Navigating the intricate landscape of financial markets can be daunting, but understanding stock and options trading is crucial for savvy investors. In this comprehensive blog post, we’ll delve into the realm of SP options, exploring their definition, history, and trading strategies. Join us as we empower you with knowledge that will elevate your investment endeavors.

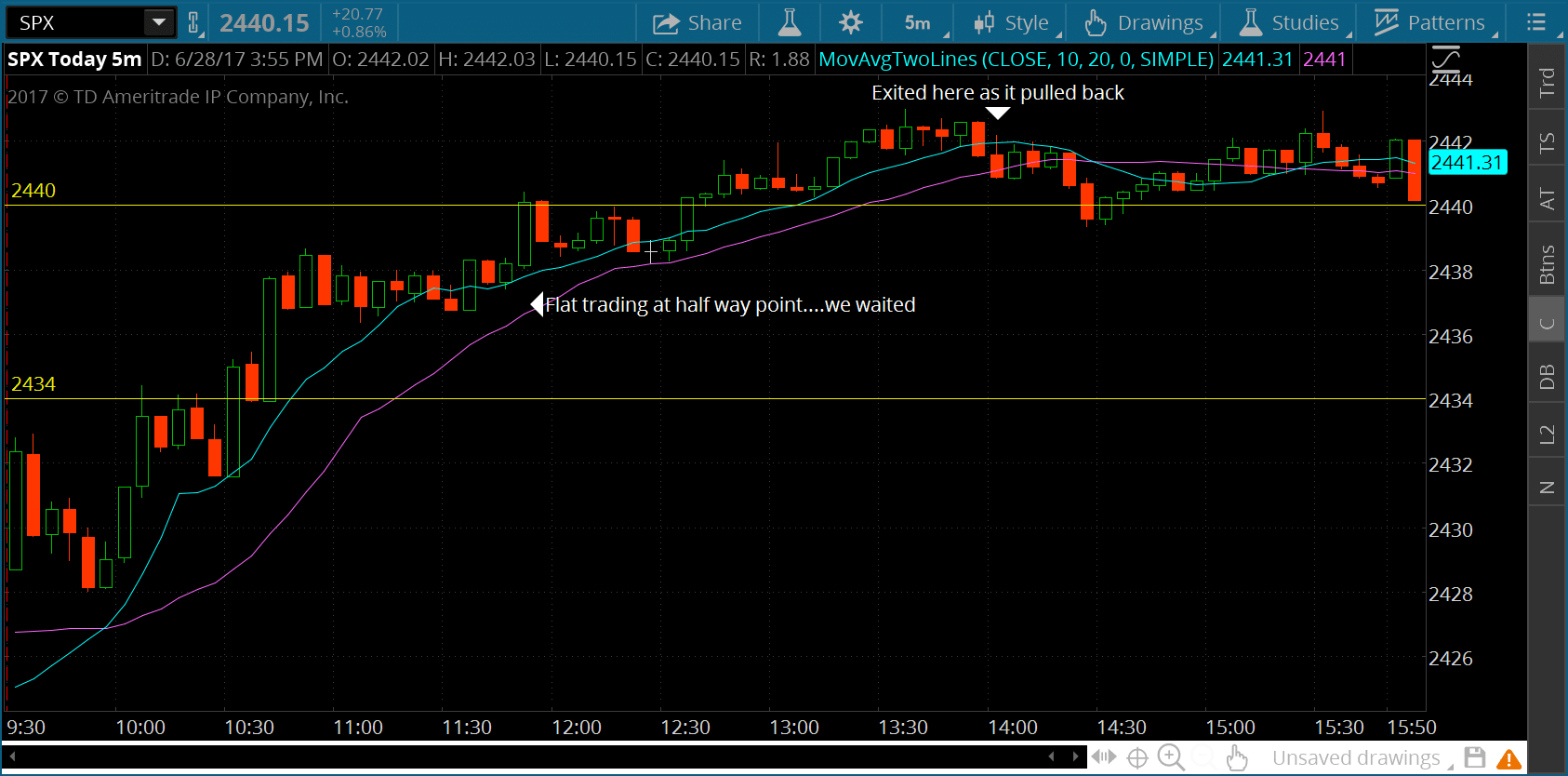

Image: www.tradingview.com

Options, often referred to as financial instruments, grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. In the case of SP options, the underlying asset is the S&P 500 index, a benchmark indicator of the U.S. stock market performance.

Analyzing SP Options: A Trading Perspective

Understanding SP options involves analyzing various factors that influence their value and trading potential. Key considerations include the underlying index price, strike price (the price at which the option can be exercised), expiration date, time decay (the gradual loss of value over time), and volatility (the level of price fluctuations).

Trends and Developments in SP Options Trading

Keeping abreast of the latest trends and developments in SP options trading is essential for successful execution. Industry experts, financial news sources, and online forums offer valuable insights into market dynamics. Monitoring these platforms can provide you with an edge in identifying profitable trading opportunities.

Tips for Successful SP Options Trading

To maximize your returns in SP options trading, consider the following tips:

- Thorough Research: Dedicate ample time to understanding SP options, market trends, and trading strategies.

- Define Trading Goals: Clearly define your investment goals and risk tolerance to guide your trading decisions.

- Risk Management: Implement sound risk management practices, such as stop-loss orders and position sizing, to mitigate potential losses.

By adhering to these principles, you can increase your chances of success in SP options trading.

Image: www.youtube.com

FAQs on SP Options Trading

Here are some frequently asked questions about SP options trading:

- Q: What is the difference between call and put options?

A: A call option gives the holder the right to buy the underlying asset at the strike price, while a put option gives the holder the right to sell. - Q: What factors affect the price of SP options?

A: The price of SP options is determined by the underlying index price, strike price, expiration date, time decay, and volatility. - Q: What is the best strategy for trading SP options?

A: The optimal strategy depends on individual goals, risk appetite, and market conditions. It is crucial to research and develop a strategy that aligns with your trading style.

By exploring the nuances of SP options, staying abreast of market trends, and applying sound trading practices, you can harness the potential of this valuable financial instrument.

Sp Options Trading View

Image: www.spxoptiontrader.com

Conclusion

We hope this comprehensive analysis of SP options has shed light on the topic and empowered you as an investor. Whether you are just starting out or seeking to enhance your trading strategies, a deep understanding of SP options is essential. Remember, investing involves both rewards and risks, and it is imperative to approach it with a well-informed and measured mindset. We encourage you to delve deeper into the world of SP options trading and embrace the opportunities it presents.