In the realm of financial markets, options trading stands as a powerful tool, offering investors the opportunity to mitigate risk and enhance potential returns. Among the various types of options, American style options hold a significant place, allowing for greater flexibility and a range of trading strategies. Join us as we delve into the world of American style options trading, uncovering its nuances and shedding light on how investors can leverage this instrument to their advantage.

Image: www.youtube.com

What are American Style Options?

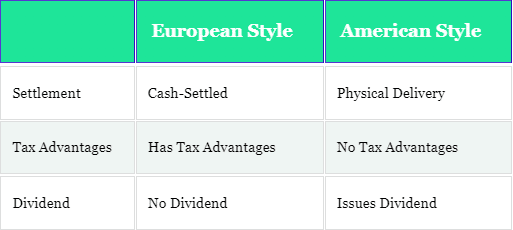

In the world of financial instruments, options contracts grant buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. American style options are distinguished by their unique characteristic of being exercisable at any time up until their expiration date. Unlike European style options, which can only be exercised at expiration, American style options provide investors with the added flexibility to adjust their positions according to market dynamics.

Benefits and Drawbacks of American Style Options

American style options offer several advantages over their European counterparts. First and foremost, the flexibility to exercise at any time allows investors to capitalize on favorable price movements. For instance, if an investor purchases an American call option on a stock that rises in value, they can exercise the option early to lock in profits rather than waiting until expiration.

Moreover, American style options can potentially enhance potential returns when the underlying asset exhibits considerable volatility. By exercising early, investors can capture additional gains from the option’s time value, a component that diminishes as the expiration date approaches.

However, the flexibility of American style options comes with a downside. Since the option can be exercised at any time, the seller has a greater risk of early exercise. This risk can translate into lower premiums for American style options compared to their European counterparts.

Trading Strategies with American Style Options

American style options unlock a diverse range of trading strategies tailored to various market conditions. One popular strategy is the covered call, where an investor sells a call option against an underlying asset that they own. By doing so, the investor generates an additional source of income while limiting their potential upside from the asset’s price appreciation.

Conversely, the protective put strategy involves buying a put option to hedge against the risk of a decline in the underlying asset’s value. This strategy is commonly employed by investors who hold a long position in an underlying asset and wish to protect their gains or limit potential losses.

Conclusion

American style options provide investors with a versatile and powerful instrument for managing

Image: www.projectfinance.com

American Style Options Trading