Unlocking the Potential of Tax-Free Trading

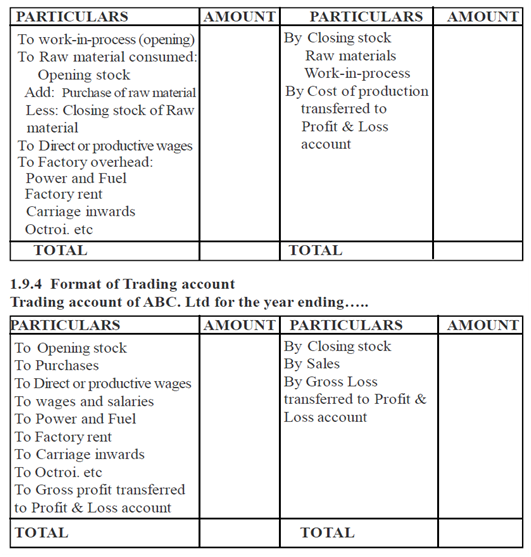

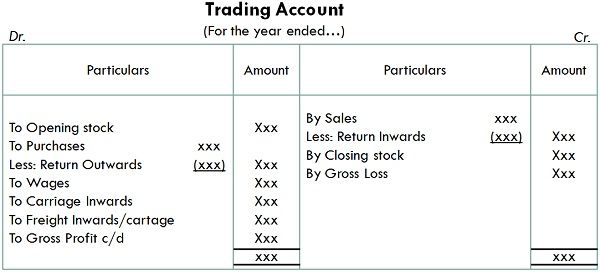

Image: tutorstips.com

In the complex world of investing, understanding how taxes can impact your returns is crucial. Options trading, a strategy that involves buying and selling financial instruments known as options, can be a powerful tool to enhance your portfolio growth. However, the tax implications of options trading can be complicated. By exploring the realm of non-taxable accounts, you can unlock the potential of options trading and reap the benefits of tax-free returns.

Understanding Non-Taxable Accounts

Non-taxable accounts are specialized investment vehicles that provide tax-advantaged treatment to your earnings. By shielding your investments from ordinary income and capital gains taxes, these accounts allow your wealth to grow at an accelerated pace. Examples include:

- Individual Retirement Accounts (IRAs): Traditional and Roth IRAs offer tax-deferred and tax-free growth, respectively.

- 401(k) and 403(b) Plans: Employer-sponsored retirement plans that provide tax-deferred contributions and potential tax-free withdrawals upon retirement.

- 529 Plans: College savings plans that allow withdrawals to be used for qualified educational expenses tax-free.

Options Trading in Non-Taxable Accounts

Options contracts, which grant the right but not the obligation to buy or sell an underlying asset at a specific price, can be traded within non-taxable accounts. This unique feature offers significant advantages:

- Tax-Deferred Growth: Profits generated from options trading in non-taxable accounts accumulate tax-deferred, allowing your investments to grow exponentially over time.

- Tax-Free Withdrawals: In the case of Roth IRAs and 529 Plans, withdrawals are completely tax-free when used for qualified purposes.

- Enhanced Returns: By leveraging the tax-free nature of non-taxable accounts, you can potentially achieve higher returns compared to taxable investments.

Strategies for Successful Options Trading

- Define Your Goals: Establish clear objectives for your options trading, whether it’s income generation, hedging risks, or achieving specific investment targets.

- Understand Options Trading: Thoroughly research and comprehend the mechanics of options trading, including the different types of options, market conditions, and trading strategies.

- Risk Management: Implement robust risk management measures to protect your capital, such as setting stop-loss orders and diversifying your portfolio.

- Seek Professional Advice: Consider consulting with a qualified financial advisor who specializes in options trading and non-taxable accounts.

Image: payehuvyva.web.fc2.com

Expert Insights

“By leveraging the power of non-taxable accounts, investors can unlock the full potential of options trading without sacrificing significant portions of their earnings to taxes,” says Dr. Michelle Chen, an expert in tax-advantaged investing.

“Options trading within non-taxable accounts provides a unique opportunity for investors to accelerate their wealth accumulation, enhance their financial flexibility, and secure their financial future,” adds Prof. Mark Jenkins, a renowned options trading strategist.

Actionable Tips

- Maximize contributions to your non-taxable accounts to take full advantage of the tax savings.

- Conduct thorough research on options trading before engaging in any transactions.

- Practice caution by setting appropriate risk parameters and monitoring your positions regularly.

- Seek personalized guidance from a financial advisor who can tailor strategies to your specific needs.

Options Trading In Non Taxable Account

Image: discuss.erpnext.com

Conclusion

Options trading in non-taxable accounts can be a valuable strategy to boost your investment returns. By understanding the tax advantages and implementing sound trading practices, you can unlock the potential of tax-free growth and enhance your financial well-being. Remember to approach options trading with informed decisions, risk awareness, and a long-term perspective. By grasping the opportunities presented by non-taxable accounts and employing effective options trading strategies, you can empower yourself to achieve your financial aspirations.