Introduction

In the labyrinthine world of options trading, understanding the interplay between option buying power and available funds is paramount for success. As many options traders quickly discover, these two concepts are not interchangeable and can significantly impact trading decisions and profitability. In this article, we delve into the intricacies of option buying power, its relationship to available funds, and the implications for savvy traders looking to maximize their returns.

Demystifying Option Buying Power

Unlike buying stocks, where you simply need enough cash to cover the purchase price, option buying power is a more nuanced concept. It refers to the maximum amount of options contracts a trader can purchase based on their account balance, margin requirements, and other factors. Intuitively, one might assume that the available funds in their brokerage account directly equate to their option buying power, but this assumption is often incorrect.

The Role of Margin Requirements

Margin trading, the practice of using borrowed funds to enhance trading leverage, plays a pivotal role in determining option buying power. When traders utilize margin, brokers require them to maintain a certain amount of equity in their accounts as collateral. This equity cushion, known as margin requirements, varies depending on the type of option being purchased and the broker’s risk assessment. Higher margin requirements mean lower option buying power, even if traders have ample funds in their accounts.

Calculating Option Buying Power

Calculating option buying power is essential for assessing trading capacity. The formula most commonly employed is:

Option Buying Power = (Available Funds – Maintenance Margin Requirement) / (Option Premium + Margin Requirement)

Image: www.fool.com

For instance, let’s say a trader has $50,000 in available funds, a maintenance margin requirement of 25%, and wants to purchase a call option with a premium of $10 and a margin requirement of 40%. Their option buying power would be:

($50,000 – $12,500) / ($10 + $40) = $2,500

This calculation indicates that the trader can purchase up to $2,500 worth of call options.

Distinction between Available Funds and Option Buying Power

The distinction between available funds and option buying power is crucial for effective options trading. Available funds represent the total cash balance in a trader’s account, while option buying power dictates the maximum amount of options they can acquire based on their account status and the margin requirements associated with the specific options they wish to trade.

Traders must meticulously monitor both available funds and option buying power to avoid overtrading and potential margin calls. Exceeding option buying power can lead to penalties and forced liquidations, which are detrimental to trading outcomes.

Maximizing Profitability through Strategic Allocation

Understanding the relationship between option buying power and available funds allows traders to optimize their trading strategies and maximize profitability. By meticulously allocating their funds between available funds and margin utilization, traders can strike a delicate balance between risk and reward.

Conservative traders might prioritize available funds, minimizing margin usage and focusing on options with lower margin requirements. Aggressive traders, on the other hand, may leverage margin more aggressively to amplify their buying power, pursuing higher-risk, higher-premium options that promise greater potential returns.

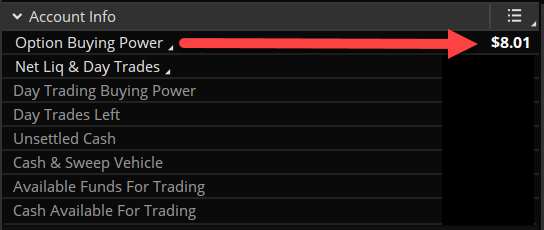

Image: thinkscript101.com

Option Buying Power Vs Available Funds For Trading

Conclusion

Option buying power and available funds are two fundamental concepts that options traders must fully comprehend. By grasping the distinction between these concepts and their interconnectedness, traders can navigate the complex world of options trading with confidence, optimizing their trading strategies and enhancing their chances of sustainable success. As always, prudent risk management and diligent research are vital to navigating the ever-evolving landscape of options trading effectively.