Navigating the world of finance can be a daunting task, and margin trading stands as a prime example. This advanced trading strategy carries both immense potential and significant risks, making it essential to understand the ins and outs before diving in. In this article, we will delve into the world of margin privileges, uncovering its benefits, drawbacks, and the intricacies involved in this enticing yet complex form of trading.

Image: speedtrader.com

Understanding Margin Trading: A Glimpse into Leveraged Investment

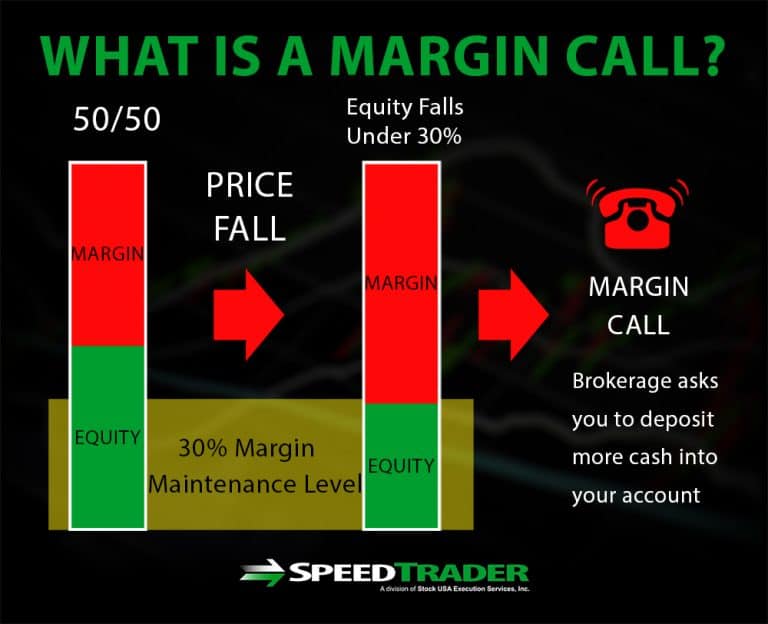

Margin trading, in its essence, allows investors to borrow funds from their broker to amplify their trading power beyond their initial capital. This leverage, however, comes at a cost – interest on the borrowed funds. By leveraging their capital, traders can potentially magnify their profits, but simultaneously, they also magnify their losses. Margin trading, therefore, is a double-edged sword, requiring a deep understanding of risk management and market dynamics.

Benefits of Margin Privileges: Riding the Waves of Profitability

When employed strategically, margin trading can unlock a plethora of benefits for savvy traders. By magnifying their capital, traders can gain exposure to larger positions, increasing their potential returns. Moreover, margin trading can provide flexibility in trading strategies, allowing traders to capitalize on both bullish and bearish market trends. Additionally, it grants access to a broader range of investment opportunities, empowering traders to diversify their portfolios.

Drawbacks of Margin Trading: Navigating the Risks

While margin trading presents alluring opportunities, it also harbors significant risks that traders must acknowledge and manage. The primary risk stems from magnified losses. As mentioned earlier, leverage amplifies both gains and losses, meaning that losses can swiftly surpass initial capital. Moreover, margin trading involves interest payments, which can erode profits over time, especially in flat or declining markets.

Image: blog.injective.com

Eligibility for Margin Privileges: The Gateway to Leveraged Trading

To qualify for margin privileges, traders need to meet specific criteria set forth by their brokers. These criteria often encompass factors such as account size, trading experience, and risk tolerance. Some brokers may impose a minimum account balance or require a certain level of investment experience before granting margin privileges. It is crucial for traders to assess their own risk appetite and trading proficiency before applying for margin privileges.

Responsible Margin Trading: Risk Management Strategies

Engaging in margin trading demands a stringent risk management framework. Traders should set realistic trading goals and strictly adhere to them. They should also employ stop-loss orders to limit potential losses, safeguarding their capital against excessive drawdowns. Diversifying investments across multiple assets and markets can further mitigate risks. Lastly, traders should always monitor their margin levels, ensuring they don’t exceed their risk tolerance.

Conclusion: Margin Trading – A Rewarding Yet Demanding Endeavor

Margin trading, with its ability to amplify both profits and losses, presents both opportunities and challenges. Traders who understand the nuances of margin trading, manage risks effectively, and possess a disciplined approach can leverage it to their advantage. However, it is imperative to recognize that margin trading is not a suitable strategy for all investors. Only those with a high tolerance for risk and a comprehensive understanding of the financial markets should consider venturing into this realm.

Margin Privileges Or Options Trading

Call to Action: Embark on a Prudent Trading Journey

If margin trading aligns with your investment goals and risk tolerance, we encourage you to explore further. Educate yourself on trading strategies, risk management techniques, and market analysis. Remember, responsible trading practices are paramount to maximizing returns while safeguarding your capital. Embrace margin trading as a tool to enhance your trading capabilities, but always prioritize prudence and discipline throughout your journey.