Option trading has captivated the financial world with its allure of high returns. However, the recent volatility and market uncertainties have amplified the risks associated with this complex investment strategy. In this comprehensive guide, we delve into the intricacies of option trading, exploring the evolving landscape, and equipping readers with insights to navigate the treacherous waters of the market.

Image: www.warsoption.com

Options, versatile financial derivatives, grant investors the right but not the obligation to buy or sell an underlying asset at a predetermined price on a specified date. While this flexibility offers immense potential for profit, it also exposes traders to substantial losses if market conditions change unfavorably. Understanding the complexities of these instruments is crucial for mitigating risks and maximizing returns.

Understanding the Dynamics of Option Premiums

The core element of option trading is the option premium, the price paid for acquiring the right to buy or sell an asset. This premium is determined by a myriad of factors, including the underlying asset’s price, volatility, time to expiration, and interest rates. As these parameters fluctuate, so does the option’s value, creating a dynamic landscape that requires constant monitoring and adjustment.

Hedging Strategies for Risk Management

Recognizing the inherent risks of option trading, employing effective hedging strategies is essential to minimize losses and protect capital. Hedging involves creating an offsetting position to neutralize or minimize the impact of price fluctuations on the option. By using complementary positions, such as buying and selling options with different strike prices or maturities, traders can mitigate the potential downside and enhance the stability of their portfolios.

Navigating Market Volatility and Uncertainty

The recent market volatility has tested the resilience of even seasoned option traders. Sharp price movements can wreak havoc on open positions, leading to significant losses if not managed appropriately. Staying abreast of market news, analyzing economic indicators, and being cognizant of geopolitical events is crucial for anticipating and reacting to market fluctuations. Dynamic adjustments to option strategies, such as adjusting strike prices, rolling positions, or implementing stop-loss orders, are vital for limiting losses and preserving capital.

Image: www.daytradetheworld.com

Evolving Regulatory Landscape and Disclosure Requirements

In light of increased participation in option trading, regulatory bodies worldwide are scrutinizing the industry and implementing measures to protect investors and ensure market integrity. Traders must comply with reporting and disclosure requirements, such as The Financial Conduct Authority’s (FCA) rules in the United Kingdom or The Options Regulatory Surveillance Program (ORSP) in the United States. Understanding these regulations is paramount for avoiding penalties and maintaining a compliant trading operation.

Technology and Advanced Trading Platforms

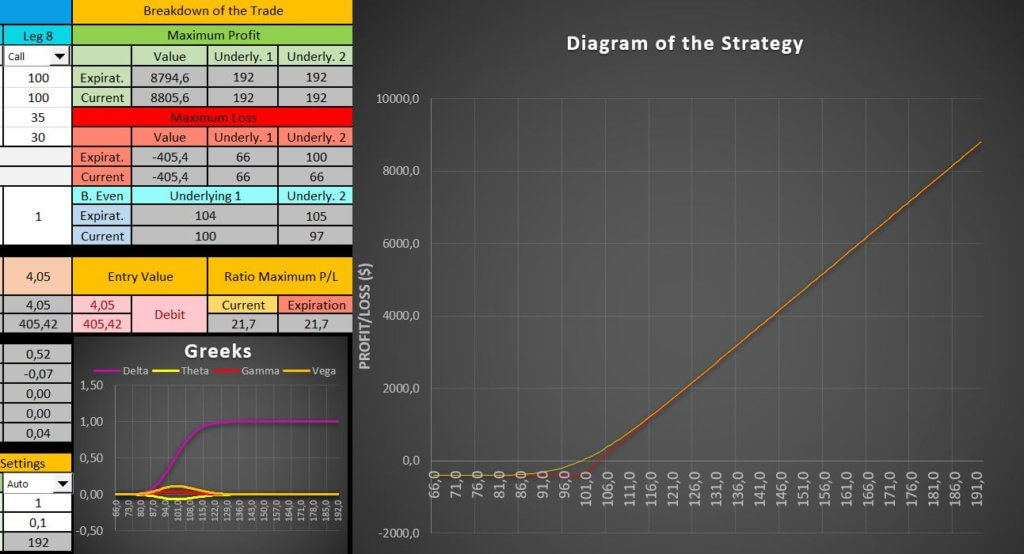

Technological advancements have transformed option trading, providing traders with sophisticated platforms and advanced tools. These platforms offer real-time data analysis, complex option strategy building, and automated trading capabilities. While these tools can enhance efficiency, traders must be prudent in their selection and thoroughly understand the platform’s features to avoid risks associated with overleveraging and complex trading strategies.

Option Trading Riskier

Image: minimalisttrading.com

Education and Knowledge: The Foundation of Success

Embarking on option trading demands a solid educational foundation and a commitment to continuous learning. Mastering the concepts, strategies, and risk management techniques is imperative for making informed decisions and navigating the market’s complexities. Traders should seek reputable courses, workshops, and resources to enhance their knowledge and stay abreast of industry developments.

As the financial landscape evolves, option trading continues to present both opportunities and risks. By embracing a proactive approach, understanding market dynamics, implementing risk mitigation strategies, and pursuing continuous education, traders can navigate the treacherous waters of option trading and increase their chances of success.