My journey into the world of options began with a desperate attempt to boost my portfolio’s performance. I stumbled upon the tantalizing allure of options spread trading, an advanced strategy promising colossal returns. Driven by a thirst for knowledge, I delved deep into books and attended webinars, eager to master this enigmatic technique.

Image: fabalabse.com

Options Spread Trading: Opening the Gateway to Limitless Profits

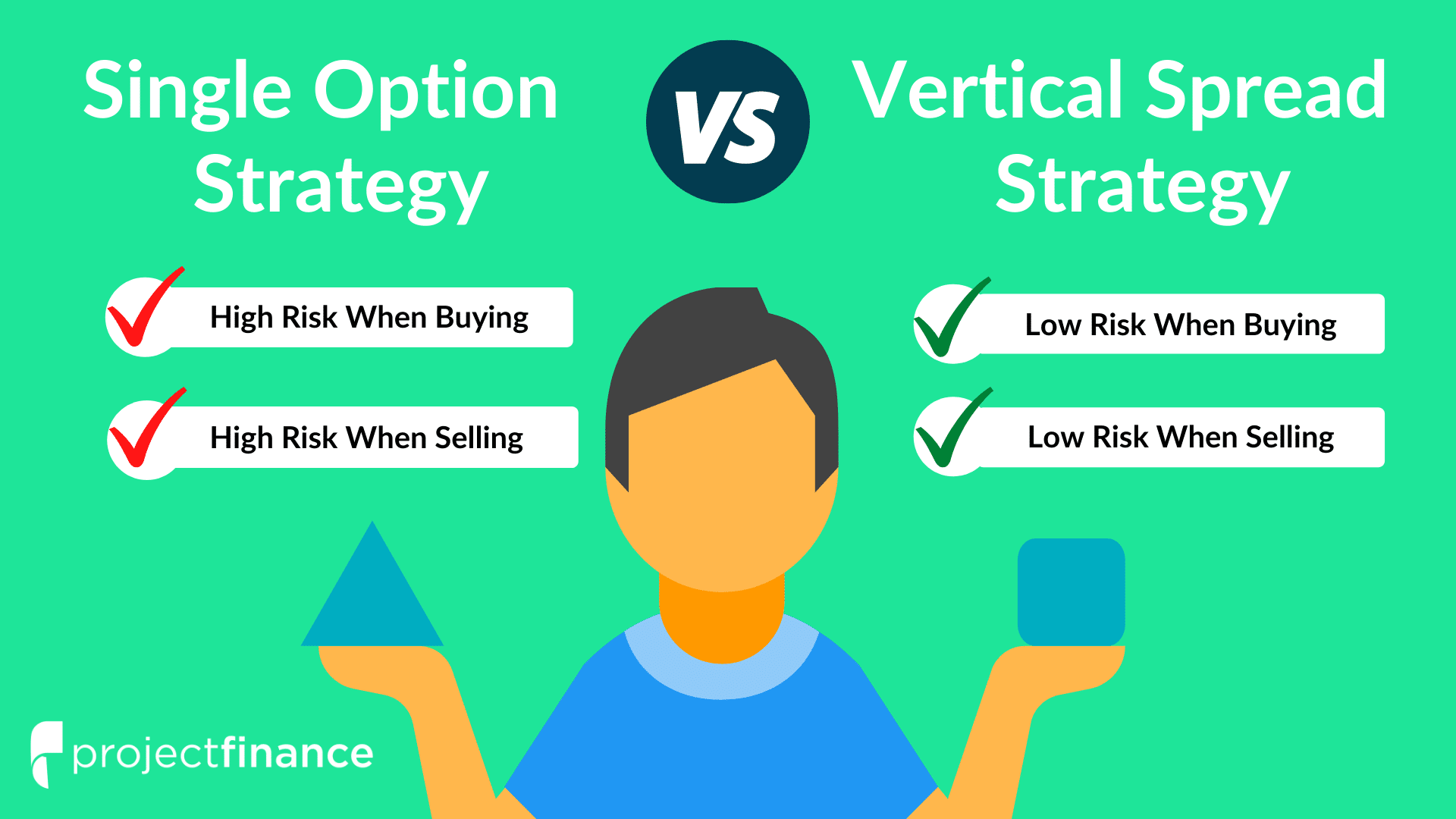

In the realm of financial markets, options spread trading stands as a symphony of calculated risks, where traders orchestrate a harmonious blend of buying and selling options to amplify potential profits. This sophisticated approach empowers individuals to harness the boundless opportunities inherent in market volatility, and master the art of minimizing risk exposure.

To unravel the intricacies of options spread trading, one must first comprehend its fundamental components. An option is a contract that grants the holder the privilege, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specified date. A spread trade involves the simultaneous purchase and sale of two options with different strike prices and expiration dates, creating a custom-tailored risk-reward profile.

The beauty of options spread trading lies in its versatility, offering an array of strategies tailored to diverse risk appetites and market conditions. From the conservative protective collar to the high-flying iron butterfly, each strategy presents a unique blend of profit potential and risk exposure. Whether aiming to mitigate downside risks or capture explosive market swings, options spread trading empowers traders to navigate the financial landscape with precision.

Unveiling the Secrets of Profitable Options Spread Trading

To attain mastery in options spread trading, aspiring traders must not only grasp theoretical concepts but also embrace practical experience. The following principles serve as indispensable guideposts on the path to success:

1. Define Your Trading Goals:

Before embarking on your options spread trading journey, establish clear trading objectives. Define your risk tolerance, profit targets, and investment horizon. Aligning your strategies with your financial goals will pave the way for informed decision-making.

Image: tradeoptionswithme.com

2. Thoroughly Research the Underlying Asset:

In the realm of options spread trading, intimate knowledge of the underlying asset is paramount. Conduct meticulous research, scrutinizing historical price movements, market sentiment, and industry dynamics. This comprehensive understanding will empower you to make well-informed trading decisions.

3. Master Technical Analysis Techniques:

Technical analysis plays an invaluable role in options spread trading. Proficiency in identifying chart patterns, trendlines, and support and resistance levels will provide invaluable insights into price behavior, enabling you to time your trades with greater precision.

4. Manage Risk Effectively:

Risk management is the cornerstone of successful options spread trading. Implement stringent risk control measures, such as setting stop-loss orders, utilizing position sizing techniques, and diversifying your portfolio. By managing risk effectively, you can safeguard your capital, navigate market fluctuations, and maximize profitability.

Frequently Asked Questions on Options Spread Trading

- Q: What is the minimum capital required for options spread trading?

A: The minimum capital requirement varies based on the type of spread strategy employed and the volatility of the underlying asset. Generally, a starting capital of $10,000 is recommended for beginner traders. - Q: Can options spread trading be profitable for beginners?

A: While options spread trading offers immense profit potential, it’s essential to approach it with a measured mindset. Beginners are advised to start with smaller positions and gradually increase their investment size as they gain experience and confidence. - Q: What is the best options spread trading strategy for beginners?

A: The protective collar strategy is a suitable option for beginners, as it provides a cushion against significant losses while offering the potential for moderate gains.

Option Spread Trading Strategies

Conclusion

Options spread trading presents a powerful tool for enhancing portfolio growth, but it’s imperative to approach this sophisticated strategy with caution and a deep understanding of financial markets. By embracing the principles outlined above, you can unlock the secrets of successful options spread trading and embark on a rewarding journey towards financial prosperity.

Now, I invite you to share your thoughts. Are you fascinated by the possibilities of options spread trading? Would you like to delve deeper into this exciting and potentially lucrative world?