Modifying your option buying power is a critical step in any simulated trading strategy, allowing you to adjust your risk exposure and maximize your potential returns. Thinkorswim, the industry-leading trading platform, offers a range of options to customize your buying power settings, empowering you to fine-tune your trades and improve your overall performance.

Image: hohparabbit.weebly.com

Understanding Option Buying Power

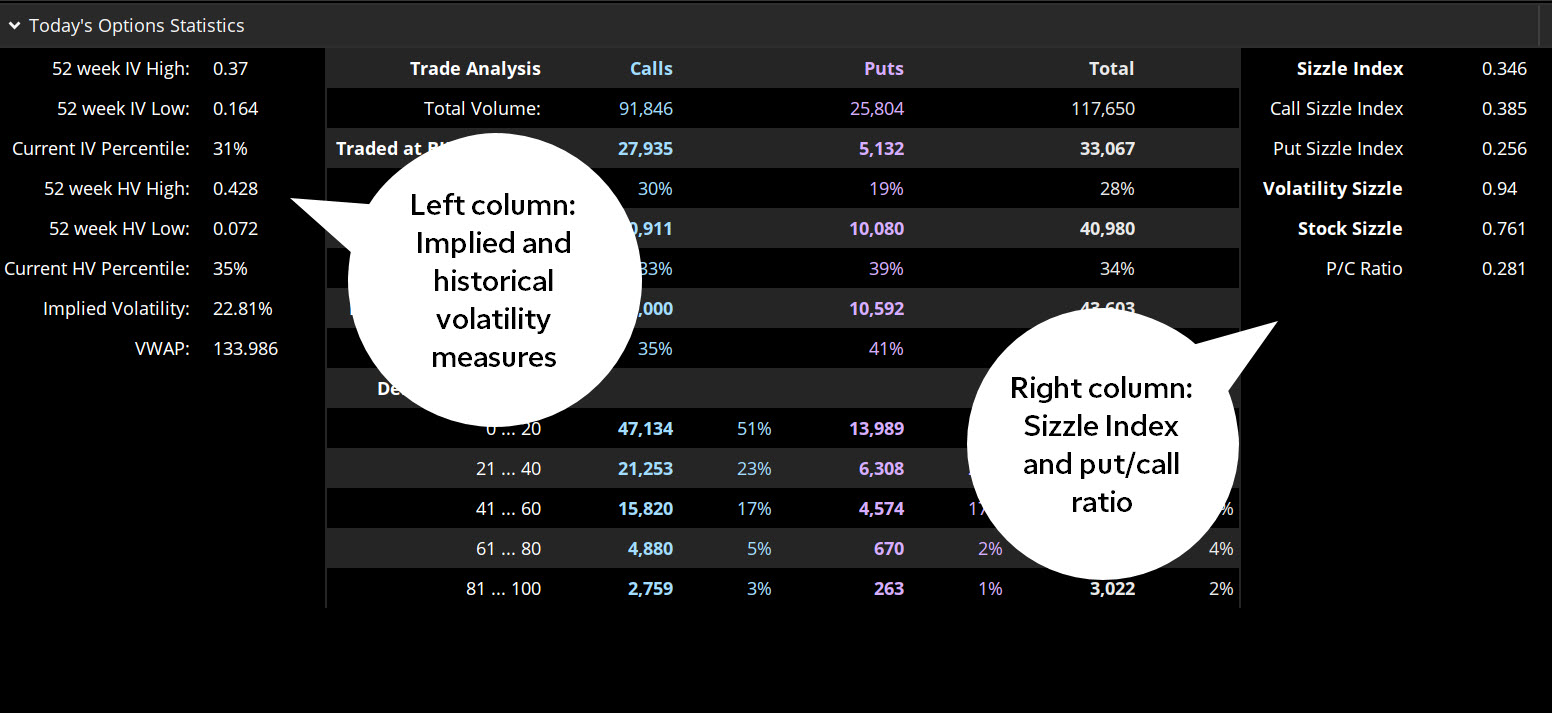

When you sell put or call options, you receive a premium from the buyer, which represents the option’s extrinsic value. This premium is essentially a collateral that serves as your buying power, enabling you to purchase additional option contracts. Thinkorswim calculates your option buying power based on your account balance, the volatility of the underlying asset, and the option’s time to expiration, among other factors.

Adjusting Option Buying Power

To adjust your option buying power in Thinkorswim simulated trading, follow these steps:

-

Open the “Preferences” menu: Click on the “File” menu at the top left corner of the Thinkorswim platform and select “Preferences.”

-

Navigate to the “Simulated Trading” tab: In the Preferences window, click on the “Simulated Trading” tab.

-

Configure your buying power settings: In the “Simulated Trading” tab, you will find various options to customize your buying power. You can adjust factors such as the account balance, the assignment risk tolerance, and the option multiplier.

-

Set your account balance: This is the total amount of simulated funds available in your account. You can set this amount to any desired value.

-

Modify the assignment risk tolerance: This setting determines how much of your buying power is reserved for options that have been assigned. A higher tolerance allows you to hold more assigned options, increasing your risk exposure.

-

Adjust the option multiplier: This setting multiplies your option buying power, allowing you to purchase more contracts. However, be cautious, as a higher multiplier increases your potential risk.

-

Click “OK” to save your changes: Once you have made your desired adjustments, click the “OK” button to save your changes and update your option buying power.

Image: tickertape.tdameritrade.com

Change Option Buying Power In Thinkorswim Simulated Trading

Image: tickertape.tdameritrade.com

Tips for Managing Option Buying Power

-

Start small: When first adjusting your option buying power, start with relatively low settings to mitigate your risk exposure.

-

Understand your risk appetite: Assess your tolerance for risk and adjust your settings accordingly. Aggressive traders may opt for higher settings, while conservative traders may prefer lower settings.

-

Monitor your account regularly: Keep a close eye on your account to ensure your buying power settings align with your trading strategy and risk profile.

-

Use stop-loss orders: Protect yourself from excessive losses by utilizing stop-loss orders that automatically close your positions when the price reaches a predetermined level.

-

Educate yourself: Gain a thorough understanding of option trading and risk management. Attend educational webinars, read articles, or consult with a financial advisor.

By adjusting your option buying power in Thinkorswim simulated trading, you can enhance your trading experience, optimize your risk exposure, and maximize your potential profits. Remember to approach this process with caution and always prioritize risk management, and you can take your simulated trading skills to the next level.