Introduction

The foreign exchange market, also known as Forex or FX, is the world’s largest financial market, with an average daily trading volume of over $5 trillion. FX options, a versatile trading instrument, allow traders to hedge currency risk, speculate on exchange rate movements, and access levered exposure to currency pairs. Choosing the right FX option trading platform is pivotal for successful options trading and achieving optimal returns.

Image: www.btcc.com

Understanding FX Options

An FX option is a derivative contract that grants the buyer the right, but not the obligation, to buy (call option) or sell (put option) a specified amount of currency at a predetermined price on or before a specified date. This flexibility provides traders with tailored risk management strategies and opportunities for profit in both rising and falling currency markets.

Essential Features of an FX Option Trading Platform

The choice of an FX option trading platform should hinge on several key features:

-

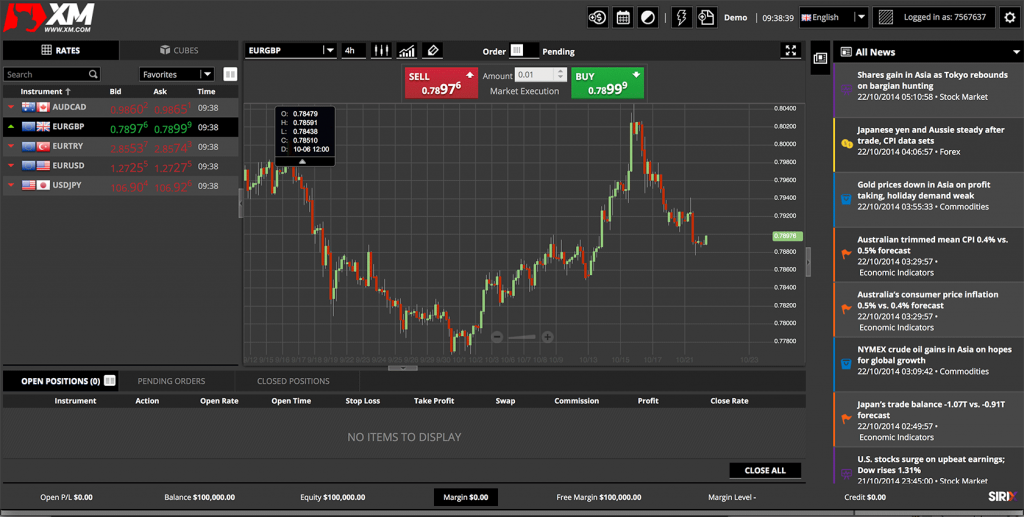

Intuitive Interface: A user-friendly interface is essential, enabling traders to interact with the platform seamlessly and execute trades efficiently.

-

Advanced Charting and Analysis Tools: Sophisticated charting and technical analysis tools are invaluable for identifying trading opportunities and making informed decisions.

-

Real-Time Price Data: Access to accurate, real-time price data is crucial for staying abreast of market movements and making timely trading decisions.

-

Flexibility and Customization: Traders must be able to customize platform settings, strategies, and risk parameters to suit their individual trading styles and objectives.

-

Exceptional Customer Support: Responsive and knowledgeable customer support is indispensable for resolving queries, providing guidance, and ensuring a smooth trading experience.

Choosing the Right Platform for Your Needs

With the myriad of FX option trading platforms available, selecting the one that aligns with your trading requirements is paramount. Consider factors such as:

-

Trading Strategy: Determine the specific trading strategies you employ and identify platforms that support them.

-

Account Type: Choose a platform that offers account options compatible with your risk tolerance and trading capital.

-

Fees and Commissions: Compare trading fees and commission structures to optimize your profitability.

-

Reputation and Reliability: Opt for reputable platforms with robust security measures, transparent trading practices, and proven track records.

Image: admiralmarkets.com

Vetting Process for FX Option Trading Platforms

To evaluate FX option trading platforms effectively, follow these steps:

-

Research and Compare: Dedicate time to researching and comparing different platforms, considering user reviews and industry insights.

-

Test Demo Accounts: Most platforms provide demo accounts, which allow you to experience the functionality and features firsthand without financial risk.

-

Consult Professionals: Reach out to experienced traders or financial advisors for recommendations and guidance in choosing the best platform.

-

Consider the Platform’s Track Record: Assess the platform’s longevity in the industry, reputation among traders, and history of stability and reliability.

Best Fx Option Trading Platform

Conclusion

Selecting the ideal FX option trading platform empowers traders to navigate the complexities of currency options trading with confidence and efficiency. By carefully evaluating the essential features, customization options, and reputation of different platforms, traders can optimize their trading performance, minimize risks, and maximize their chances of success in the ever-fluctuating foreign exchange market. Remember to approach platform selection with due diligence and consider your specific trading needs and preferences to make an informed decision that aligns with your financial goals.