Investing in the financial markets has never been more accessible, thanks to the advent of online platforms like Upstox. With its user-friendly interface and a wide range of trading options, Upstox has empowered traders of all levels to navigate the complex world of stock options.

Image: mrgaga.in

Options trading offers a unique opportunity to enhance portfolio returns and mitigate risks, but it also comes with its own set of challenges. This comprehensive guide will equip you with the essential knowledge and practical tips to make informed decisions and unlock the power of options trading with Upstox.

Understanding Options: The Basics

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on or before a specific date. There are two main types of options: calls and puts.

- Call options give the buyer the right to buy the underlying asset at the strike price or above.

- Put options give the buyer the right to sell the underlying asset at the strike price or below.

Options are characterized by their underlying asset, strike price, expiration date, and premium. The underlying asset can be a stock, index, commodity, or currency. The strike price is the price at which the buyer can exercise their right to buy or sell the asset. The expiration date is the date on which the option contract expires. The premium is the price paid by the buyer to acquire the option.

Why Trade Options with Upstox?

Upstox has emerged as a leading platform for options trading, offering several advantages:

- User-friendly interface and intuitive trading tools

- Competitive brokerage fees and low margins

- Real-time market data and advanced charting capabilities

- Access to a wide range of underlying assets

- Educational resources and support for new traders

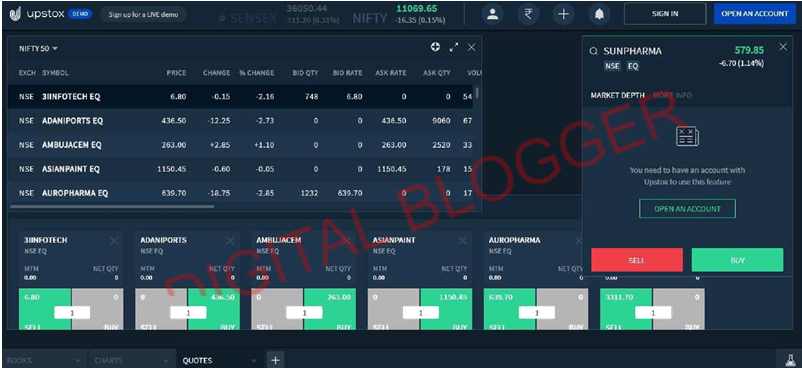

With Upstox, you can trade options on stocks, indices, and commodities. The platform provides a variety of order types and advanced risk management tools to help you manage your positions effectively.

Step-by-Step Guide to Options Trading with Upstox

To start options trading with Upstox, follow these simple steps:

- Open an account with Upstox and fund it.

- Choose an underlying asset and analyze its price action and volatility.

- Identify a potential trading opportunity and select the appropriate option type (call or put).

- Determine the strike price and expiration date.

- Calculate the premium and decide how much you are willing to risk.

- Place an order using Upstox’s trading platform.

It is important to remember that options trading involves risk of loss. Before entering any trade, it is essential to understand the risks involved and trade within your means.

Image: www.adigitalblogger.com

Mastering Options Trading with Expert Insights

To become a successful options trader, it is imperative to learn from the experiences of others. Here are some insights from seasoned experts:

- Choose an underlying asset that you understand and follow closely.

- Start with small trades and gradually increase your position size as you gain experience.

- Manage your risk by using stop-loss orders and position sizing techniques.

- Stay informed about market trends and track the performance of the underlying assets.

- Be disciplined and stick to your trading plan.

Upstox Option Trading

Conclusion

Options trading can be a powerful tool for enhancing portfolio returns, but it requires a deep understanding of the concepts and risks involved. By leveraging the advantages of Upstox and following the guidance of experienced traders, you can unlock the potential of options trading and take control of your financial future.

Remember, education is the key to success in any endeavor. By continuously learning, practicing, and adapting, you can become a confident and profitable options trader with Upstox.