Introduction

The realm of digital currency is abuzz with excitement as the long-awaited debut of options trading for Bitcoin draws near. This groundbreaking development promises to revolutionize the way that investors interact with the world’s leading cryptocurrency, empowering them with unprecedented tools to manage risk and potentially enhance returns. In this comprehensive article, we delve into the fascinating universe of options trading on Bitcoin, uncovering its complexities, exploring its applications, and offering expert insights for navigating this exciting new landscape.

Image: www.gforgames.com

Unveiling Options Trading: A Path to Diversify and Optimize

Options trading introduces a valuable new instrument into the Bitcoin ecosystem, akin to a sophisticated chess move that enhances investors’ strategic options. Unlike traditional trading, options grant the holder a contractual right — but not an obligation — to buy or sell Bitcoin at a predetermined price and time. This versatility provides a gateway to sophisticated risk management techniques and opens doors to potentially lucrative investment strategies.

Understanding the Landscape: Types of Options Contracts

Within the intricate world of options trading, two primary types emerge: calls and puts. Call options bestow upon the holder the right to purchase a specific number of Bitcoins at a fixed price (known as the strike price) on or before a certain date (the expiration date). On the flip side, puts empower the holder to sell the agreed-upon quantity of Bitcoins at the predetermined strike price. These contracts serve as potent tools for investors seeking exposure to Bitcoin’s price movements within a defined framework of risk and potential reward.

Leveraging Options: A Versatile Palette for Astute Investors

Options trading empowers investors with a versatile toolkit that adapts seamlessly to their individual goals and risk tolerance. For risk-averse individuals seeking downside protection, hedging strategies with options provide a haven. On the other hand, those with a penchant for risk can harness options to magnify potential gains while limiting losses. Additionally, options offer flexibility in managing positions and can serve as valuable assets in income-generating strategies, such as writing covered calls to earn premiums.

.png)

Image: www.ig.com

Real-World Applications: Unveiling the Power of Options

Options trading extends its reach into a multitude of real-world applications, empowering investors to navigate market fluctuations with confidence. Seasoned investors can employ options as a hedging mechanism against sudden price drops. New entrants to the Bitcoin market, on the other hand, may find solace in using options to limit potential losses while still participating in the market’s potential upside. The versatility of options grants investors the ability to tailor their strategies to suit their unique risk-reward preferences.

Expert Voices: Navigating the Options Trading Labyrinth

Navigating the complexities of options trading on Bitcoin requires a judicious approach. We sought guidance from industry experts to uncover their insights and advice for investors embarking on this exciting journey. Here are their invaluable takeaways:

-

“Embrace continuous learning and seek out educational resources to master the nuances of options trading.” – John, a veteran Bitcoin trader

-

“Conduct thorough research and due diligence to select reliable and reputable trading platforms.” – Emily, an options trading enthusiast

-

“Start cautiously, gradually scaling your involvement as you gain proficiency and confidence.” – Mark, a financial advisor specializing in digital assets

Embracing the Future: A Glimpse into the Evolution of Bitcoin Options

As options trading sets sail on the Bitcoin seas, the future unfurls with limitless possibilities. Enhancements in trading platforms and the integration of sophisticated tools will empower investors with even greater control and flexibility. Additionally, the increasing popularity of Bitcoin options may attract the attention of institutional investors, potentially injecting substantial liquidity into the market and further propelling its growth.

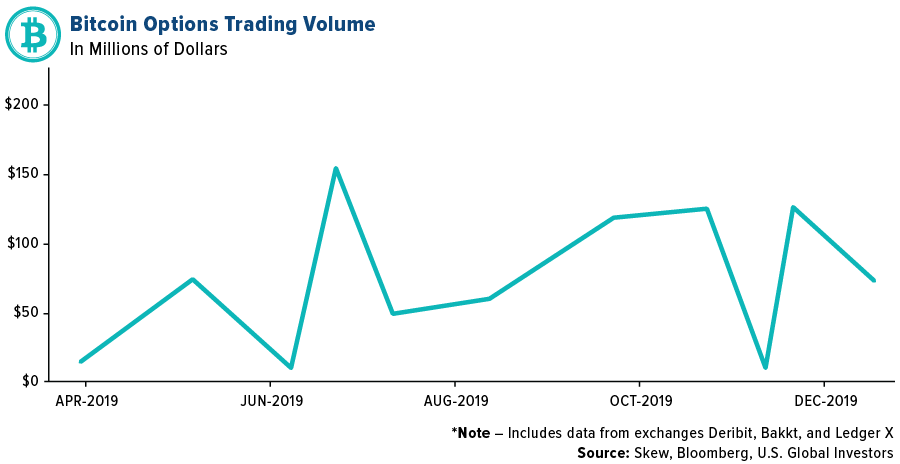

Options Trading On Bitcoin To Begin

Image: www.usfunds.com

Conclusion

The advent of options trading for Bitcoin empowers investors with unprecedented tools to navigate the digital currency market strategically. By understanding the fundamentals of options contracts, leveraging their versatile applications, and seeking guidance from experienced professionals, investors can unlock the potential of this exciting new investment frontier. As Bitcoin continues to evolve, options trading will undoubtedly play an increasingly significant role, opening doors to innovative strategies and broadening access to this transformative digital asset.