Navigating the Margin Trading Landscape

In the realm of investing, unlocking the potential of margin trading can be both alluring and daunting. But before venturing into this advanced field, it’s crucial to understand the fundamental difference between margin privileges options trading and cash account trading. In this article, we’ll delve into the intricacies of both options, empowering you to make informed decisions that align with your investment goals and risk tolerance.

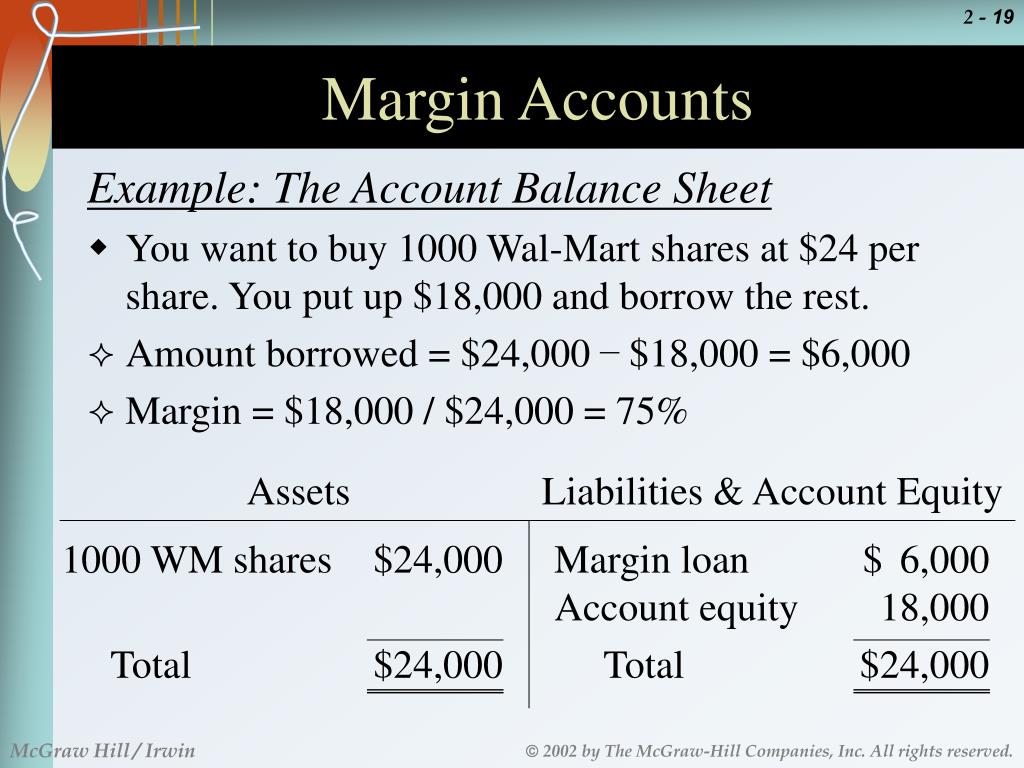

Image: www.slideserve.com

Margin Privileges Options Trading: A Double-Edged Sword

Margin privileges options trading grants traders the ability to amplify their buying power by borrowing money from their broker. This leverage can magnify potential profits, but it also amplifies losses. With margin trading, investors have the flexibility to use borrowed funds to purchase stocks, options, or other financial instruments, often with a higher return on investment.

However, this power comes with significant risks. Margin trading can exacerbate losses if market conditions turn unfavorable. Fluctuations in the underlying asset’s price can lead to margin calls, where the broker demands additional collateral to cover potential losses. If the trader fails to meet the margin call, the broker may liquidate their positions, resulting in substantial financial loss.

Cash Account Trading: Safety First

Cash account trading, on the other hand, is a more conservative approach that involves trading with funds that have already settled into the account. Without the leverage of margin trading, investors cannot magnify their buying power. However, this limitation also provides a layer of protection against potential losses. Any trades must be made with funds available in the account, thus eliminating the risk of margin calls and forced liquidations.

The decision between margin privileges options trading and cash account trading hinges on an investor’s risk appetite and financial goals. For experienced traders with a tolerance for higher risk and the potential for greater returns, margin trading can be a valuable tool. However, it’s essential to approach margin trading with caution and a thorough understanding of its inherent risks.

:max_bytes(150000):strip_icc()/margin-101-the-dangers-of-buying-stocks-on-margin-356328_V2-3a27513fade64c769d9abce43cec81f7.png)

Image: www.thebalancemoney.com

Margin Privileges Options Trading Or Cash Account Only

Image: pippenguin.com

Expert Insights and Actionable Tips

According to a study by the Financial Industry Regulatory Authority (FINRA), over 50% of margin accounts experience losses. Before jumping into margin trading, consider these expert insights and actionable tips:

- Start Small: When experimenting with margin trading, begin with a small amount of borrowed funds to mitigate potential losses.

- Set Realistic Expectations: Don’t overestimate your ability to handle market volatility. Losses can occur quickly and unexpectedly.

- Monitor Market Conditions: Keep a close watch on market conditions and be prepared to react to fluctuations that could trigger a margin call.

- Diversify Investments: Spreading your investments across different assets can reduce overall risk, including the risks associated with margin trading.

Investing involves a degree of risk. By understanding the nuances of margin privileges options trading and cash account trading, you can make informed decisions that align with your financial objectives and risk tolerance. Remember, the journey to financial success is often about making prudent choices that safeguard your hard-earned money.