predetermined price (strike price) on or before a specific date (expiration date). These contracts, known as options, offer a spectrum of strategies tailored to diverse investment goals and risk appetites.

Understanding the types of options available is paramount. Call options grant buyers the right to buy the underlying asset, while put options provide the right to sell the asset. With call options, you anticipate the asset’s price to rise, and with put options, you expect the price to fall.

Mastering the Options Trading Language

The language of options trading is imbued with specialized terms that may initially seem daunting but gradually become familiar as you engage with the subject. Understanding these terms is fundamental to unraveling the complexities of the options market.

- Premium: The price paid to purchase an options contract, representing the value of the option’s right to buy or sell the underlying asset.

- Expiration date: The day on which the option contract expires, rendering it worthless unless exercised.

- Strike price: The predetermined price at which the buyer may exercise the option to buy or sell the underlying asset.

- In the money: An option contract is considered “in the money” when its strike price is favorable to the buyer. For call options, the strike price is below the underlying asset’s current price; for put options, it is above the current price.

- Out of the money: An option contract is “out of the money” when its strike price is unfavorable to the buyer. For call options, the strike price is above the underlying asset’s current price; for put options, it is below the current price.

Unveiling the Options Trading Strategies

The beauty of options trading lies in its versatility, offering an array of strategies to align with your unique goals and risk tolerance. Each strategy involves a unique combination of buying or selling call and put options at strategic strike prices and expiration dates.

- Covered call: A strategy designed to generate income on an underlying asset you own. You sell a call option against the asset, giving the buyer the right to buy it at a specific price. If the asset’s price remains below the strike price, you retain the asset and collect the premium paid for the option.

- Protective put: A strategy to protect yourself against potential losses in a stock you own. You purchase a put option that gives you the right to sell the stock at a specific price. If the stock’s price falls below the strike price, you can exercise the put option to sell the stock and limit your losses.

- Bull spread: A strategy that bets on the underlying asset’s price rising. You buy a lower-priced call option and sell a higher-priced call option, both with the same expiration date. The profit potential lies in the difference between the two option premiums.

- Bear spread: A strategy that bets on the underlying asset’s price falling. You buy a lower-priced put option and sell a higher-priced put option, both with the same expiration date. The profit potential lies in the difference between the two option premiums.

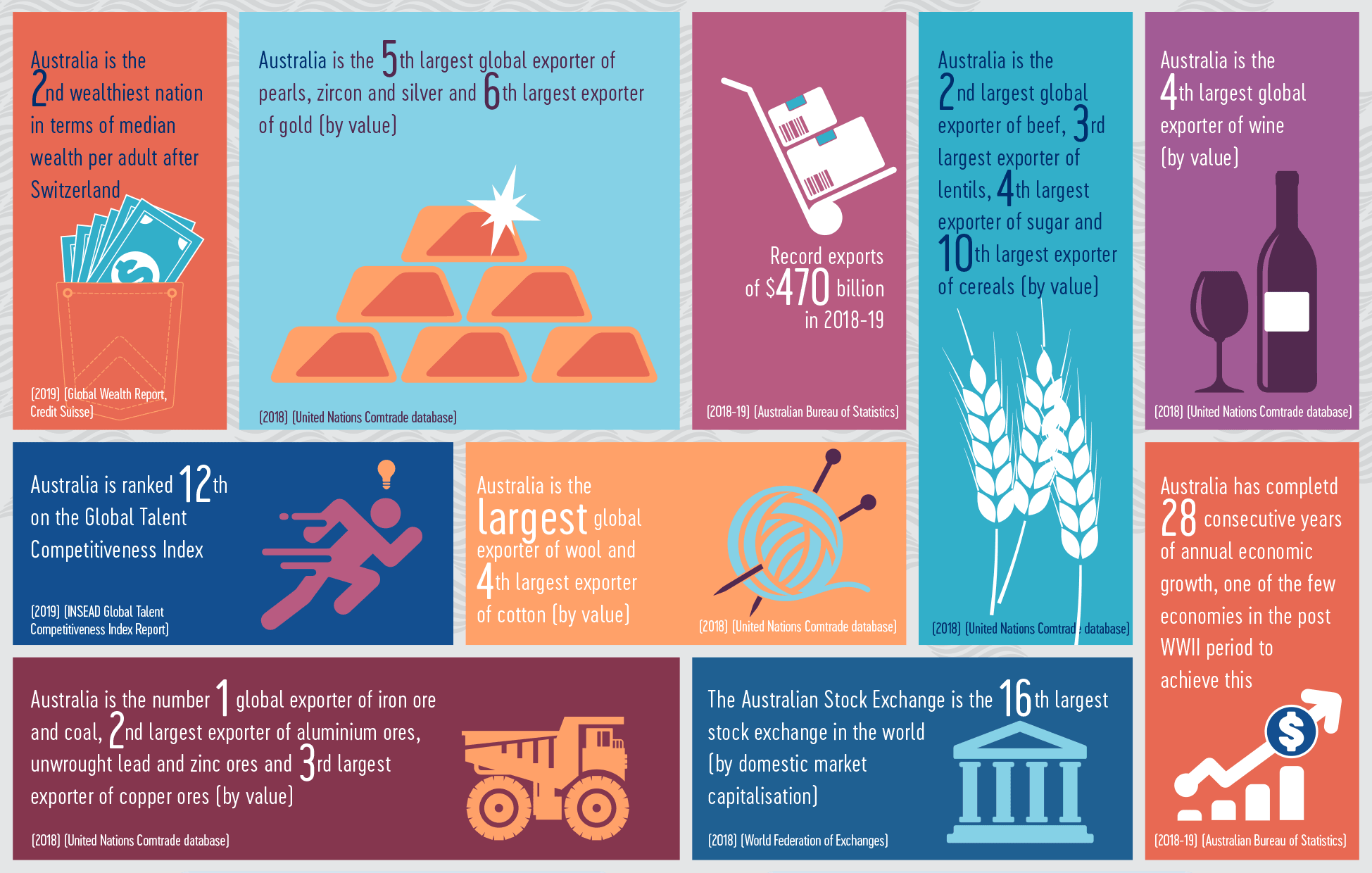

Image: www.dfat.gov.au

Options Trading Australia Forum

Image: daotaonec.edu.vn

Maximize Your Options Trading Potential

To maximize your options trading potential, consider seeking the guidance of a reputable financial advisory firm or professional financial advisor. An experienced advisor can tailor personalized advice based on your individual circumstances and goals.

Remember, options trading is a complex strategy that involves high risk and the potential for significant losses. Thorough research, a deep understanding of market dynamics, and a measured approach are crucial to mitigate risks and enhance your chances for success.

Join our vibrant Options Trading Australia Forum, a treasure trove of invaluable insights, expert perspectives, and real-time market updates. Connect with like-minded individuals, engage in thought-provoking discussions, and stay abreast of the latest trends in the options trading universe. Together, we will navigate the market’s intricacies, empower our trading decisions, and unlock the full potential of options trading.