Introduction

Image: yolafoq.web.fc2.com

In the intricate realm of options trading, seasoned investors seek strategies that not only offer the potential for profit but also provide a degree of risk mitigation. Among these sophisticated tactics, box spreads stand out as a refined technique that combines both these attributes. Understanding the nuances of box spreads is crucial for traders looking to navigate the complexities of the options market.

This comprehensive guide delves into the world of box spreads, exploring their historical origins, explaining their core concepts, and showcasing their practical applications. Through a myriad of examples, you’ll unearth the versatility of this strategy in varied market conditions. As we conclude, we’ll touch upon the latest developments within the box spread strategy universe and illuminate the path to further exploration.

Understanding the Symphony of Box Spreads

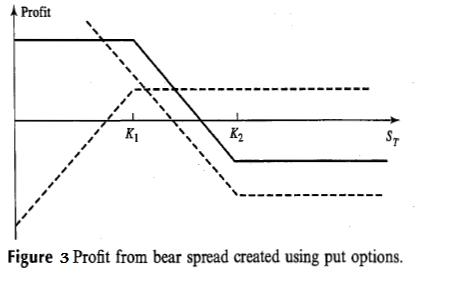

A box spread, in essence, is a neutral strategy constructed by combining two different vertical spreads, one bullish and one bearish, with identical strike prices but different expiration dates. The beauty of this construction lies in its ability to capture a profit within a defined range while simultaneously minimizing potential losses beyond those boundaries.

Imagine a scenario where the underlying asset, say XYZ stock, is trading at $100. An investor anticipates limited price fluctuations in the near future. Employing a box spread strategy, they might purchase a specific number of June at-the-money (ATM) call options and sell the same quantity of June ATM put options. Simultaneously, they would purchase an equal number of July ATM put options and sell an identical number of July ATM call options.

Examples Illustrating the Box Spread’s Versatility

To fully grasp the nuances of box spreads, let’s explore a few illustrative examples:

-

Profit Potential: If XYZ stock remains within the predetermined trading range, the premiums collected from selling the options will offset the premiums paid for purchasing them. The profit potential is limited to the net premium received at the initiation of the strategy.

-

Risk Management: The defined boundaries of the box spread limit the trader’s potential losses. If XYZ stock breaches the upper boundary, the profit potential of the call spread is offset by the losses incurred in the put spread, resulting in a contained loss.

-

Flexibility: Box spreads provide flexibility in terms of strike prices and expiration dates, enabling traders to tailor their strategies based on market conditions and risk tolerance.

The Evolution of Box Spreads: A Thriving Investment Tactic

Box spreads have their roots in classical options trading strategies and have evolved over time to meet the demands of increasingly sophisticated investors. Today, advanced box spread variations like iron butterflies and calendar spreads have emerged, catering to specific market dynamics and risk-reward profiles.

Conclusion: Unlocking the Potential of Box Spreads

Box spreads offer a unique combination of profit potential and risk management, making them a valuable tool in the arsenal of options traders. By understanding their construction and employing them strategically, traders can navigate volatile markets with greater confidence, maximizing returns while minimizing risk.

As the options market continues to evolve, so too will the nuances of box spreads. Embark on a journey of further exploration, delving into the intricacies of this multifaceted strategy. Embrace the opportunities it presents, while always exercising prudence and maintaining a keen eye on the ever-changing market landscape.

Image: narekyfuhevaq.web.fc2.com

Option Trading Box Spreads

Image: epsilonoptions.com