In the thrilling world of finance, where potential rewards dance alongside calculated risks, options trading stands as an enigmatic gateway to financial empowerment. Among the myriad strategies that adorn this captivating realm, option spreads emerge as a refined technique, a symphony of risk management and profit optimization.

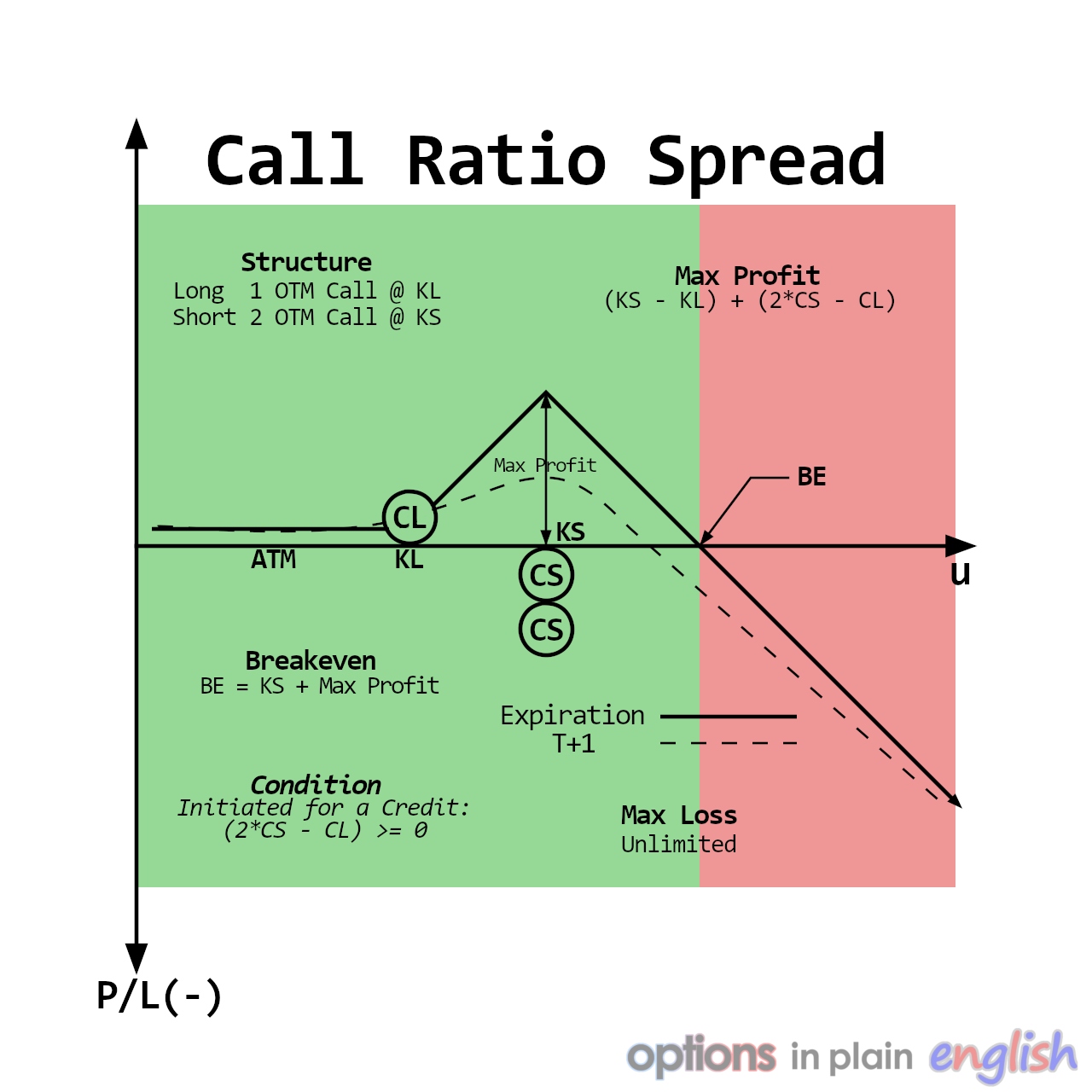

Image: optionsinplainenglish.com

If you’re an aspiring trader seeking to elevate your game, delving into the intricacies of option spreads is akin to unlocking a treasure trove of trading wisdom. This comprehensive guide will illuminate the path, guiding you through the fundamentals of option spreads, their types, strategies, and the art of crafting a winning approach.

What are Option Spreads?

Option spreads, the epitome of risk-tuned trading, are strategies that involve simultaneously buying and selling options with different strike prices and/or expiration dates. By orchestrating these transactions, traders meticulously construct a tailored risk-reward profile, akin to a financial ballet where calculated moves orchestrate a symphony of potential profits.

Striking a Balance: The Anatomy of an Option Spread

Composing an option spread resembles a balancing act, a harmonious interplay of buying and selling. Traders juxtapose a “long” position, where they purchase an option, with a “short” position, where they sell an option. This strategic combination mitigates risk while judiciously positioning the trader to capture market movements.

Types of Option Spreads: A Spectrum of Strategies

The world of option spreads unfurls a vast tapestry of strategies, each tailored to specific market conditions and risk appetites. Here are some commonly employed spreads:

-

Bull Call Spread: A bullish bet anticipating rising prices. The trader buys a higher-strike call option while simultaneously selling a lower-strike call option.

-

Bear Put Spread: A bearish strategy wagering on falling prices. The trader sells a higher-strike put option and buys a lower-strike put option.

-

Straddle: A neutral strategy capitalizing on volatility. The trader buys both a call and a put option with the same strike price and expiration date.

-

Strangle: A broader straddle anticipating significant price movements. The trader buys a call option and a put option with different strike prices but the same expiration date.

-

Butterfly Spread: A complex strategy aiming for moderate profits within a specific price range. It involves buying one option at a middle strike price and selling two options at higher and lower strike prices, respectively.

Image: db-excel.com

Crafting Your Option Spread Masterpiece

Devising a successful option spread strategy is not a task for the faint-hearted. It necessitates meticulous planning, astute market analysis, and a keen understanding of risk management.

-

Define Your Goal: Crystallize your trading objective. Are you seeking to capitalize on price increases (bullish) or price decreases (bearish)?

-

Analyze the Market: Thoroughly assess market trends, volatility, and potential catalysts. Historical data and technical indicators can provide invaluable insights.

-

Select Strike Prices and Expiration Dates: Strategically choose strike prices and expiration dates that align with your market outlook. Consider the time decay of options as expiration approaches.

-

Manage Risk: Calculate the potential profit and loss (P&L) of your spread before executing the trade. Determine the maximum risk you’re willing to assume.

-

Monitor and Adjust: Once you’re in a trade, diligently monitor market movements and adjust your strategy as needed. Timely adjustments can mitigate losses and protect profits.

The Path to Trading Mastery: Education and Experience

Mastering option spreads is a continuous journey, an ongoing pursuit of knowledge and refinement. Embark on this path with unwavering determination, embracing educational resources, seeking mentorship from experienced traders, and honing your skills through disciplined paper trading.

-

Education: Delve into books, articles, and online courses dedicated to option spreads. Seek out reputable sources and expert insights.

-

Paper Trading: Simulate real-world trading in a risk-free environment. Paper trading allows you to experiment with different strategies and gain valuable experience without risking capital.

-

Mentorship: Connect with experienced traders who can impart their wisdom and guide your trading journey. Their mentorship can accelerate your learning curve and enhance your decision-making.

Trading Option Spread

Image: www.thinkmarkets.com

Conclusion: The Allure of Option Spreads

In the realm of financial trading, option spreads reign supreme as a sophisticated instrument for risk management and profit maximization. Embracing the intricacies of option spreads empowers traders to navigate market complexities with greater precision and confidence.

Whether you’re a seasoned trader seeking to expand your arsenal or an aspiring trader eager to unlock the potential of options, the world of option spreads beckons. Approach this endeavor with a thirst for knowledge, a disciplined mindset, and an unwavering belief in your ability to conquer the financial landscape.