Options Trading Account Definition: Unlock the Power of Derivatives

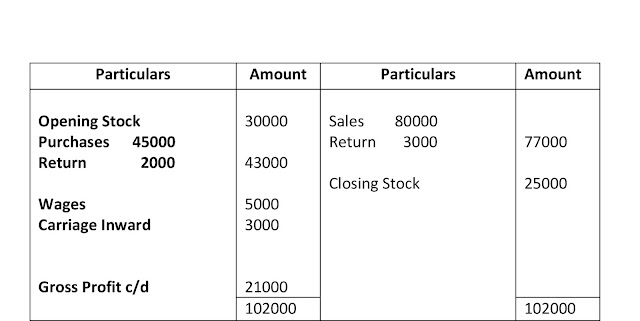

Image: www.bank2home.com

In the dynamic world of finance, options trading holds immense potential for investors seeking both income generation and risk management strategies. Understanding the intricacies of options trading requires an in-depth grasp of the account that facilitates these transactions – the options trading account.

Options Trading Account: A Gateway to Derivatives

An options trading account is a specialized account established with a brokerage firm that permits the trading of options contracts. Options are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset (such as stocks, bonds, or commodities) at a predetermined price on or before a specified date.

Understanding Options Contract Basics

The core elements of an options contract include the underlying asset, the strike price, the expiration date, and the premium. The underlying asset is the security that the contract represents. The strike price is the price at which the holder can exercise their right to buy or sell the underlying asset. The expiration date marks the last day when the contract can be exercised. The premium is the price paid to the option seller for the right granted by the contract.

Types of Options Trading Accounts

Different brokerage firms may offer various types of options trading accounts to meet the needs of different investors. These include:

- Cash Accounts: These accounts require the investor to maintain a cash balance equal to the value of the options they wish to purchase.

- Margin Accounts: Margin accounts allow investors to borrow funds from the broker to buy options, increasing their potential profits – but also their potential losses.

- Synthetic Accounts: These accounts combine cash and margin features, providing investors with flexibility in their risk tolerance.

Selecting an Options Trading Account

When choosing an options trading account, investors should consider their experience level, investment goals, and risk appetite. Factors to consider include:

- Brokerage Fees: Transaction fees and account maintenance costs can vary significantly between brokerages.

- Trading Platform: The platform should be user-friendly, offering robust tools for option analysis and trading.

- Customer Support: Reliable and responsive customer support can be crucial when navigating complex options trades.

Conclusion

Options trading accounts open the door to a diverse range of potential financial strategies. By understanding the definitions and mechanics involved, investors can make informed decisions and harness the power of these sophisticated financial instruments to achieve their investment objectives. Remember to research thoroughly and select an options trading account that aligns with your individual circumstances and investment goals.

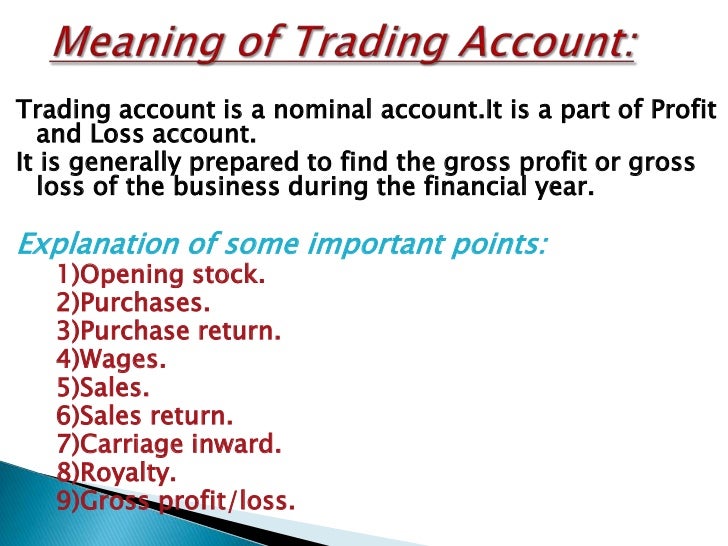

Image: www.slideshare.net

Options Trading Account Definition

Image: www.superfastcpa.com