Introduction

Investing opens doors to financial freedom, but navigating the complexities of different account types can be daunting. Brokerage firms offer a spectrum of account options, from margin privileges to options trading, each with unique features and risk profiles. Understanding the nuances between these accounts is crucial for making informed investment decisions. In this article, we delve into the world of margin privileges, options trading, and cash account only, empowering investors to choose the account that aligns with their goals and risk tolerance.

Image: financelifes.com

Margin Privileges: Borrowing Power for Amplified Returns

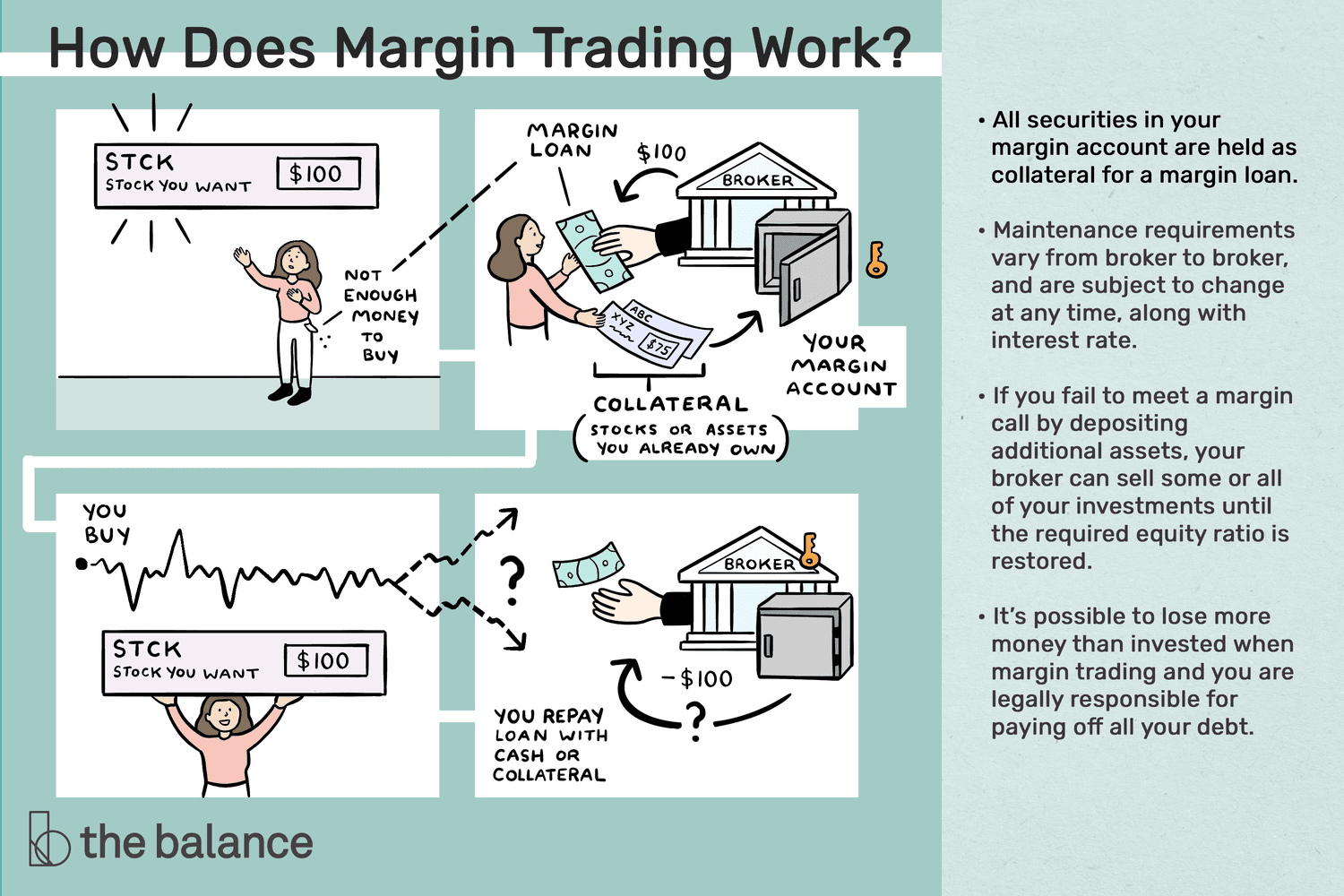

Margin privileges grant investors the ability to borrow money from their brokerage firm to purchase securities. This leverage can amplify both potential profits and losses, making it a double-edged sword. Margin accounts are suitable for experienced investors with a high risk tolerance who are comfortable with potentially significant fluctuations in their account balance.

Benefits of Margin Privileges

- Enhanced purchasing power: Margin accounts allow investors to purchase more securities than they could with their own cash, maximizing potential returns.

- Flexibility: Margin accounts provide flexibility to adjust positions quickly, allowing investors to capitalize on market opportunities and hedge against risks.

Risks of Margin Privileges

- Unlimited loss potential: Losses on margin can exceed the investor’s initial capital investment, leading to potential financial ruin.

- Interest charges: Margin accounts typically accrue interest on borrowed funds, reducing overall returns.

- Margin calls: If the value of the securities purchased on margin declines significantly, the brokerage firm may issue a margin call, requiring the investor to deposit additional funds or liquidate positions.

Image: patternswizard.com

Options Trading: Navigating Volatility with Rights and Obligations

Options trading offers investors the opportunity to trade contracts that give them the right (but not the obligation) to buy or sell an underlying asset at a predetermined price and expiration date. Options can be used for speculation, hedging, and income generation.

Benefits of Options Trading

- Limited risk: Compared to margin trading, options trading allows investors to limit their potential losses to the premium paid for the option contract.

- Flexibility: Options contracts provide investors with various strategies, such as buying calls for potential gains in the underlying asset or selling puts for income generation.

- Speculative potential: Options trading offers sophisticated traders the opportunity to speculate on future price movements of underlying assets.

Risks of Options Trading

- Time decay: The value of options contracts decays over time, even if the underlying asset’s price remains unchanged.

- Complexity: Options trading requires a comprehensive understanding of option pricing models and risk management techniques.

- Market volatility: Options premiums can fluctuate dramatically in response to market volatility, potentially eroding profits or resulting in losses.

Cash Account Only: A Conservative Approach for Peace of Mind

Cash account only imposes the restriction of purchasing securities with available cash. This account type is ideal for risk-averse investors or those starting their investment journey.

Benefits of Cash Account Only

- Safety: Cash accounts eliminate the risk of margin calls or losses exceeding the investor’s cash balance, providing peace of mind.

- Simplicity: Cash account only provides a straightforward and easy-to-understand approach to investing.

- No interest charges: Unlike margin accounts, cash account only incurs no interest charges on funds used for investments.

Limitations of Cash Account Only

- Limited buying power: Investors are confined to investing within the limits of their available cash, restricting the potential for substantial growth.

- Missed opportunities: Cash accounts only may not allow investors to take advantage of market opportunities that require leverage or options strategies.

Margin Privileges Vs Options Trading Vs Cash Account Only

Image: optionalpha.com

Conclusion

Margin privileges, options trading, and cash account only present investors with distinct investment options, each carrying unique benefits and risks. Margin privileges offer amplified returns with unlimited loss potential, while options trading provides flexibility and limited risk, but requires a high level of sophistication. Cash account only ensures safety and simplicity, but limits growth potential. Understanding the nuances of each account type empowers investors to make informed decisions tailored to their individual risk appetite and financial goals. By carefully weighing these options, investors can embark on their investment journey with confidence, paving the way for financial liberation and prosperity.