Navigating the world of investing involves understanding the nuances between different account types. TD Ameritrade offers three primary options: cash accounts, margin accounts, and options trading accounts. Each account type caters to specific investment strategies, and choosing the right one is crucial to maximizing your potential returns while minimizing risks.

Image: www.reddit.com

Margin Trading Explained

Margin trading allows investors to borrow funds from their brokerage firm to purchase securities, effectively amplifying their buying power. This can be a double-edged sword, as it provides the potential for greater profits but also magnifies potential losses. Margin trading is suitable for experienced investors who are comfortable with high levels of risk and have a clear understanding of market dynamics.

Benefits of Margin Trading

- Increased buying power: Margin trading enables you to purchase more securities than you could with a cash account.

- Potential for higher returns: Increased buying power can lead to greater profits, but it’s important to remember that profits are not guaranteed.

Risks of Margin Trading

- Potentially large losses: Margin trading magnifies losses, potentially leading to significant financial losses.

- Interest charges: Investors pay interest on borrowed funds, which can eat into potential profits.

- Margin calls: If the value of your investments falls below a certain level, the brokerage firm may require you to deposit additional funds (margin call) or liquidate assets to cover the margin loan.

Image: onlinetradingab.blogspot.com

Options Trading Demystified

Options trading involves contracts that give the holder the right, but not the obligation, to buy or sell an underlying asset at a specific price within a set time frame. Options trading is a sophisticated investment strategy that requires a deep understanding of market movements and option pricing.

Benefits of Options Trading

- Flexibility: Options provide investors with flexibility in managing their investments, allowing them to tailor strategies to their specific goals.

- Potential for hedging: Options can be used as hedging tools to protect against potential losses in other investments.

Risks of Options Trading

- Complexity: Options trading can be highly complex and requires a comprehensive understanding of options pricing and trading mechanisms.

- Potential for losses: Options trading can result in substantial losses, especially if the underlying asset’s price does not behave as expected.

- Expiration dates: Options contracts have expiration dates, and if the holder fails to exercise or sell the option before the expiration date, the contract becomes worthless.

Cash Account Characteristics

Cash accounts are the simplest and most straightforward account type. They allow investors to purchase securities using only the cash available in the account. This eliminates the risks associated with margin trading and options trading but also limits the potential for higher returns. Cash accounts are suitable for beginner investors or those who prefer a less risky investment strategy.

Benefits of Cash Accounts

- No risk of margin calls: Investors can only spend the cash available in the account, eliminating the possibility of being forced to cover losses.

- No interest charges: Investors do not incur any interest expenses associated with borrowed funds.

- Simplicity: Cash accounts are easy to understand and manage, making them suitable for novice investors.

Limitations of Cash Accounts

- Limited buying power: Investors are restricted to investing within the cash they have in their account.

- Lower potential for returns: The lack of leverage limits the potential for higher returns.

Choosing the Right Account Type: A Guide

The choice between a margin account, an options trading account, or a cash account depends on your investment goals, risk tolerance, and experience. Consider the following factors when making your decision:

- Investment goals: Are you seeking aggressive growth, or do you prefer a more conservative approach?

- Risk tolerance: Are you comfortable with the potential for large swings in account value?

- Investment knowledge: Do you have a thorough understanding of margin trading and options trading?

- Time horizon: How long do you plan to invest your funds?

Expert Advice and Tips

- Conduct thorough research before engaging in margin trading or options trading.

- Start with a small amount of capital to gain experience before increasing your investments.

- Monitor your investments regularly and rebalance your portfolio as needed.

- Consider seeking professional guidance from a financial advisor if you are unsure about your investment strategy.

Frequently Asked Questions

Q: Can I open different account types with TD Ameritrade?

A: Yes, you can open multiple account types with TD Ameritrade to accommodate different investment strategies.

Q: Are there fees associated with margin trading or options trading?

A: Yes, there may be fees associated with margin trading and options trading, such as interest charges or commissions.

Q: What is the minimum deposit to open a margin account?

A: The minimum deposit to open a margin account with TD Ameritrade is $2,000.

Q: How does a margin call work?

A: A margin call occurs when the value of your investments falls below a certain level, requiring you to deposit additional funds or liquidate assets to cover the margin loan.

Q: Can I trade options in a cash account?

A: No, you cannot trade options in a cash account. You need an options trading account for that.

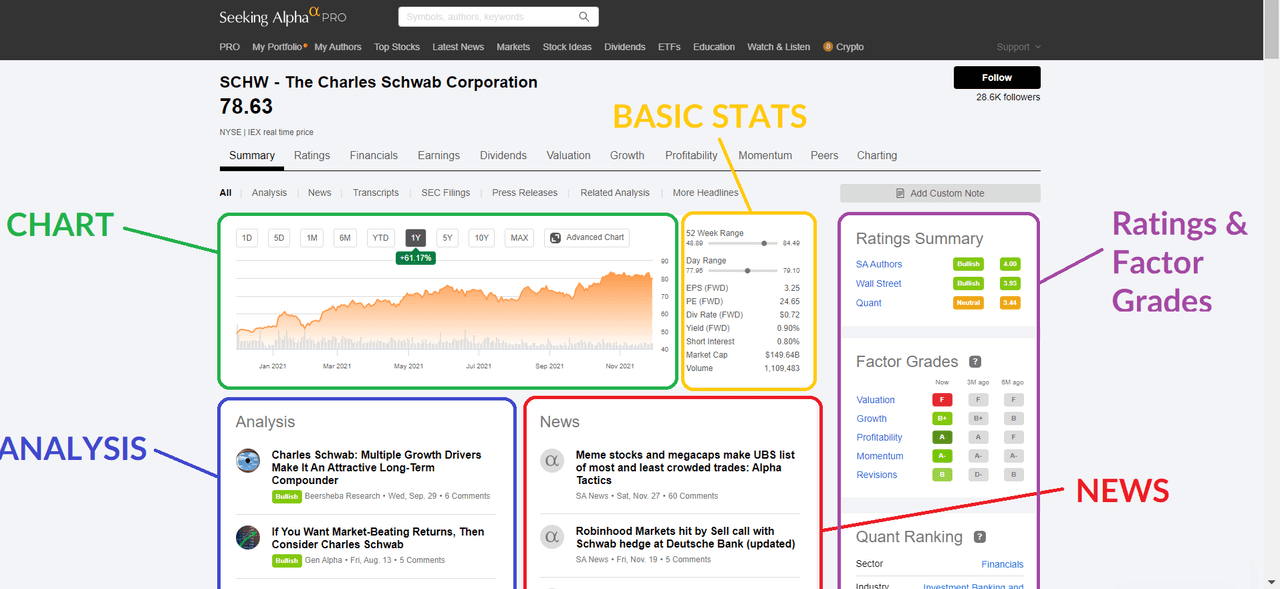

Td Ameritrade Margin And Options Trading Vs Cash Account

Image: seekingalpha.com

Conclusion

Understanding the differences between TD Ameritrade’s margin and options trading accounts, as well as cash accounts, is crucial for investors seeking to make informed investment decisions. By carefully considering your investment goals, risk tolerance, and experience, you can select the account type that best aligns with your financial objectives. Remember, prudent investing involves ongoing research, monitoring, and a willingness to seek professional guidance when needed.

Is the content detailed enough to help you better understand the topic?