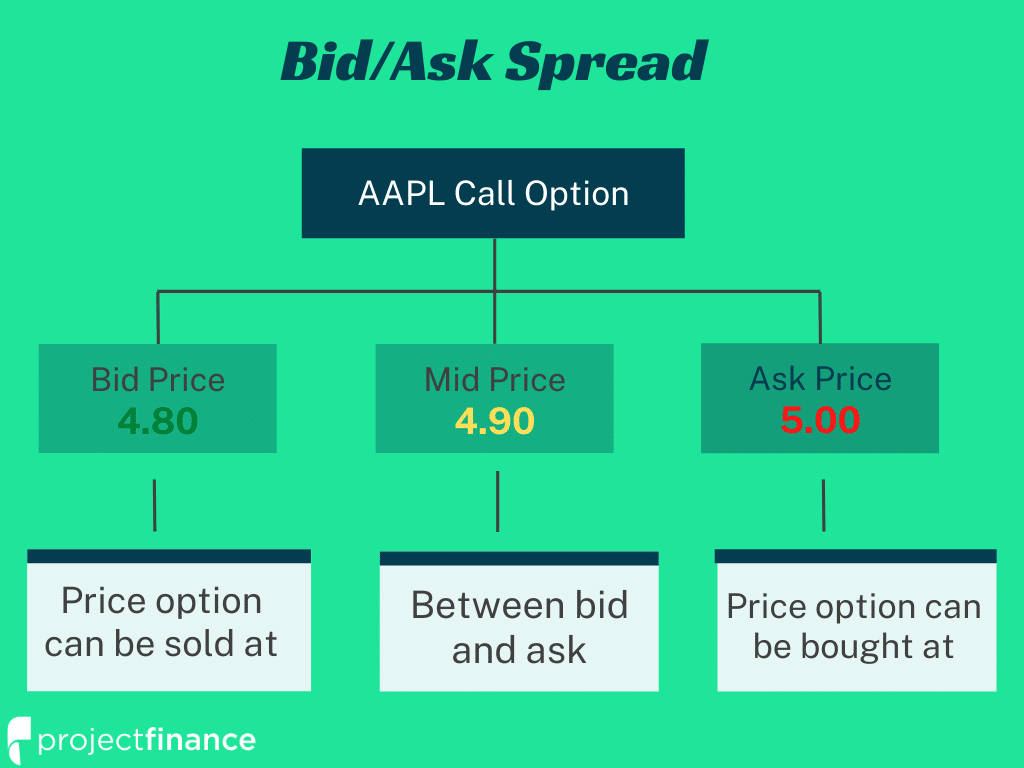

In the realm of option trading, two fundamental concepts lay the foundation for successful decision-making: bid and ask prices. These are the prices at which individual investors or market makers are willing to buy (bid) or sell (ask) an option contract, respectively. Understanding their significance is paramount for navigating the complex landscape of options.

Image: www.projectfinance.com

Defining Bid and Ask

Bid Price: The bid price represents the maximum amount a buyer is willing to pay to acquire a specific option contract. It reflects the demand for that option and indicates the value other market participants perceive in it.

Ask Price: Conversely, the ask price denotes the minimum amount a seller demands to part with an option contract. It mirrors the supply for the option and signals the value the seller attributes to it.

The Importance of Bid and Ask Spreads

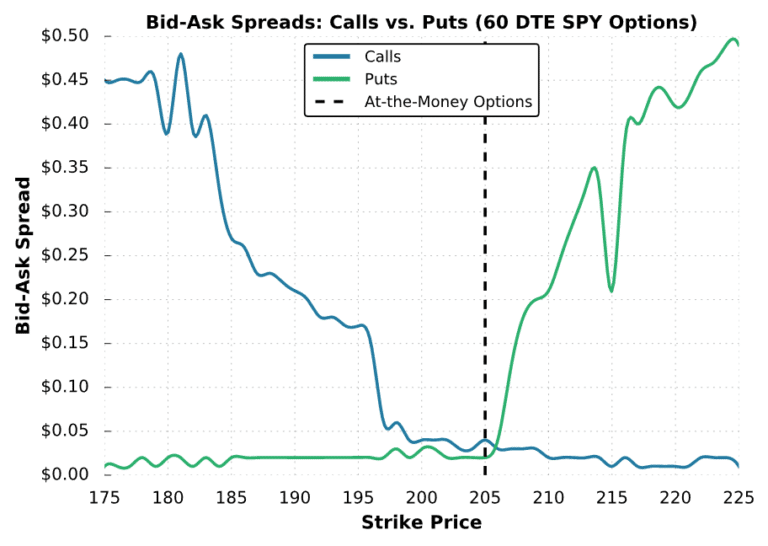

The difference between the bid and ask prices, known as the bid-ask spread, provides crucial insights into market sentiment and liquidity. A narrow spread indicates high liquidity, with buyers and sellers closely aligned in their valuations, while a wide spread signifies lower liquidity and greater disparity in opinions.

In general, a narrow spread suggests a liquid market with ample buyers and sellers, making it easier to execute trades at fair prices. A wide spread, on the other hand, implies a less liquid market with fewer active participants, potentially leading to less favorable execution prices.

Impact of Option Type and Expiration on Bid and Ask

The bid and ask prices of an option contract are also influenced by its type (call or put) and expiration date. Call options give the buyer the right but not the obligation to buy the underlying asset at a predetermined price (strike price) before the option expires. Put options, on the other hand, confer the right to sell the underlying asset at the strike price.

The closer the option is to expiration, the more likely it is to be in-the-money (ITM) or out-of-the-money (OTM). ITM options have a higher intrinsic value and, therefore, typically trade with tighter bid-ask spreads. OTM options, on the contrary, may have wider spreads due to lower intrinsic value and the uncertainty surrounding their potential profitability.

Image: www.projectfinance.com

Trading Strategies Involving Bid and Ask

Understanding bid and ask prices enables traders to employ various strategies to enhance their risk-reward profiles.

Bid-Ask Bounce: This strategy involves buying an option at the bid price and selling it at the ask price, capturing the quick profit generated by the spread. It is a low-risk strategy suitable for scalpers and short-term traders operating on very small timeframes.

Spread Trading: This strategy entails simultaneously buying an option at one price and selling another option of the same type and expiration but with a different strike price. The goal is to create a predetermined profit window based on the anticipated price movement.

FAQ on Bid and Ask in Option Trading

Q: What is the difference between bid and ask prices?

A: Bid price is the price at which buyers are willing to buy an option, while ask price is the price at which sellers are willing to sell.

Q: Which type of option typically has a narrower bid-ask spread: ITM or OTM?

A: ITM options usually have narrower spreads due to their higher intrinsic value.

Q: What is a bid-ask bounce strategy?

A: It is a short-term strategy that involves buying an option at the bid price and selling it at the ask price, pocketing the spread as profit.

Bid And Ask In Option Trading

Image: markettaker.com

Conclusion

Bid and ask prices in option trading are pivotal concepts that provide valuable insights into market sentiment, liquidity, and option value. By leveraging this knowledge, traders can refine their decision-making, optimize their risk management, and navigate the complexities of the options market more effectively. As with any financial instrument, it is essential to conduct thorough research, and seek professional guidance when necessary.