Introduction

Venturing into the realm of options trading can be an alluring prospect for investors seeking to enhance their financial returns. However, understanding the intricacies of this complex financial instrument is paramount to achieving success. One crucial aspect to consider before embarking on this journey is determining the minimum amount required to open and maintain an options trading account. In this comprehensive guide, we will delve into the minimum amount for options trading with TD Ameritrade, exploring its significance, implications, and strategies to navigate the process effectively.

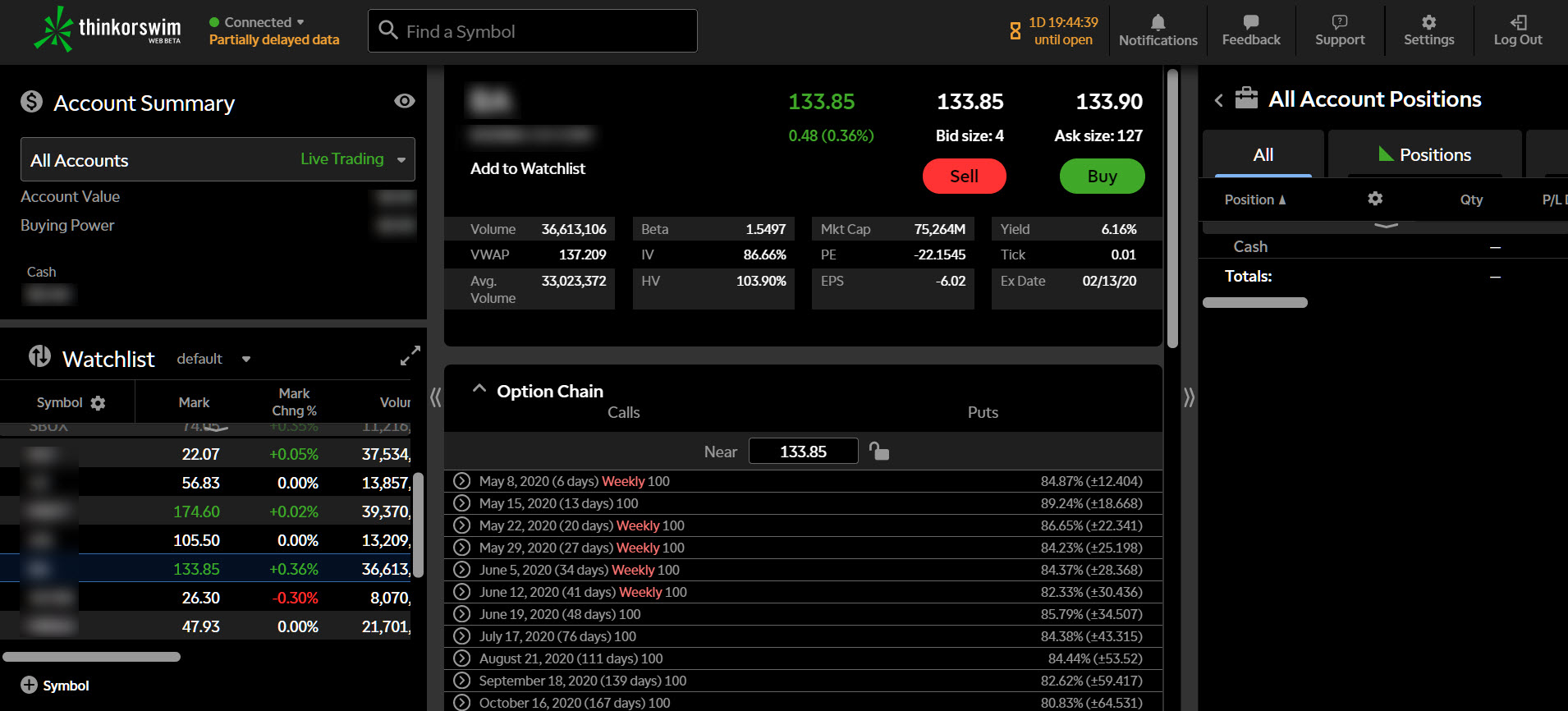

Image: www.pinterest.com

Understanding the Minimum Amount Requirement

Every brokerage firm, including TD Ameritrade, establishes a minimum account balance threshold for options trading. This requirement serves as a safeguard to ensure that aspiring traders possess adequate capital to mitigate potential risks associated with options trading strategies. The minimum amount demanded varies across brokerages, ranging from a few hundred dollars to several thousand dollars. It’s essential to note that this threshold applies to newly opened accounts and may differ for existing clients with established trading histories.

Significance of the Minimum Amount

The minimum amount requirement plays a pivotal role in responsible options trading practices. By mandating a certain level of capital, brokerages aim to deter impulsive or underfunded traders from engaging in options strategies beyond their financial capabilities. Options trading involves inherent risks, and having sufficient capital acts as a buffer against potential losses. Additionally, maintaining the minimum account balance allows traders to seize opportunities and respond to market fluctuations without being constrained by capital limitations.

Implications for Options Trading

Understanding the minimum amount requirement has significant implications for options trading strategies. First, it influences the selection of options contracts. Traders with limited capital may be restricted to near-the-money (NTM) options or options with lower premiums. These options typically entail lower profit potential but also carry reduced risk compared to deep-out-of-the-money (OTM) options. Secondly, the minimum amount affects position sizing. Traders must carefully calculate the number of contracts to trade based on their available capital, taking into account potential fluctuations in the underlying asset’s price and option premiums.

Image: blog.joinfingrad.com

Strategies for Meeting the Minimum Amount Requirement

Aspiring options traders may employ various strategies to fulfill the minimum amount requirement. One approach is to accumulate funds gradually through regular deposits or transfers. This method allows traders to build their capital over time and begin trading once they reach the designated threshold. Another strategy involves exploring brokerages that offer lower minimum deposit requirements. However, it’s crucial to conduct thorough research and consider other aspects of the brokerage, such as trading fees, platform features, and customer support, before making a decision.

Minimum Amount For Options Trading Td Ameritrade

Image: binary.mxzim.com

Conclusion

Understanding the minimum amount for options trading with TD Ameritrade is a foundational step toward responsible and successful participation in this dynamic market. By acknowledging the importance of this requirement, traders can make informed decisions and develop trading strategies that align with their financial capabilities and risk tolerance. Whether aspiring traders choose to accumulate funds gradually or seek brokerages with lower minimums, adhering to this requirement is essential for mitigating risks and paving the way for long-term trading success.