In the dynamic realm of financial markets, options trading stands as a sophisticated instrument that empowers investors to navigate market uncertainties and seize profit-making opportunities. At the heart of this potent strategy lies the Black-Scholes equation, an indispensable tool that unlocks the intricacies of options pricing and empowers traders with the knowledge to make informed decisions.

Image: ppt-online.org

Unveiling the Black-Scholes Equation: A Journey into Options Valuation

The Black-Scholes equation, aptly named after its creators Fischer Black and Myron Scholes, emerged from the depths of Princeton University in the hallowed halls of the Journal of Political Economy. This groundbreaking formula revolutionized the field of options trading, transforming it from a realm of guesswork to one of calculated precision.

The Essence of Black-Scholes: Unlocking Option Value

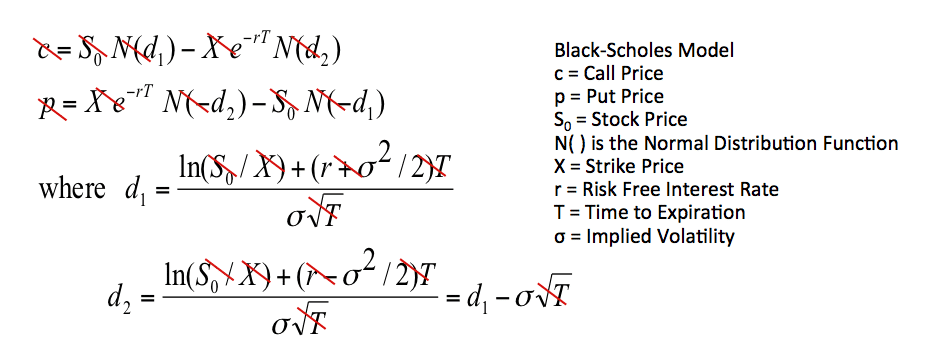

The Black-Scholes equation serves as the cornerstone for valuing options, considering a myriad of crucial factors that influence their worth. These factors include the underlying asset’s price, the option’s strike price, the time to expiration, the risk-free interest rate, and the volatility of the underlying asset. By integrating these elements into its calculation, the Black-Scholes equation provides a comprehensive assessment of an option’s value.

Beyond Theory: Practical Applications in Real-World Scenarios

The Black-Scholes equation is not merely an abstract concept but a practical tool that traders employ extensively in the real world. Whether it’s determining the fair price of an option or assessing its risk and return profile, the Black-Scholes equation is an indispensable resource for investors seeking to navigate the complexities of options trading with confidence and expertise.

Image: cartacommunity.force.com

Precision and Accuracy: The Cornerstones of Black-Scholes

The Black-Scholes equation has gained widespread recognition for its precision and accuracy in options pricing. Its sophisticated mathematical framework incorporates various variables that impact an option’s value, resulting in highly reliable valuations. This reliability has made the Black-Scholes equation a benchmark for options trading, trusted by investors and institutions alike.

Limitations and Considerations: Navigating the Nuances of Black-Scholes

It is essential to acknowledge that the Black-Scholes equation, while robust, is not without its limitations. It assumes constant volatility and normal distribution of asset prices, which may not always hold true in the unpredictable financial markets. Understanding these limitations allows traders to apply the Black-Scholes equation judiciously, recognizing its strengths and potential drawbacks.

Harnessing Black-Scholes: Empowering Informed Decision-Making

Empowered with the knowledge of the Black-Scholes equation, traders gain a competitive edge in the options market. They can make informed decisions regarding option pricing, risk management, and hedging strategies. The Black-Scholes equation provides the foundation for sound investment decisions, enabling traders to navigate market uncertainties and pursue their financial goals with greater confidence.

Black Scholes Options Trading Equation

Image: irudivupic.web.fc2.com

Conclusion: Unveiling the Secrets of Options Trading, One Equation at a Time

The Black-Scholes options trading equation is an invaluable tool that empowers traders with the knowledge and precision to navigate the complexities of the options market. By embracing this equation, investors can unlock the secrets of options pricing, assess risk and return profiles, and make informed decisions that propel their financial success. As they delve into the world of options trading, the Black-Scholes equation will serve as their constant companion, guiding their path toward informed decision-making and unlocking the potential for lucrative returns.