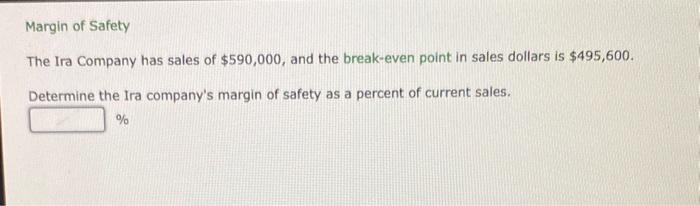

Margin Privileges: A Pathway to Enhanced Returns

Image: www.chegg.com

For seasoned investors seeking to magnify their earning potential, options trading within an IRA offers an exceptional opportunity through margin privileges. Margin privileges grant investors the capacity to borrow funds from their brokerage firm, effectively amplifying their purchasing power and potentially boosting returns. However, this power comes with inherent risks, necessitating a comprehensive understanding of the underlying mechanisms and careful risk management strategies.

Delving into Options Trading: A Strategic Toolkit

Options trading involves contracts that convey the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price on or before a specific date. These versatile instruments offer investors a spectrum of strategies, from hedging against market downturns to pursuing speculative gains. By utilizing margin privileges, investors can amplify their positions, enhancing potential profits while also amplifying potential losses.

Navigating the Maze: Understanding Margin Trading in IRAs

While margin trading within a traditional brokerage account is commonplace, extending this privilege to IRAs is a relatively recent development. The SEC’s Regulation T sets forth the rules governing margin trading within IRAs, establishing specific requirements for account eligibility, permissible leverage ratios, and risk management measures. It is imperative to note that not all IRAs qualify for margin privileges, and those that do may impose restrictions on the types of investments eligible for margin trading.

Harnessing Opportunities: Maximizing Margin Privileges

Seasoned investors can leverage margin privileges to capitalize on market opportunities and enhance portfolio returns. One compelling strategy involves purchasing call options on stocks anticipated to appreciate in value. By leveraging margin, investors can increase their option position, potentially amplifying their gains if the stock price rises. Conversely, selling put options on stocks expected to decline can generate income while providing protection against potential losses.

Managing Risks: Prudent Strategies for Margin Trading

While margin privileges can amplify returns, they also heighten risks. Unwielding margin effectively necessitates a robust understanding of risk management techniques. Establishing clear entry and exit points, setting stop-loss orders, and maintaining adequate diversification are indispensable practices for prudent margin trading. Moreover, diligent monitoring of market conditions and portfolio performance is paramount to mitigating risks and safeguarding capital.

Exploring Leveraged ETFs: An Alternative to Margin Trading

Leveraged ETFs offer an alternative to margin trading, providing investors with exposure to amplified market movements. These ETFs employ leverage techniques to magnify returns, either bullishly or bearish. While leveraged ETFs can potentially enhance returns, they also inherit the associated risks of margin trading, including the potential for significant losses. Investors should exercise due diligence in evaluating the suitability of leveraged ETFs within their portfolios.

Conclusion: Margin Privileges and Options Trading: A Strategic Balancing Act

Margin privileges within IRAs empower investors to harness the potential of options trading, amplifying both returns and risks. By comprehending the underlying mechanisms, implementing prudent risk management strategies, and leveraging alternative instruments such as leveraged ETFs, investors can navigate the complexities of margin trading and harness the power of options to enhance their financial outcomes. Vigilant monitoring and a disciplined approach are pivotal for unlocking the full potential of margin privileges while mitigating inherent risks.

Image: www.reddit.com

Margin Privileges Or Options Trading Ira

Image: www.tastylive.com