Prologue: A Quest for Options Trading Mastery

In the ever-evolving financial realm, options trading has emerged as a formidable force, beckoning investors seeking exponential growth potential. However, amidst the myriad of trading platforms, two titans stand tall: Tastyworks and Robinhood. Each armed with its distinctive features, strengths, and weaknesses, discerning investors are left grappling with the question: Which platform holds the key to unlocking options trading mastery? Join us as we embark on an insightful journey, meticulously analyzing Tastyworks vs. Robinhood, armed with unbiased facts and expert perspectives, to guide your decision-making process towards informed and profitable trading.

Image: www.youtube.com

Delving into the Foundation of Options Trading

Before delving into the intricacies of Tastyworks vs. Robinhood, it is imperative to establish a foundational understanding of options trading. Options are financial instruments that confer upon the bearer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and date. This flexibility endows options trading with immense potential for both profit generation and risk mitigation. Whether you aspire to hedge against market volatility, amplify returns, or generate income, options trading opens a world of possibilities for astute investors.

Tastyworks vs. Robinhood: Unveiling Their Distinct Profiles

With the conceptual backdrop firmly established, let us now shift our focus to the defining characteristics of Tastyworks and Robinhood.

Tastyworks: Precision Tools for Options Traders

Tastyworks has carved a niche for itself as a haven for experienced options traders seeking an advanced and feature-rich platform. Its robust order entry system, unparalleled charting capabilities, and comprehensive educational resources cater to the discerning needs of active traders. Tastyworks’ commitment to options trading is evident in its proprietary thinkorswim platform, renowned for its intuitive interface and advanced analysis tools. Seasoned traders particularly value the platform’s customizable options chains, real-time profit/loss calculations, and sophisticated risk management functionality.

Image: www.youtube.com

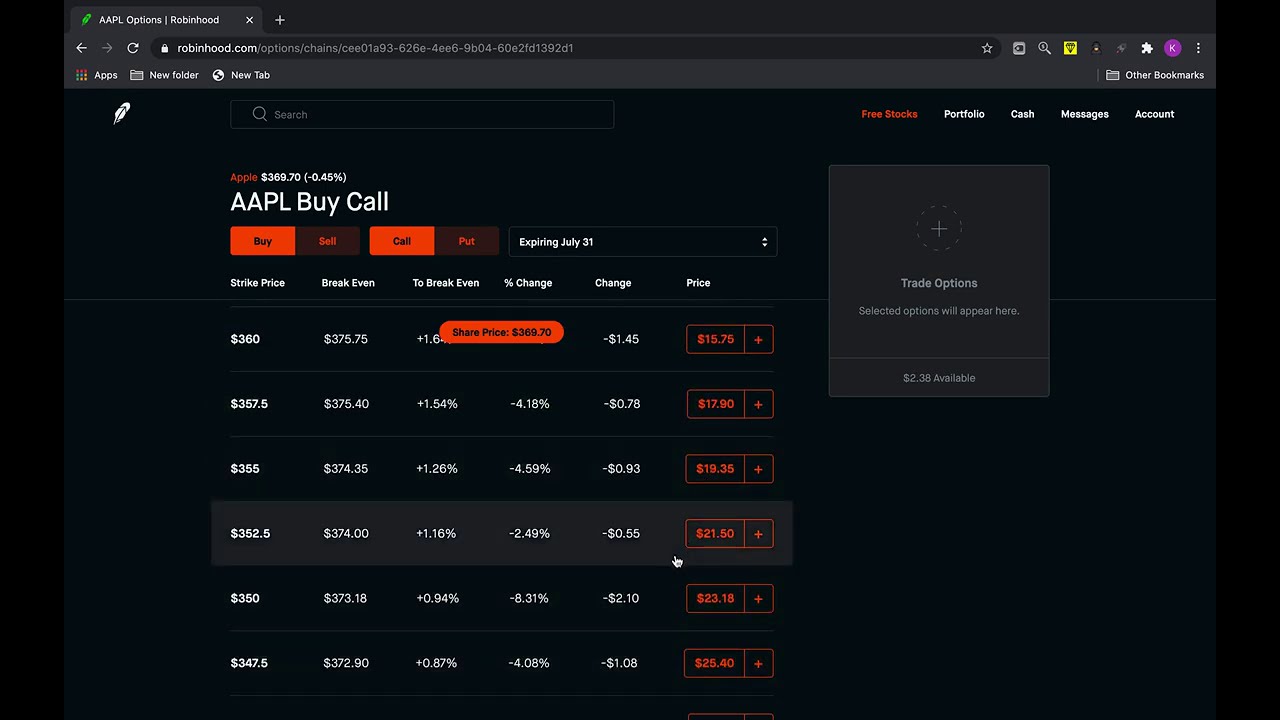

Robinhood: Accessibility and Simplicity for the Masses

Robinhood, on the other hand, has democratized investing by making it accessible to the masses. Its user-friendly interface, commission-free trading, and mobile-first approach have captivated a vast audience of novice investors. Robinhood simplifies options trading by providing pre-built option strategies, making it an attractive choice for those just starting their options trading journey. However, it is important to note that Robinhood’s limited order types, research tools, and charting capabilities may not suffice for experienced traders seeking a more comprehensive trading experience.

Expert Insights: Unlocking the Secrets of Options Mastery

To further illuminate the intricacies of Tastyworks vs. Robinhood, let us seek wisdom from seasoned options traders who have navigated the complexities of both platforms.

“For active options traders, Tastyworks is an indispensable ally, providing the precision tools and advanced functionality required to execute complex strategies with confidence,” asserts seasoned trader Mark Douglas. “Its thinkorswim platform is a masterpiece that empowers me to make informed decisions and manage risk effectively.”

In contrast, Emily Jones, a successful options trader, highlights Robinhood’s accessibility and simplicity: “As a beginner in options trading, Robinhood’s user-friendly interface and commission-free structure were instrumental in my early success. Its pre-built option strategies simplified the learning curve and instilled confidence in my trading endeavors.”

Actionable Tips: Embracing Informed Trading Practices

Empowered with expert insights, let us now explore actionable tips to guide your own options trading journey:

- Define your investment goals and risk tolerance before venturing into options trading.

- Diligently research and understand the underlying assets associated with the options you intend to trade.

- Select an options trading platform that aligns with your skill level, trading style, and long-term aspirations.

- Utilize educational resources and seek guidance from experienced traders to enhance your knowledge and decision-making process.

- Practice risk management strategies and prioritize capital preservation.

- Monitor market conditions closely and adjust your trading strategies accordingly.

Options Trading Tastyworks Vs Robinhood

Image: belucydyret.web.fc2.com

Conclusion: A Path to Options Trading Mastery

The choice between Tastyworks and Robinhood is a pivotal one, deeply influenced by your individual trading preferences and skill level. While Tastyworks caters to the sophisticated needs of experienced traders, Robinhood provides a welcoming gateway for beginners seeking simplicity and accessibility. Both platforms offer unique advantages and limitations. By carefully considering the factors outlined in this comprehensive analysis and incorporating the expert insights and actionable tips provided, you are well-positioned to navigate the complexities of options trading and embark on a journey towards informed and profitable trading decisions.