Unlock the Dynamic World of Options Trading

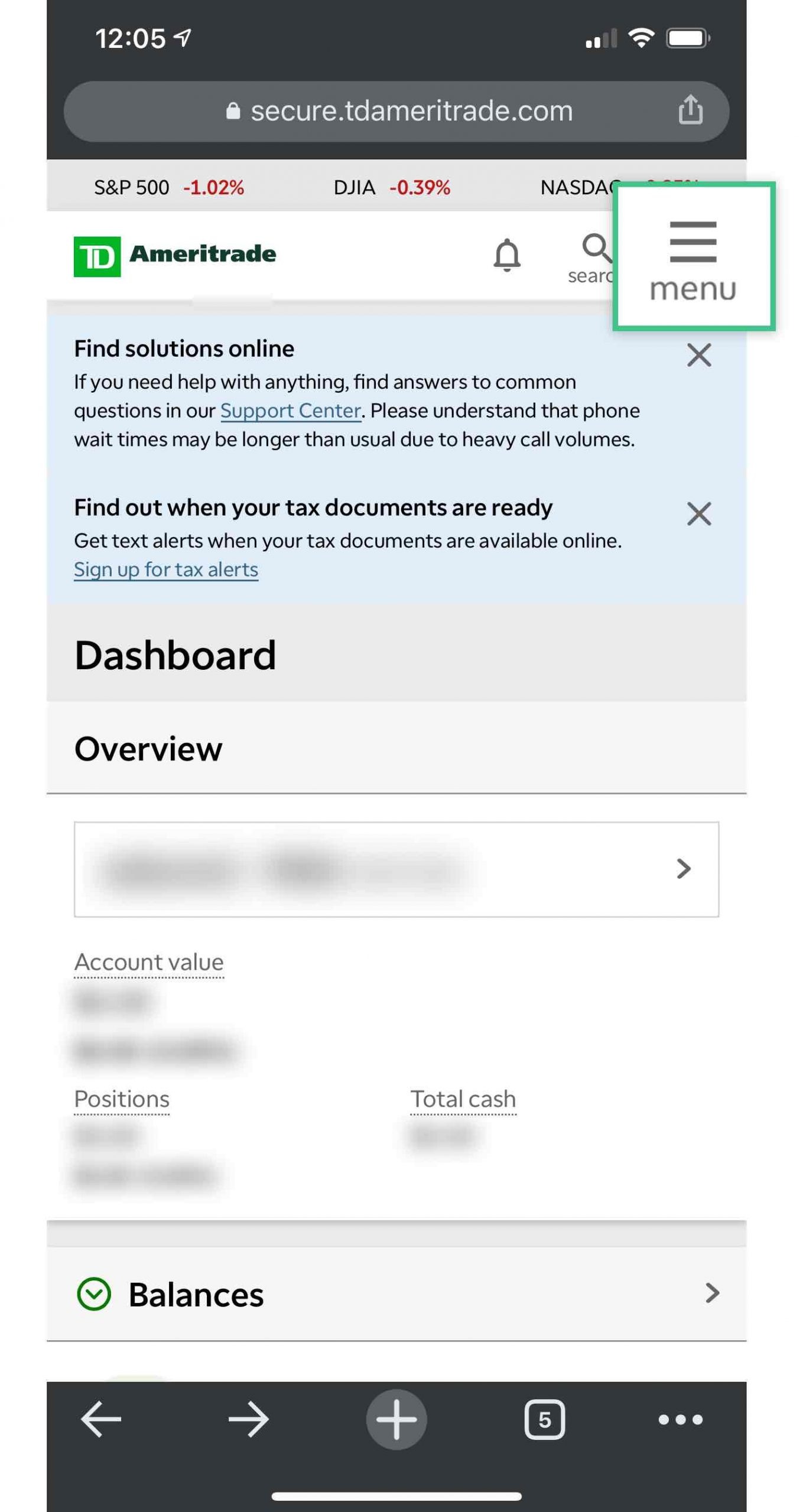

Options trading empowers investors with unparalleled flexibility and leverage in the financial markets. It involves contracts that give buyers the right, but not the obligation, to buy or sell an underlying asset at a specified price within a specific timeframe. TD Ameritrade, renowned for its cutting-edge platform and unparalleled customer support, has emerged as a leading broker for options traders seeking advanced trading capabilities.

Image: www.hicapitalize.com

Cash Accounts: The Foundation of Options Trading

Cash accounts serve as the cornerstone of options trading, providing investors with the funds necessary to execute trades and meet margin requirements. These accounts are distinctly separate from margin accounts, offering reduced risk accompanied by lower borrowing power.

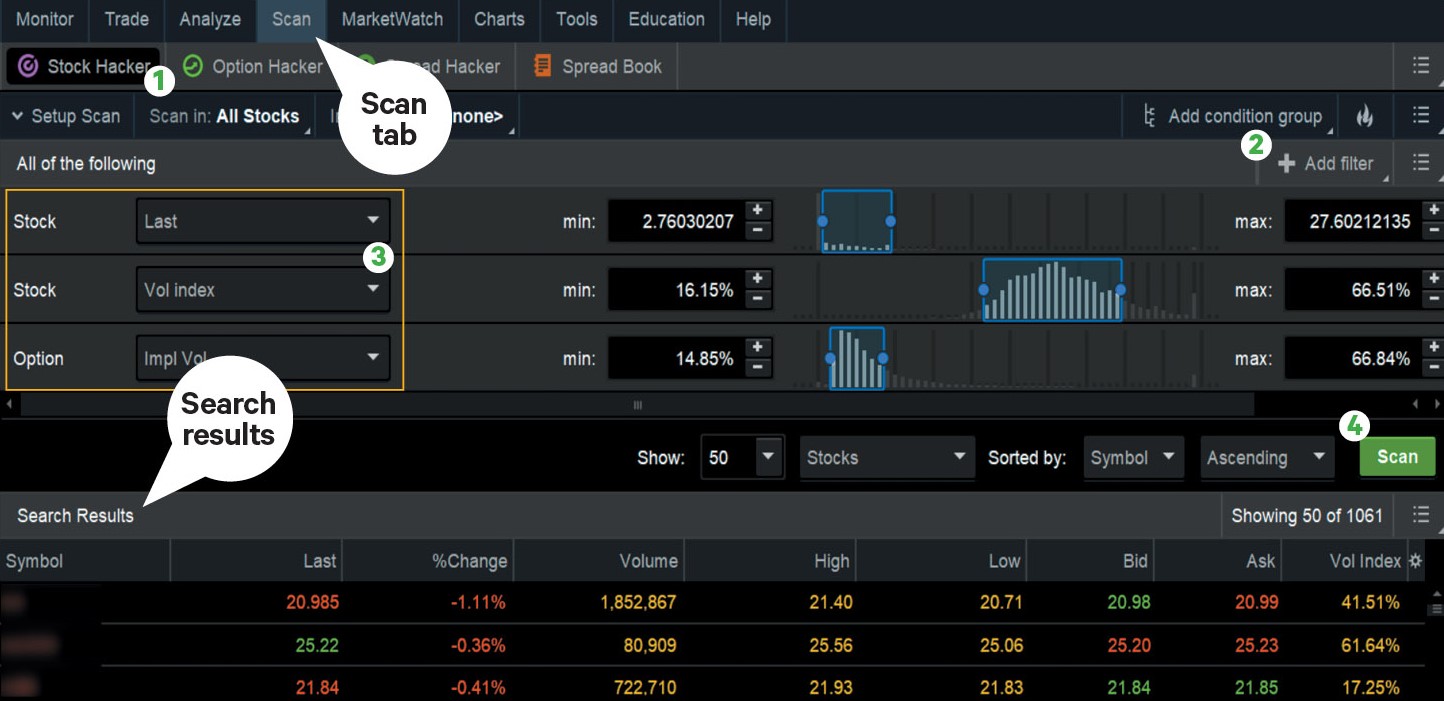

Navigating Options Trading with TD Ameritrade

TD Ameritrade has meticulously designed its platform to accommodate the complexities of options trading. Its user-friendly interface empowers traders to:

- Monitor market data in real-time, including quotes, charts, and news feeds.

- Build customizable watchlists to track favorite assets and identify trading opportunities.

- Place and manage orders with ease, leveraging advanced features like stop orders and trailing stop-loss orders.

- Analyze options contracts in depth, including Greeks, implied volatility, and risk-reward calculations.

- Access educational resources to enhance trading knowledge and stay abreast of industry trends.

Proven Strategies for Options Trading Success

Seasoned options traders have devised astute strategies to maximize profitability and manage risk effectively:

- Master the Greeks: Delve into the intricacies of Greeks, such as delta, theta, and vega, to understand how different factors influence option prices.

- Leverage Technical Analysis: Employ technical analysis techniques to identify potential market trends and trading opportunities based on historical data.

- Manage Risk Prudently: Implement robust risk management strategies, including setting realistic profit targets, using stop-loss orders, and understanding margin requirements.

- Continuous Education: Stay up-to-date with market developments, new trading strategies, and industry insights through ongoing education and research.

Image: thewaverlyfl.com

FAQs: Unraveling Common Questions about Options Trading

Q: Who is options trading suited for?

A: Options trading is ideal for experienced traders seeking leverage and increased risk tolerance.

Q: What are the risks associated with options trading?

A: Options trading carries significant risk, including potential for substantial financial losses.

Q: How can I learn more about options trading?

A: Utilize educational resources provided by brokers like TD Ameritrade, attend webinars, or engage with experienced traders.

Q: Can I trade options on margin?

A: Yes, options trading on margin is possible with appropriate approval and adherence to strict margin requirements.

Options Trading Cash Account Td Ameritrade

Embrace the Future of Options Trading

As the financial markets continue to evolve, options trading remains a dynamic and ever-evolving field. By embracing innovative platforms like TD Ameritrade, educating oneself through continuous learning, and adhering to prudent risk management strategies, traders can unlock the full potential of options trading.

Join us in exploring the exciting world of options trading and learn how to harness the power of TD Ameritrade to maximize your trading potential. Are you ready to take your financial journey to the next level?