Unveiling my Options Trading Strategy: A Journey of Calculated Risks and Rewarding Outcomes

Image: www.projectfinance.com

Introduction:

The allure of the financial markets beckons to those seeking to amplify their wealth. Amidst this vibrant realm of stocks, bonds, and commodities, options emerge as a dynamic instrument that harnesses the power of speculation and risk management. In this comprehensive guide, I embark on a journey to unveil my meticulously crafted options trading strategy, unlocking the secrets to informed decision-making and unlocking the potential for financial success.

Defining Options: The Gateway to Speculation

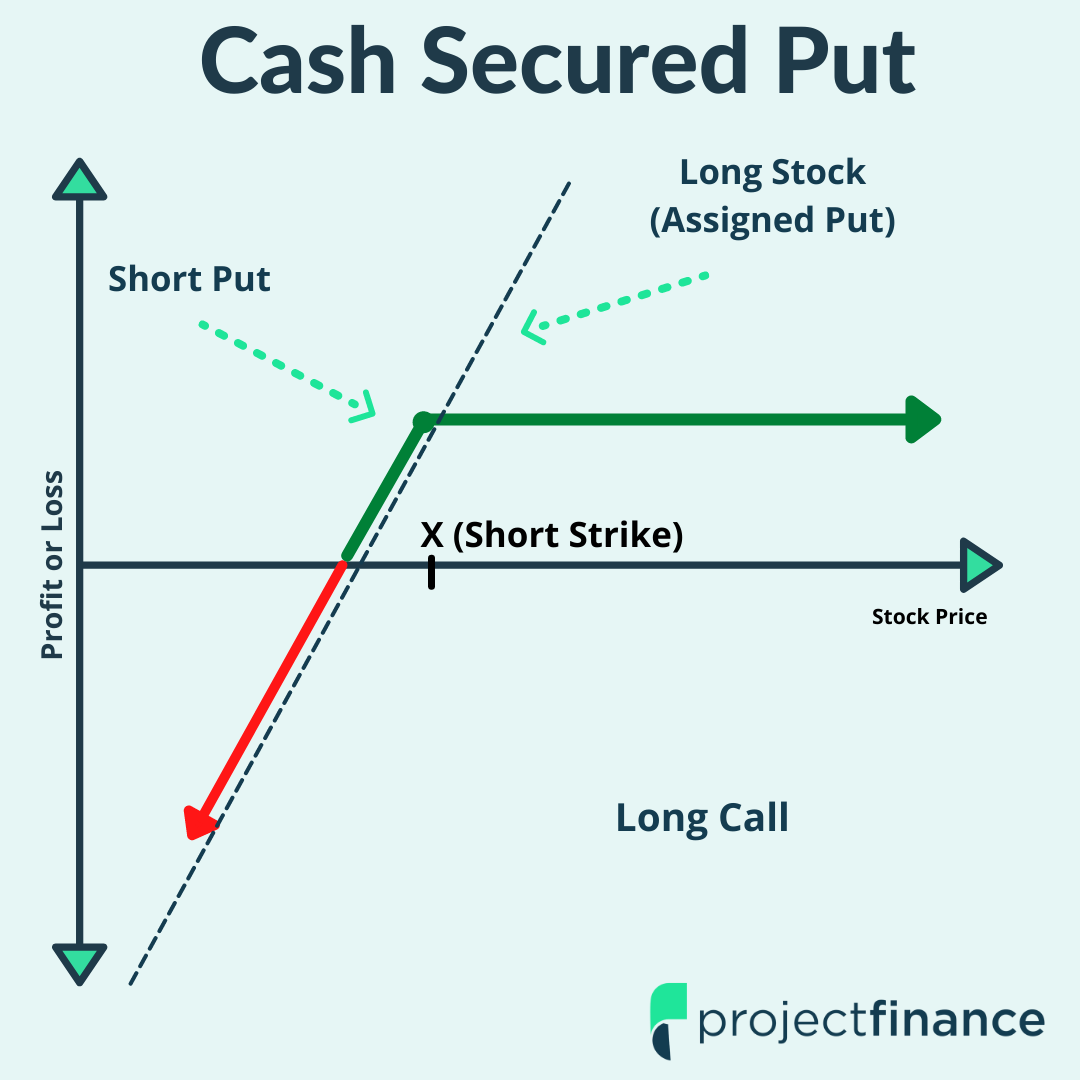

An option, in its essence, is a flexible financial contract that grants the buyer the right, but not the obligation, to purchase (in the case of a call option) or sell (in the case of a put option) an underlying security, such as a stock, at a predetermined price (strike price) on or before a specified date (expiration date). This versatility empowers traders to craft tailored strategies based on their market outlook and risk appetite.

Navigating the Maze of Options Trading Types

The world of options is a multifaceted tapestry, and each type serves a distinct purpose. Call options, as mentioned earlier, bestow the right to buy, allowing traders to capitalize on rising prices. Put options, on the other hand, provide the right to sell, enabling protection against declines or income generation. The ability to combine and execute these options in various sequences forms the foundation of sophisticated trading strategies.

Understanding the Nuances of Options Pricing

The value of an option is not static; rather, it undergoes constant fluctuations driven by a myriad of factors. Among the key variables influencing price are the underlying security price, strike price, time until expiration, and implied volatility. Grasping these nuances is essential for making informed decisions that maximize profit potential.

Technical Indicators: Illuminating Market Patterns

In the relentless pursuit of profitable options trades, technical indicators emerge as invaluable tools. These mathematical formulas, applied to historical price data, attempt to predict future price movements or identify potential trading opportunities. Moving averages, Bollinger Bands, and Relative Strength Index (RSI) are just a few examples of the many indicators employed by traders to gain a competitive edge.

Expert Insights: Discerning the Wisdom of Leaders

The path to trading mastery is paved with the wisdom of seasoned professionals. In this article, I share insights from leading experts in the field, offering profound perspectives and actionable advice. Their experiences serve as a beacon, guiding traders through the complexities of the markets and enhancing their chances of success.

Case Study: Deciphering Real-World Success

To illustrate the practical application of my options trading strategy, I delve into a compelling case study. By analyzing a specific trade in depth, including entry and exit points, risk management techniques, and profit potential, I provide tangible proof of its effectiveness.

Conclusion: Unveiling the Path to Financial Empowerment

Options trading, while a high-risk endeavor, offers the tantalizing prospect of substantial rewards. By mastering my comprehensive strategy, complemented by diligent research, technical analysis, and expert guidance, you can embark on a path of informed decision-making and financial empowerment. Remember, the markets are ever-evolving entities, and continuous learning is the key to unlocking their true potential.

Image: www.pinterest.com

My Options Trading Strategy

![Options Trading For Beginners [Option Trading For Dummies] - Xtreme ...](https://www.xtremetrading.net/wp-content/uploads/2018/05/options-trading-for-beginners-option-trading-for-dummies.jpg)

Image: www.xtremetrading.net